IDBI Bank Sale—The Height of Madness

When the Nobel Prize in Economics is awarded to economists for their work on “why banks should not be allowed to fail,” the Union Government announced an Expression of Interest in selling IDBI Bank.

When the Nobel Prize in Economics is awarded to economists for their work on “why banks should not be allowed to fail,” the Union Government announced an Expression of Interest in selling IDBI Bank.

Arvind Panagariya and Poonam Gupta have come up with a demand that all public sector banks except the State Bank of India should be privatised.

“Banking is a very good business if you don't do anything dumb,” goes an anonymous quote.

The Deposit Insurance Act 1961 came into force from 1st January 1962. Though the name still continues to be ‘Deposit Insurance and Credit Guarantee Corporation,’ the Credit Guarantee scheme was discontinued in 2003. The Deposit...

The banking sector has definitely come a long way since nationalisation, we still are many miles behind in our target of achieving a fully inclusive banking system. Do we have a banking system where...

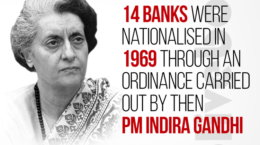

The story of India’s Bank nationalisation in 1969, i.e. the public takeover of a significant part of the country’s banking system, its causes, consequences, achievements, and finally concerted attempts to weaken/roll-back the banking and...

RBI has downgraded India’s growth projection to 9.5% from 10.5%. World Bank projects it at 8.3%. Actually, it may be worse. This is at the backdrop of GDP growth of a negative 7.3%. Last year,...

All over the country, people came out in support of the general strike on March 15,16,17 & 18. With thanks to The Research Collective, Delhi, Sneha, Nagapatinam, TN, Defeat Fascist BJP Campaign, TN, Shahri...

When the financial resolution and deposit insurance Bill was introduced in Parliament many thought that the mighty Government will get it passed. But the campaign against it, not only by Trade Unions but also...

Almost all financial newspapers have informed that 3-5 banks and 3 general insurance companies are going to be privatized. They have indicated that Bank of India, Indian Overseas Bank, UCO Bank, Punjab and Sind...

An Analysis of Non-Performing Assets & Loans by the Public Sector Banks in the Pre-COVID Era For the Indian banks, reeling under the weight of mounting Non-Performing Assets (NPAs), COVID came as a blessing...

The Banking Sector was already in crisis. Crisis was created through the policies. Large credit was encouraged leading to the NPA Crisis. Development institutions like IDBI, ICICI and even UTI were converted into banks....

The Economic Survey for 2019-20, on page 158 in Chapter 7 puts it on record that “PSBs are clearly not efficient today”. This is the statement issued by the owner of these banks. If...

On 22nd Oct, AIBEA and BEFI went on strike against merger of Banks. Did anybody care? Sad that all Unions and Associatious objecting merger did not fight together. The Banking Sector Trade Unions in...

All India Bank Officers’ Confederation in a statement condemning the bank merger said, “the announced merger of three public sector banks is nothing but a diversion away from the core issue of NPA recovery....