Last week, according to the media reports, the board of the Insurance Regulatory and Development Authority of India (IRDAI) approved public-owned Life Insurance Corporation’s (LIC) proposal to increase its stake in the troubled public sector bank Industrial Development Bank of India (IDBI) by investing in Rs. 10,000-13,000. According to the media reports, IRDA has approved the acquisition of up to 51% stake by LIC in IDBI Bank. The final decision on this will be taken by the LIC’s board.

The news about LIC’s takeover of IDBI resulted in a temporary six per cent increase in the price of IBDI’s shares. However, a cursory look at the documents reveals that there are many reasons which should force LIC to think at least 1,30,000 crore times before investing hard-earned savings and future of over 250 million Indians on IDBI or any public sector banks.

Before the increase, as mentioned above, in the prices of shares — which lasted for just two days — of IDBI Bank, the shares of IDBI fell 37.2 per cent in the two year period between July 05, 2016 and July 6, 2018. This fall is represented in the graph mentioned below.

The reasons behind this massive loss in the market capitalisation of the IDBI bank are its high bad loans and negative return on assets. As per the 2016-17 Annual Report of the IDBI, “at end-March 2017, 78.75% of IDBI’s loan were Standard Assets, 4.26% were Sub-standard Assets, 16.45% were Doubtful Assets.” After IDBI posted the loss on two consecutive years, Reserve Bank of India invoked Prompt Corrective Action (PCA) framework, which restricted distribution of dividend, branch expansion, capital expenditure, investment in subsidiaries, etc.

The outcome of the rapidly deteriorating asset quality of the banks’ earnings is two-fold. First, with increasing NPA levels, the interest income of the bank is adversely affected. Second, the banks have to maintain higher provisions (from their reduced earnings); hence their net profits would be adversely affected, and could even turn negative, leading to faster erosion of banks’ available capital. Since the Government of India is the majority shareholder, the public sector banks (PSBs) serve broader objectives of distributional growth and equity, and the fact they PSBs have over 70% share in the total lending, the government recapitalised the public sector banks.

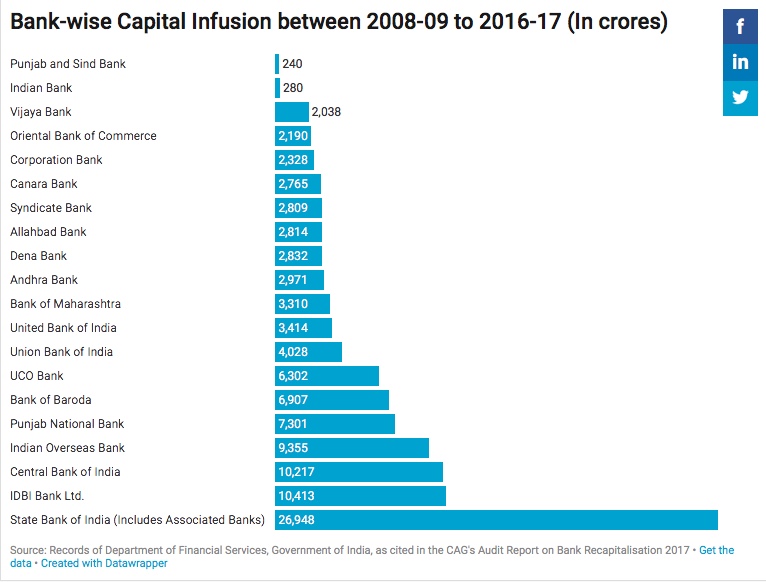

As per the 2017 Report of the Comptroller and Auditor General of India on Recapitalisation of Public Sector Banks, “to build up the capital adequacy of the PSBs, the Government of India, as the majority shareholder, infused 1,18,724 crore from 2008-09 to 2016-17 in PSBs.” The IDBI received Rs 10,413 crores during this period.

