Internal Working Group of RBI has released a draft report on banking titled, “Ownership Guidelines and Corporate Structure for Indian Private Banks”. Comments on the report can be submitted before January 15. While few corporate and NBPCs have welcomed the report, Dr. Raghuram Rajan, former governor RBI & Dr. Viral Acharya, former Dy. Governor RBI have asked to exercise caution in giving control to corporates / industrial houses. Dr. T.T. Ram Mohan, Professor at IIM, Ahmedabad has written a very well researched article wherein he has highlighted that this is a step towards privatisation of public sector banks where corporates will be allowed to have majority shareholding of 26%. (The Hindu, Nov 25). One should remember that Ramalinga Raju had control over Satyam with a shareholding of 10%.

Let’s analyse some of the recommendations and who will be benefited?

Shareholding to Corporates / Industrial Houses

Presently corporates can have shareholding upto 15%. USA even now does not permit corporates into banking on the principle that commerce and banking should not be mixed. Some countries permit their entry with strict controls. But no country has business houses owned by families like Reliance, Adani,Tatas, Agarwals etc. This phenomenon is unique to India.

Indian Banking is different:

Indian banking is very different from other countries. Even now 70% of the banking business is with public sector banks. It is based on the trust and belief that these banks will not fail as they are owned by the government. If these banks fail then the government itself will fail. There is an unwritten sovereign guarantee.

The deposit guarantee of DICGC which has been enhanced to Rs. 5 lakhs from Rs.1 lakh is immaterial for public banks.

In other countries the amount of insurance for deposits in private banks is huge.

For example in US, the guarantee is US $250000 which is equivalent to Rs.18451887 for an individual account provided by Federal Deposit Insurance Corporation which monitors more than 5500 financial institutions. In fact a depositor can have insurance upto $1500000 if deposits in different category accounts in different financial institutions / banks.

[Each ownership category of a depositor’s money is insured separately up to the insurance limit, and separately at each bank. Thus a depositor with $250,000 in each of three ownership categories at each of two banks would have six different insurance limits of $250,000, for total insurance coverage of 6 × $250,000 = $1,500,000.[8] The distinct ownership categories are[8]

- Single accounts (accounts not falling into any other category)

- Certain retirement accounts (including Individual Retirement Accounts (IRAs))

- Joint accounts (accounts with more than one owner with equal rights to withdraw)

- Revocable trust accounts (containing the words “Payable on death”, “In trust for”, etc.)

- Irrevocable trust accounts

- Employee Benefit Plan accounts (deposits of a pension plan)

- Corporation/Partnership/Unincorporated Association accounts

- Government accounts

China which has the top banks in the world has public sector banks which are governing the economy. If loans turn bad the government of China infuses additional capital because the banking business and loans directly and indirectly help economic growth and employment. Share holding limits in different selected countries is annexed. It is from the IWG report itself.

We have had bitter experiences with private banks before 1969. Between 1947 and 1969 there were 559 private banks which collapsed and in many cases the depositors lost their deposits.

Payment banks allowed to become small finance banks

The report says payment banks with 3 years track record can become small finance banks. Payment banks can’t give loans which small finance banks can.

Reliance has started Jio Payment Bank and Airtel has Airtel Payment Bank. The payment banks have limited operations but in the last 4 years they have not done much. Jio Payment Bank was recently fined by RBI with Rs.1 Crore for not complying with RBI guidelines. Reliance was earlier denied Universal Banking licence because they did not full fill the fit and proper criteria. Now they can convert Jio into a small finance bank and if this report is accepted they can buy 26% share in SBI or any other public sector bank.

So if these draft guidelines are implemented this will pave way for corporates / industrial houses and multi national corporations to takeover Indian private and public sector banks which will end access to banking for the masses of the country. Income inequality will increase. Ambani Adani, Agarwal, Tatas and few others will control banks and thus have control over the economy. The government can do nothing. Imagine what would have happened if Anil Ambani who was named 8th richest man in the world or Nirav Modi the diamond merchant of the world or Subrata Roy of SAHARA or Essar or Bhushan were allowed to run banks? Most of the corporates are running with people’s money and huge borrowings. They can fail any time. Tatas may be an exception.

