The story of India’s Bank nationalisation in 1969, i.e. the public takeover of a significant part of the country’s banking system, its causes, consequences, achievements, and finally concerted attempts to weaken/roll-back the banking and financial policies since 1991, have been discussed and analysed at great length by a large number of scholars and public policy experts. In this very brief note, I want to recall and highlight only a couple of arguments which constitute the basis for my claim (shared by a large number of academics) that the 1969 banking policy intervention was among the most important tools for a broad-based economic transformation and social justice during the dirigiste era, or during the period of planned economic development soon after independence. As we know, so-called economic reforms started in a slow and creeping fashion during the 1980s, but 1991 was a watershed moment when a dramatically different market-driven regime was put firmly in place. This was also the beginning of the rolling back of the policy-architecture associated with bank nationalisation, and consequently gradually undoing of their gains. We flag a couple of indicators in the following pertaining to both these phases, specifically with reference to the rural economy which is critical to the wellbeing of a large section of the population, in particular the working people of the country.

The story of India’s Bank nationalisation in 1969, i.e. the public takeover of a significant part of the country’s banking system, its causes, consequences, achievements, and finally concerted attempts to weaken/roll-back the banking and financial policies since 1991, have been discussed and analysed at great length by a large number of scholars and public policy experts. In this very brief note, I want to recall and highlight only a couple of arguments which constitute the basis for my claim (shared by a large number of academics) that the 1969 banking policy intervention was among the most important tools for a broad-based economic transformation and social justice during the dirigiste era, or during the period of planned economic development soon after independence. As we know, so-called economic reforms started in a slow and creeping fashion during the 1980s, but 1991 was a watershed moment when a dramatically different market-driven regime was put firmly in place. This was also the beginning of the rolling back of the policy-architecture associated with bank nationalisation, and consequently gradually undoing of their gains. We flag a couple of indicators in the following pertaining to both these phases, specifically with reference to the rural economy which is critical to the wellbeing of a large section of the population, in particular the working people of the country.

But, first a word on the context of nationalisation. On the eve of independence in 1947, India’s banking and financial structure happened to be in an utterly disparate and weak state, full of malpractices, short-sighted quests of quick returns, frequent bank failures etc. Although some important regulatory measures were put in place during the 1950s and early 1960s, most of the major problems, including extremely inadequate banking coverage of the country’s population, very poor level of resource mobilisation and lending, huge inequities across regions, sectors and segments of the population, among others, continued to plague the system, and the need to address these challenges on an urgent basis were increasingly recognised by the policy establishment. For instance, to get a sense of the uneven access to the banking sector, we may note that even as late as 1967, of the total scheduled commercial bank branches in the country, barely 18 percent were in rural areas, where majority of Indians resided and had their primary sources of livelihood. Further, in the same year, agriculture received as little as 2 percent of the total advances by the scheduled commercial banks for the country as a whole.

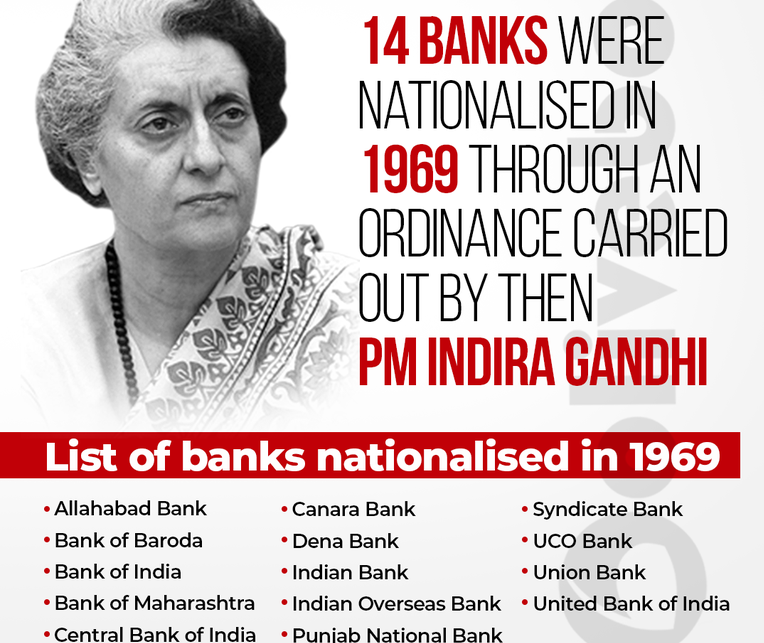

Possibly, the major economic shocks of the 1960s, which were partly due to factors organically connected with the overall development strategy, but got seriously aggravated due to the military engagements of 1962 and 1965 followed by the huge monsoon failures of 1965 and 1966, made the government of the day acutely aware of the need to address, on an urgent basis the massive deficits of the banking system. In fact, my hunch is that the agrarian crisis of the mid 1960s, which resulted in serious food shortages in several parts of the country, was a major catalyst behind government’s decision to nationalise the leading commercial banks, although a host of other factors hinted above, and the increasingly felt need to have an overall social and economic control on the financial system, were major drivers. There was a strong sentiment in the political/policy establishment that the hold of a small powerful elite on national resources and savings must be loosened for better access to the marginalised sectors and vulnerable populations. It was, to put it telegraphically, such a backdrop that resulted in the government led by Indira Gandhi to nationalise 14 large banks in 1969.

And it was a major step in ushering social and development banking in the country, and in particular, addressing some of the most pressing challenges in agriculture through much needed support to the newly launched strategy of Green Revolution. All the major indicators relating to the banking sector and connected economic outcomes, for the next couple of decades tell us an impressive story. Expansion of banking coverage across the country, significant increases in deposits and credits, increased allocations as targeted lending for priority sectors etc., are very well documented. But a couple of numbers are worth flagging to get a feel of these important changes. Share priority sector advances, in total credit allocation from the banking system, more than doubled between early 1970s to late 1980s, touching 45 percent at the latter date; agriculture, small scale industries and a host of economically and socially vulnerable groups were significant beneficiaries of such a shift that promoted trajectories inclusive transformation. Increases in deposits, as a share of GDP, went up from 13 to 38 percent between 1969 to 1991, and comparable figures of 10 to 25 percent in advances, are impressive achievements indeed. It should also be underscored that the performance of these ratios in rural areas were equally laudable. Of course, there were significant lapses and gaps in achievement-indicators of the banking across social geography in the country, and lot more could have been achieved; further, progress across states were uneven. However, none of these should take away from the impressive outcomes that we have already hinted.

In fact, several economists are of the view that bank nationalisation was absolutely critical in India’s economic turn around after a slump of more than a decade since the mid 1960s. interestingly, some of the advocates of neoliberal reforms also view India’s experience of nationalisation in a positive light. Instead of getting into an assessment of these views, what I would like to underscore here is that the progress in several important economic and social indicators in rural economy, e.g. agricultural growth, expansion of non-farm activities, employment generation, poverty alleviation etc. would have been inconceivable without bank nationalisation.

As it happens, market-driven reforms in the banking sector, beginning with the implementation of the recommendations of the Narsimham Committee, have resulted in major setbacks to the vision of ‘development banking’. Huge evidence has accumulated over the last three decades regarding regressions and reversals pertaining to almost indicator, e.g. coverage, equity, attention to priority sector and vulnerable socio-economic categories etc. However, the policy changes of the last few years during the NDA II and III regimes, are nothing short of a disaster, with hyper-privatisation becoming the ruling theology, in complete disregard of our own experience, or evidence that have accumulated across the world. Such a scenario defies even elementary logic!

Picture credits: Oliveboard/Facebook

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.