The CAG’s comprehensive audit, which had the objectives to assess whether objective parameters were adopted for recapitalisation of PSBs and to check consistency of their application across all PSBs, and to assess whether the release of capital funds was monitored and check whether conditions attached to recapitalisation were complied with and objectives of recapitalisation were achieved, found that the Ministry of Finance’s Department of Financial Services (DFS), which covers the functioning of Banks, Financial Institutions, Insurance Companies and the National Pension System and was responsible in ensuring that the PSBs increase the quantum of recovery vis-à-vis write-offs, failed to apply the criteria for fund infusion across all PSBs consistently. Moreover the report found “there was underachievement of targets, in respect of the five parameters [CASA, ROA, Cost to Income Ratio, Net Profit Per Employee (in lakh) and Ratio of Staff in Branches to Total Staff] for the FY 2011-12 to 2013-14, as shown in Annexures VII to IX.” The report reprimanded DFS for poor compliance by the PSBs with regard to submission of quarterly progress reports, and for having no evidence to suggest that DFS had analysed the achievement / non-achievement against targets in signed MoUs and linked the same to capital infusion.

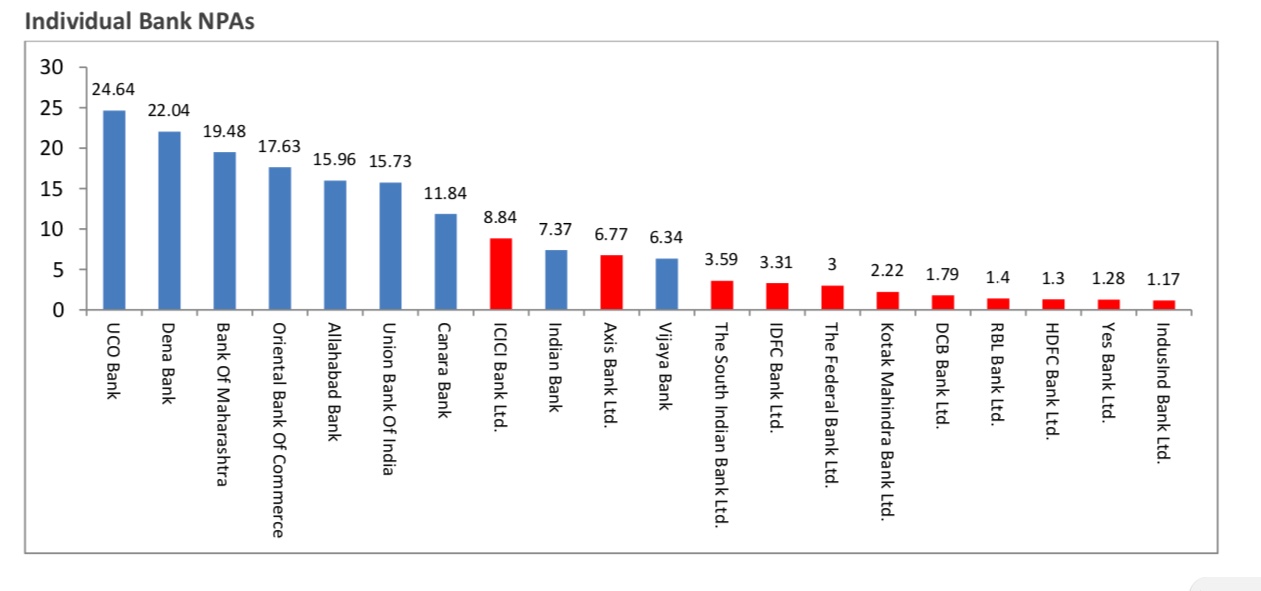

The stress in the banking sector, according to Reserve Bank of India’s latest Financial Stability Report, continues as gross non-performing advances (GNPA) ratio rises further. Profitability of scheduled commercial banks (SCBs) declined, partly reflecting increased provisioning. The Report after its stress tests projected that the gross non-performing asset ratio (ration of net NPA to loans (advances), a measure of the overall quality of the bank’s book) of scheduled commercial banks could rise up to 12.2 per cent by March 2019 from 11.6 per cent in March 2018.

The BloombergQuint reported, “as part of its assessment, RBI also measured the performance of state-owned banks under PCA and those outside the framework. Banks under PCA saw their gross bad loan ratios rise to 21 per cent of total loans, while non-PCA banks reported a gross NPA ratio of more than 13.5 per cent. These numbers could worsen to 22.3 per cent and 14.1 per cent by March 2019, respectively, the RBI noted.”

