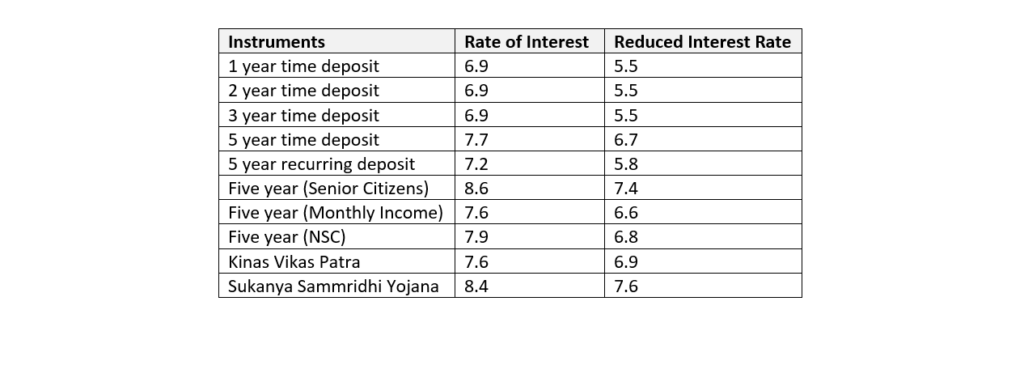

The government of India has reduced deposit interest rates drastically in addition to the banks which have been reducing the rates in tune with reduction of repo rates by the RBI. (Repo rate is the rate at which Banks can borrow from RBI).

SBI has reduced savings bank interest rate to 2.75%. The maximum rate for fixed deposits in SBI has come down to 5.7% and for senior citizens from 6.2%. During 1993 the FD rates had gone upto 13% and 13.5%.

India’s interest rates have come down to its lowest. This is affecting the small depositors badly and the impact could be disastrous. As per RBI Report of 2016, in our country, 61.5% of the depositors are household deposits, 12.8% is by government, 10.8% is by corporate and the rest is by other categories of depositors.

The household depositors save for getting a regular income. One third of the deposits is in saving bank accounts and two third in fixed deposits. Out of this 58% is by retired people who have invested for getting some regular income. Imagine what will be their position as the interest rates have become half of what they were getting in 1993 when they retired?

Those who are under the National Pension Scheme from 2000/2004 (banks) have to deposit 60% of their fund value on retirement in some income scheme to get return as pension. Their position is becoming precarious.

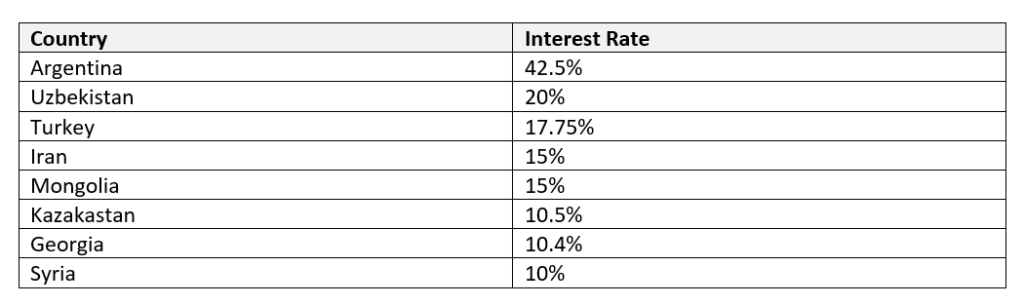

Interest Rates in different countries

Japan, Denmark and Switzerland have negative Interest Rates. In US interest rate is 2.75%.

Three reasons are attributed for reduction in interest rates.

1. To reduce the lending rates

2. To encourage people to spend

3. To encourage people to invest in stock markets.

For as you lend at cheaper rates, people are not going to borrow. Encouraging spending without reserve savings will be disastrous when you get into difficulties like medical expenses. Stock Market is only a gamble.

For the majority in the country who are outside a decent social security system which we are seeing today, will be more disastrous.

The countries which have lesser interest rates have excellent social security system for the unemployed and senior citizens. Their Pension system is also superior. Education and Health for which we spent a lot is free for the citizens.

Hence the reduction in interest rates for India will be disastrous. People will switch over to real estate, gold or private chit funds. Only 20% of the population saves in banks even now. Once they withdraw, the deposits especially savings bank deposits which is the cheapest for banks, the banks will be affected. They will have to borrow to lend. The spread will become less and affect the banking system. For the vast majority who are outside a good social security system, this will be disastrous.

Thomas Franco is former General Secretary of All India Bank Officers’ Confederation.