There are several factors which play an important role in determining the relationship between banks and their customers. One of the most important amongst them is what services banks provide and how they deliver it to their customers which can facilitate the best to their financial needs. Banks were nationalised with the objective of making banking available to everyone, especially the poor and the marginalised. In the last five decades public sector banks have emerged as one of significant institutions in contributing and shaping the entire economy of the county. The vast number of the country’s population opened their accounts with public sector banks because there was a considerable level of trust and accountability in government’s owned financial institutions.

But all this has changed in the past few years when the government has brought numerous service charges levied by banks. These are the charges introduced by banks for almost all the basic services such as for SMS alerts, cash withdrawal/deposit, balance inquiry from ATMs, issuance and reissuance of debit card, debit card annual charges, for any mobile number, address or other KYC related changes, for depositing money at cash deposit machines, ATM pin generation, cheque book etc.

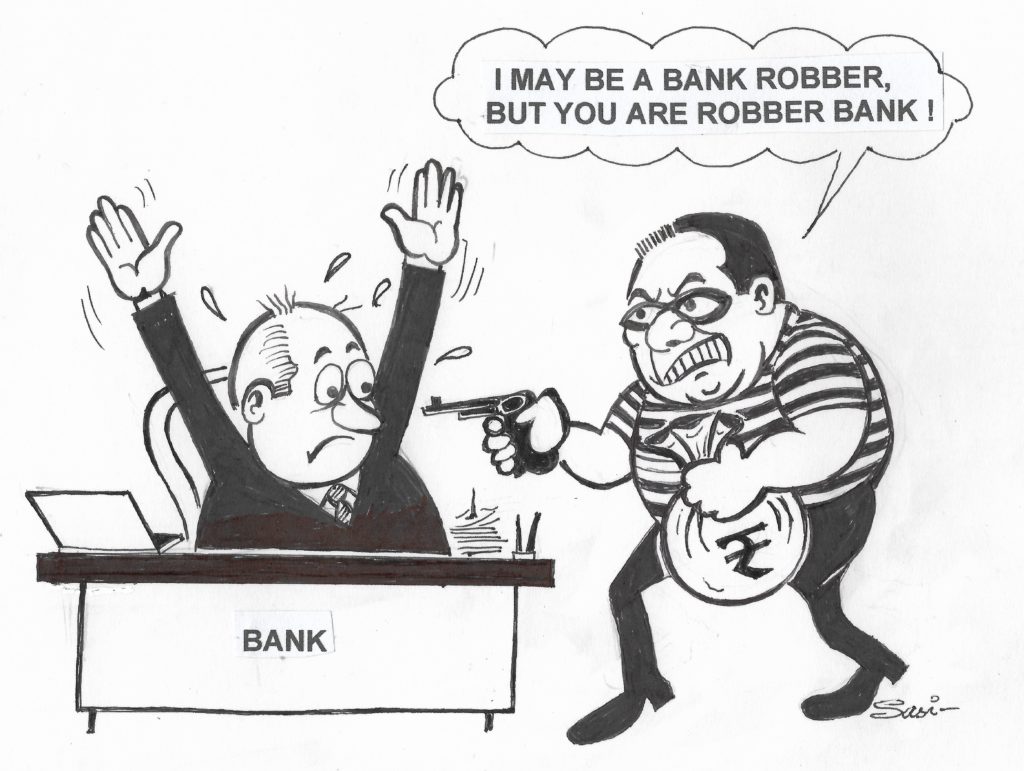

All the banks have increased their service charges and this has not only adversely impacted the relationship of customers with their banks but also decreased their trust gradually towards banking system. Now banks seem to be neither that place where people can keep their money safe nor the service provider who operates with the motive of benefiting and serving common people. It has become contrary to its nature and objective of existence.

High service charges have led to several changes in customers thinking and preferences regarding their savings and investments. This can be clearly seen in a major shift of customer’s trust from one bank or account to another in search of minimal bank charges and lower costs. In fact they would rather prefer to keep their money with themselves instead of keeping in bank accounts because all such charges are deteriorating their savings and making it unsafe to keep money there.

In order to avoid the risk and uncertainty of higher cost related to the availing of the banking services, people have started considering alternative investments which can give them highest possible return for their funds. These charges will also shape customer’s future choices regarding the kind of banks they will choose to open their accounts with. Some customers might move to other forms of banking system such as payment banks, small banks or other non-banking financial companies, etc. But whatever they will prefer, they will definitely be more careful in choosing a particular bank to open their accounts. They will consider the level of bank charges imposed by that particular bank as their first concern than its services. But the worse off will be people from lower middle class and poorer economic background who will be forced into the banking system to avail government benefits but will be looted in the name of charges.

As institutions that run on the deposits of the people, the banks cannot afford to risk them moving away from banking. Therefore it is very essential that banks must review their operating ways and must go back to its goals of nationalisation. Otherwise without common depositors, it will be drifted away from its very basis of existence.

Hence through ‘No Bank Charges’ campaign we demand that the RBI and Banks must withdraw all its service charges from saving account holders as it is influencing its customers in a most negative way and fading their trust from the banking system.

The article published in CounterCurrents can be accessed here.