LIC’s Exposure to the Public Sector banks

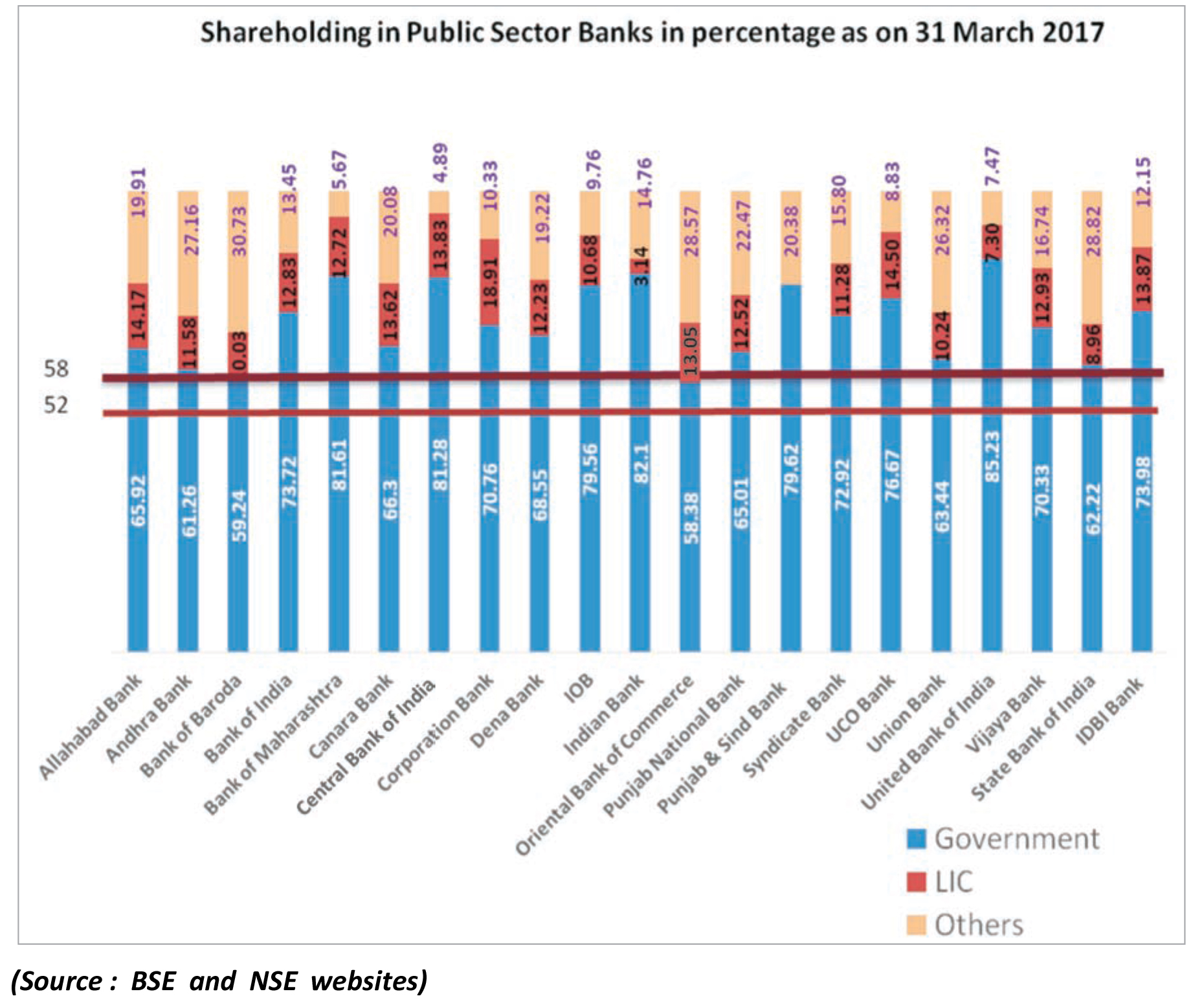

The LIC, which as per 2016-17 Annual Report of the IRDAIcontrols 71.81 per cent of the market share, recorded a profit equity trading profits of Rs 25,000 crore in 2017-18, up from Rs 19,000 crore a year ago. As a government-owned insurance group and investment company, LIC has heavily invested in the Public Sector Banks.