You will not be surprised if Google or Amazon takes over one of our public sector banks as DBS Bank has taken over Lakshmi Vilas Bank ltd swiftly with the connivance of RBI

Permitting Non–Banking Financial Companies (NBFCs) to convert into universal banks.

Non-Banking Finance Companies are the ones which fleece the people with high interest rates. They borrow money from the banks at cheaper rate of interest but on lend to people upto 24% Interest. Many of them are owned by corporates. They are actually erstwhile money lenders. Now they will be permitted to start universal banks (with all banking operations) which will be dangerous. We can’t predict how long they will survive. Banking is basically a service not a business for profit. It is to help people to save and use the savings for giving loans to others who need. You can’t become Shylock. That’s why in every country there are social controls. For example Germany has state banks who operate within a state and use the deposits mobilised to give loans within the state only. Kerala has started a Kerala Bank which is similar but not the same. The RBI is creating enough of trouble for Kerala Bank which can actually become a role model.

RBI Governor has failed in all counts

Mr. SaktiKanta das, as economic affairs secretary was the spokes person of the government during the monumental failure called demonetisation. As governor RBI he has made the institution weak by transferring reserves to government which Dr. Urjit Patel refused. The economy has become weak and he has no plans worthwhile. The NPA is mounting and there is no worthwhile recovery mechanism. PMC Bank depositors are dying. LVB is handed over to a foreign bank. Hence it is time for the RBI governor to quit.

It is time for trade unions, people’s movements and civil society to give their opposition to the report, demand public hearing and launch agitation against every move of RBI and Govt to privatise the public sector banks. In fact it is time for one more nationalisation of private banks.

Annexure

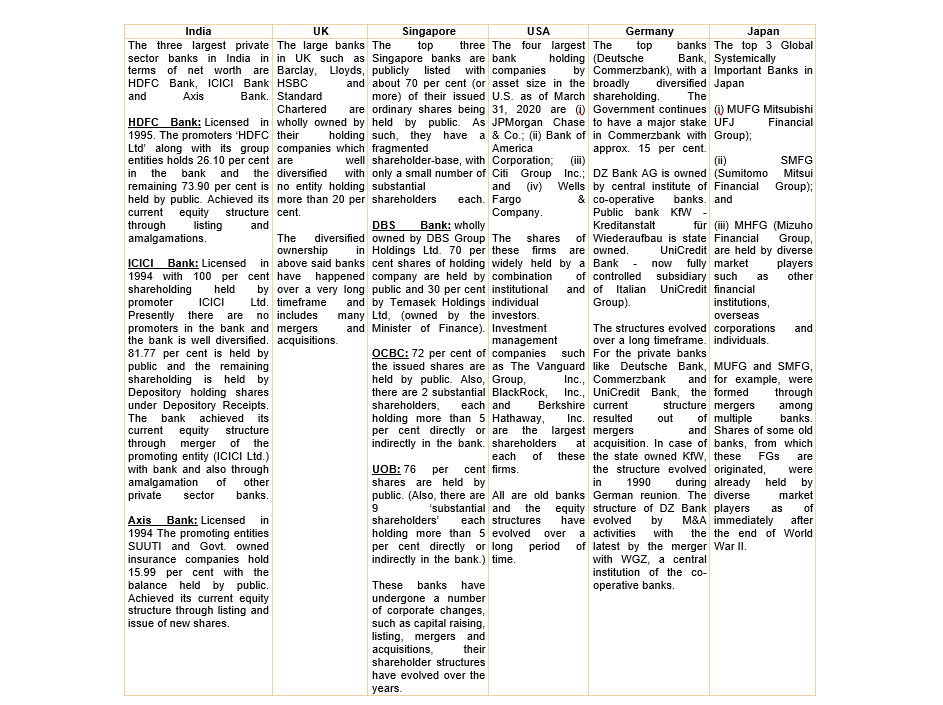

Current equity structure of top 3 to 5 banks in the jurisdiction:

Time frame over which these banks achieved the current equity structure and the applicable regulatory norms for these banks and methodoly adopted by these banks to bring down the promoters’ stake.