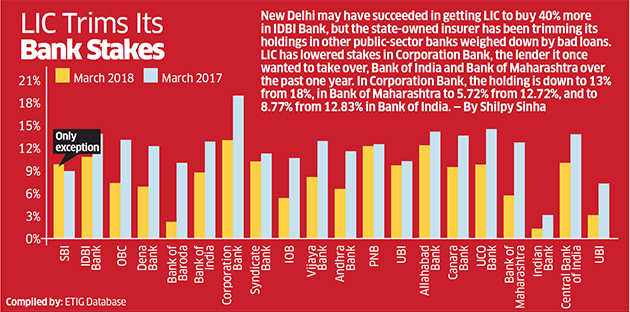

However, as the above table indicates, the LIC’s shareholding, as per the Insurance Regulatory and Development Authority of India (IRDAI) rule, is less than 15 per cent in single stocks. For LIC to acquire majority shares in the IDBI, the IRDAI has to change the rule. This opens up a possibility of LIC making more such suicidal decisions to rescue the government. If one of the reasons behind this deal is the bad-loan ratio, which IDBI has 28 per cent the highest among all state-run lenders in India, then according to the Care Ratings’ 2018 data UCO Bank, and Dena Bank are the next to be taken over by the LIC. The reality is that over half of India’s PSBs are under RBI’s Prompt Corrective Action (PCA) framework with five more banks all set to join in. This indicates the gravity of the situation.

A Business Standard’s analysis of LIC’s holding of PSBs revealed that it had lost money in 18 out of 21 PSBs in the last two and a half years. Even, if one takes into consideration that LIC is a long-term investor, the analysis of the LIC’s investment pattern has shown that it systematically reduced its holding in the PSBs which are weighed down by the bad loans. If we consider the existing crisis in the banking sector, failure of the recapitalisation as mentioned in the CAG’s audit, and RBI’s projections of the increase in the bad loans, then LIC’s attempt to bailout IDBI looks bizarre.

The All India Bank Officers’ Confederation (AIBOC) in its press release attacked this ill-thought move by calling it an attempt to privatise IDBI and LIC. It said “Rescuing a dying bank with taxpayers’ money is often the only way to prevent a costlier contagion. But nursing a deposit-taking institution by tapping life-insurance premiums of policyholders? That’s like allowing a localised infection to spread all over, hoping the natural immunity of an otherwise healthy body will help beat back the germs. The government’s plan to sell a majority stake in IDBI Bank Ltd. to Life Insurance Corp. of India is not modern medicine. It’s bureaucratic quackery which will ultimately weaken the LIC as well. It’s a deliberate attempt on the part of the government to weaken LIC to promote privatisation.”

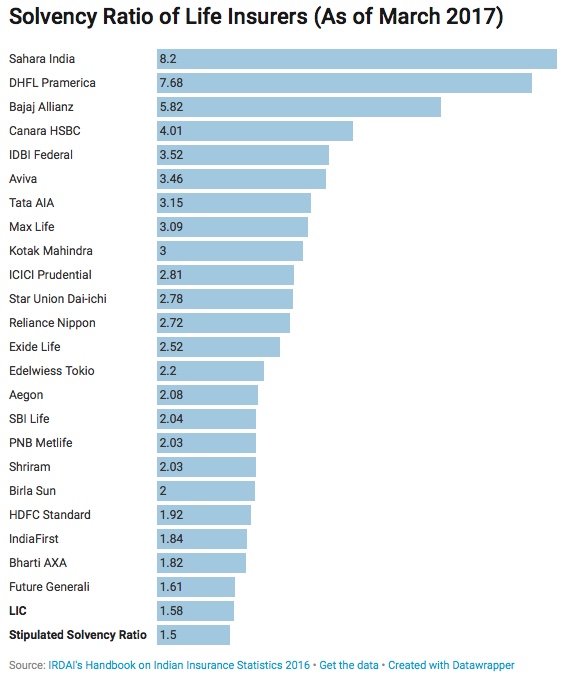

This argument does carry weight when one looks beyond the government’s narrative that Rs 13,000 crore deal is only 0.4 per cent of the LIC’s corpus of around Rs 30 lakh crore. Irrespective of what the government says, this myopic view on the corpus does not represent the accurate picture. The truth is that the LIC is not in the pink of its health. LIC’s solvency ratio of 1.58 lingers dangerously close to the minimum threshold of 1.5. Investopedia defines the solvency ratio as a key metric used to measure an enterprise’s ability to meet its debt and other obligations. The solvency ratio indicates whether a company’s cash flow is sufficient to meet its short-term and long-term liabilities. The lower a company’s solvency ratio, the greater the probability that it will default on its debt obligations.

The IDBI’s takeover will only put an additional burden on this solvency ratio. As mentioned before, the IDBI deal will open the window for more such deals. The government is also considering to completely exit Air India by selling its residual stake to LIC and other financial institutions.

This brings us to the question of the independence of the LIC and IRDAI as institutions. LIC has been violating the shareholding limit of 15 per cent in L&T, ITC, and Corporation Bank. Barely a year ago, the IRDAI, as the regulator, set a two-year deadline for LIC to adhere to the regulations and asked it to submit a blueprint for the same. One wonders then why did IRDAI approve LIC’s takeover of IDBI? Another important question that has to be raised is that LIC does not have any experience in running a bank. Being entrusted with policy-holders money, why does it want to expand its footprint in a territory where it has no expertise?

“The notion that LIC has an unlimited war chest is totally fallacious because life insurance companies hold people’s premium money for 30-years-plus only to eventually pay back the insured or their nominees. LIC invests these funds so that it can meet its long-term liabilities. The investments thus have to be sound and based on economic merit. Such funds can’t be used to fill black holes in the government’s fiscal exercise,” wrote senior journalists M K Venu and Noor Mohammad on the Wire.

Not so far ago, in 2012, the IRDAI had expressed concerns over the corporate governance at LIC. The main issue raised was the composition of LIC’s government-appointed board which includes the chiefs of some government-owned financial institutions like banks and insurance companies. According to a report published in the Economic Times, “IRDAI reckons that the appointment of these CEOs as independent directors may not be in tune with current corporate governance norms, though such a practice has been in vogue for several years. The regulator has informally raised the issue with the finance ministry, said an official with knowledge of the matter.” It is important to note here that nothing much has changed, the present board still has members from the PSBs and government-owned insurance companies, apart from the bureaucrats, which severely hampers the LIC’s ability to protect the rights of policyholders.

It is high time that the LIC Board goes back to its objective, which explicitly mentions that the primary obligation of LIC is to its policyholders, whose money it holds in trust, without losing sight of the interest of the community as a whole, and stops dancing to the tunes of its only shareholder — the government.