International practices for shareholding limits in banks in some other major jurisdictions

Australia

In Australia, the statutory provisions in the Foreign Acquisitions and Takeovers Act 1975 and Financial Sector (Shareholdings) Act 1998 prohibit any person from holding more than 20 per cent stake in a bank without prior approval of the Treasurer of Australia. The threshold for the stake was raised from 15 per cent to 20 per cent by the 2018 amendment act inter alia to align it with the 20 per cent foreign shareholding threshold under the Foreign Acquisitions and Takeovers Act 1975. The Corporations Act 2001 prohibits any person (including a corporation) from acquiring a relevant interest in voting shares of a corporation if, after the acquisition, that person or any other person would be entitled to exercise more than 20 per cent of the voting power. A person will have a substantial holding if the person and person’s associates have 5 per cent or more of the total voting rights.

Canada

The Bank Act does not permit any person to have ‘significant interest’ (aggregate holding greater than 10 per cent by the person and entities controlled by the person) in any class of shares of the bank or bank holding company except with requisite approval. A major shareholder of a body corporate is defined in the Act as a person with aggregate holding of voting shares of more than 20 per cent or non-voting shares of 30 per cent. Further, there is differential treatment with respect to maximum permitted shareholding in banks depending on size of equity of the bank. In banks with equity greater than CAD 2 billion but less than CAD 12 billion, a person is permitted to have aggregate shareholding upto 65 per cent with at least 35 per cent being publicly held. Banks with equity greater than CAD 12 billion are required to be widely held i.e. with no major shareholder except in certain circumstances.

France

Credit institutions (which include banks) must report financial information relating to ‘significant shareholders’ i.e. persons holding 10 per cent or more of a credit institution’s voting rights to the Prudential and Resolution Control Authority (ACPR), annually. A change in the shareholding structure of a credit institution (CI) must be also be informed to the ACPR. Prior approval of ACPR and ECB, under the Single Supervisory Mechanism (SSM), are required for a transaction by which a person acting alone or in concert with other persons can acquire, increase, reduce or cease to have, directly or indirectly, a participation in a CI, when either the fraction of voting rights held by that person/persons exceeds or falls below defined thresholds or credit institution becomes or ceases to be the subsidiary of that person or persons.

Hong Kong

The principal statue governing banks in Hong Kong is the Banking Ordinance (‘BO’) and banks are regulated by the Hong Kong Monetary Authority (‘HKMA’). Banks are within the definition of ‘authorised institutions’ under the BO. Though the BO does not specify a maximum percentage of shares in authorised institutions which may be owned by a shareholder, controllers of authorised institutions incorporated in Hong Kong are subject to the approval of the HKMA. ‘Controller’ is defined in the BO to include indirect controller (a person in accordance with whose instructions the directors of a company or of its parent company are accustomed to act), minority shareholder controller (a person who either alone or with associates controls 10 per cent but not more than 50 per cent of the voting rights of the bank or of another company of which the bank is a subsidiary) and majority shareholder controller (a person who either alone or with associates controls over 50 per cent of the voting rights of the bank or of another company of which the bank is a subsidiary).

Indonesia

As per the Act of the Republic of Indonesia Number 7 of 1992 concerning Banking as Amended by Act Number 10 of 1998, a Commercial Bank in Indonesia may only be established by (i) Indonesian citizens and/or an Indonesian legal entity; or (ii) Joint venture between Indonesian citizens and/or an Indonesian legal entity with foreign citizens and/or a foreign legal entity. The OJK Regulation issued in 2016 has prescribed ownership limits in Commercial Banks based on the category of shareholders viz. for banks and non-banks financial institutions – 40%; non-financial institution – 30%; and individual shareholders – 20%. The said ownership limits are not applicable to Central Government and such institutions involved in bank’s recovery. Financial institutions which intends to acquire more than 40% in a bank requires approval from Financial Services Authority, Indonesia. Controlling shareholder is an individual/entity/group that holds 25% or more of the total shares of the bank or even in case of holding less than 25%, however, proven to exercise control over the bank directly or indirectly, has to seek prior approval. Non-controlling stakes, lower than 25 per cent, face no other constraints and are permitted without approval. This freedom is permitted for overseas investors as well.