The Significance of the IDBIWhat we see today as a loss-making public sector unit that does not instil hope of recovery was once a very different beast. It was one of the first development finance institutions set up for industrial lending. Along with Industrial Finance Corporation of India (IFCI 1948), Industrial Credit Investment Corporation (ICICI, 1955), the Industrial Development Bank of India (IDBI, 1964) laid the foundation of a stronger Indian economy. At the time of its incorporation, it was a subsidiary of the Reserve Bank of India with a very wide mandate. IDBI could lend to industrial corporations, state finance corporations, scheduled banks, state co-operative banks. It could borrow funds via the issue of bonds and debentures. Bonds issued by IDBI, along with ICICI and IFCI, were given SLR (statutory liquidity ratio) status. This meant that, as an investment, they were essentially on par with central government bonds. In 1976, RBI transferred its ownership to the government and, as unbelievable as it may sound, IDBI had a phenomenal growth. IDBI was way ahead of ICICI and IFCI with regard to project finance. This growth within a decade of its inception took an unfortunate turn in the 1980s. The introduction of term lending in the 1980s and the withdrawal of SLR status to the bonds issued by DFIs in 1992 changed the future of DFIs in India. With term lending, IDBI could not match with the interest rates of other banks and the removal of SLR status put questions on the sovereign guarantee of the bonds. The changed policies of DFI marked the beginning of the neo-liberal era that struck the first nails in the coffin of public sector undertakings. Within a decade, IDBI started to accumulate NPAs raising questions on its future. By 1994, IDBI started operations as a commercial bank as a subsidiary of IDBI. Even though it could not match its private counterpart ICICI, IDBI just managed to pick up retail banking. In 2003, the government took another disastrous decision to merge IDBI and the retail subsidiary by repealing the IDBI Act converting IDBI Ltd. into a banking company. The corporate debts incurred by IDBI shrouded its retail growth. Even now, corporate loans account for the two third of the bank’s loans. Today, if we see IDBI isolated from its history as a development bank one might even find the recapitalisations and subsequent disinvestment of the government justified. But IDBI cannot be seen as a lossmaking PSU that took bad decisions, but as a strong DFI that was made to bite the dust as government after government grovelled before the neo-liberal tactics. |

*Priya Dharshini contributed the section on the significance of IDBI.

Calling IDBI as a DFI is only partially true, as it does not really hold that status anymore. It is a pure PSB as of now, unless one were to carry some baggage from history, which as such has melted away. But, the question is, if IDBI even happens to be a Central Government Undertaking? IDBI Ltd was incorporated as a government company under the Companies Act 1956 in September 2004. Thereafter the undertaking of IDBI was transferred to and vested in IDBI Ltd. In terms of the provisions of the Repeal Act, IDBI Ltd has been functioning as a bank in addition to its earlier role of a financial institution.

Now, why should this deal be opposed, or on what grounds? And, if these grounds are febrile in nature, then what is to be expected? On similar lines, does this deal even qualify as disinvestment? Lets tackle these one by one. Starting with disinvestment: That qualification would depend on how the deal is structured. The buzz is that IDBI Bank will issue fresh shares which means expansion of the equity base. On an expanded base, the Government’s stake will come down without selling a single share. The Government may consider selling shares at an appropriate time when it gets better valuation. Another thinking is that the entire Government stake will be bought by LIC and there will be no fresh equity.

Now, there is something called DIPAM, or The Department of Investment and Public Asset Management, which has been kept outside the LIC-IDBI deal. The LIC-IDBI deal can be treated similar to the ONGC-HPCL transaction, where ONGC bought the government stake in Hindustan Petroleum Corporation Ltd. The process and mechanism were defined by DIPAM then and the same could be adopted here. In the LIC-IDBI deal, the Department of Financial Services (DFS) is taking the call on behalf of the Central government. Now, that the LIC has already got the regulatory clearance to raise its stake, the insurance giant must make an open offer as mandated by the SEBI takeover code to the shareholders of the target company on acquiring shares of voting rights of 25 per cent or more. LIC has a stake not just in IDBI Bank, but in almost every public sector bank. as things stand today, a controlling stake in one bank would mean a significant infusion of capital in the bank beyond the initial stake purchase. IRDA has capped LIC’s investments in other firms at 15%, but the insurer has some leeway as it is under the LIC Act 1956, which precedes the IRDA Act 1999. Breaching this provision is what needs to be critiqued.

So, what are the options for IDBI? When IDBI was converted into a bank in 2004, its toxic loans were transferred into a stressed assets stabilization fund. Repeating this by bifurcating the corporate and retail book of the bank could be an option. Another option would be to get pure private capital but for that the bank’s balance sheet will have to be fixed. The third option is to merge IDBI Bank with another bank, which now looks improbable. It must be remembered that the IDBI is not divesting its stake to LIC, but is making a preferential allocation to LIC through fresh equity of shares. The current regulatory norms forbid insurers from holding more than 15% stake in a company, and for that limit to be crossed, IRDA’s blessings are a must. Also, since IDBI Bank is a listed entity, LIC ought to make an open offer. However, since two state-controlled entities are at play, SEBI has gleefully exempted it.