Malaysia

In terms of Financial Services Act, 2013, an individual shareholder is not allowed to hold more than 10 per cent interest in shares in a licensed financial institution in Malaysia. Under the Companies Act, 2016, substantial shareholders i.e. persons having an interest in not less than 5 per cent of the total voting shares of a company, which includes banks, are required to give notice of acquisition or change or cessation of substantial shareholding to the company within specified time frame. Prior approval of Bank Negara Malaysia (BNM) is required for acquisition of interest of in shares by way of an agreement or arrangement which would result in an aggregate interest of 5 per cent or more in the shares of the bank. Prior approval of the Minister is required, with the recommendation of BNM, for a person to acquire control of a bank. A person shall be presumed to have control if such person has an interest of more than 50 per cent of the shares of the bank or the power to elect, appoint, remove majority of the directors or the power to make or cause decisions to made and executed or is the person on whose directions or instructions the management and board are accustomed or obligated to act.

New Zealand

There are no ownership limits that are specifically applicable to registered banks in New Zealand. If a registered bank in New Zealand is subject to a change of ownership, the prior consent of the Reserve Bank of New Zealand (RBNZ) will need to be sought. Once again there is no fixed threshold but the RBNZ consent will need to be obtained before a person gains a ‘significant influence’ over a registered bank or increases the level of ‘significant influence’. As a guideline the RBNZ considers that significant influence includes the ability to directly or indirectly appoint 25 per cent or more of the board of directors or a direct or indirect qualifying interest in 10 per cent or more of the voting shares of the registered bank.

Sweden

The rules on prudential assessments of acquisitions and increase of holdings in banks in Sweden are based on the directives of European Union Parliament and laid down in the Swedish Banking and Financing Business Act. The approval of the Swedish Supervisory Authority is necessary for a direct or indirect acquisition of a qualifying holding (direct or indirect holding of 10 per cent or more of the capital of or voting rights or a holding which makes it possible to exercise a significant influence over the management) in a bank or the direct or indirect increase in such a qualifying holding whereby the holding of capital or voting rights would reach or exceed 20 per cent, 30 per cent or 50 per cent or the bank would become the acquirer’s subsidiary.

Switzerland

There is no threshold limit for bank shareholding in Switzerland. Prior reporting is mandatory for all individuals and entities for directly or indirectly buying or selling ‘qualified participation’ in a bank. A ‘qualified participation’ exists when an individual or legal entity directly or indirectly owns at least 10 per cent of the capital or voting rights of a licensed institution or can otherwise influence its business activities in a significant manner. They must also report when their shareholding rises above or falls below the threshold values of 20 per cent, 33 per cent and 50 per cent. Natural persons or legal entities that directly or indirectly participate in the bank with at least 10 percent of the capital or voting rights or whose business activities are otherwise such that they may influence the bank in a significant manner (qualified participation) must guarantee that their influence will not have a negative impact on the bank’s prudent and solid business activity.

South Africa:

Bank Act, 1990 mandates prior approval of Prudential Authority (PA) for a person to acquire more than 15 per cent but less than 24 per cent of shares or voting rights; and more than 24 per cent but less than 49 per cent of shares or voting rights in a bank or in a controlling company. Further, prior approval of Minister is required for acquisition of (i) more than 49 per cent but less than 74 per cent of shares or voting rights and (ii) more than 74 per cent of shares or voting rights in a bank or in a controlling company. The PA or Minister before granting permission for above said acquisition of shares or voting rights should be satisfied that the said acquisition will not be contrary to the public interest or the interest of the bank concerned or its depositors or of the controlling company. While granting such approvals, if required, PA or Minister may consult Competition Commission.

Also, the Bank Act stipulates that where the PA or Minister is of the opinion that the retention of shareholding or voting rights by a particular shareholder will be detrimental to the bank or concerned controlling company, the PA or Minister (as the case may be), may apply to the High Court requesting for an order compelling such shareholder to reduce the shareholding or voting rights to not more than 15 per cent or to limit the voting rights to 15 per cent of total voting rights. While granting such approvals, if required, PA or Minister may consult Competition Commission. Further, Financial Sector Regulation (FSR) Act, 2017 defines significant owner as the one who directly or indirectly, alone or together with a related person has the ability to control or influence materially the business or strategy of the financial institutions. The FSR Act prescribes approval requirement for such significant owner of a financial institution.

Thomas Franco is former General Secretary of All India Bank Officers’ Confederation.

can we prepare a common letter to rbi.

sending email by public opposing this.

please send