After nationalisation of 14 banks in 1969 and 6 more in 1980, access to credit became possible for small borrowers. But everything changed after 1991 and worsened after 2014.

After nationalisation of 14 banks in 1969 and 6 more in 1980, access to credit became possible for small borrowers. But everything changed after 1991 and worsened after 2014.

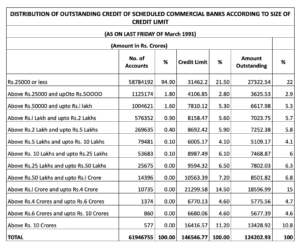

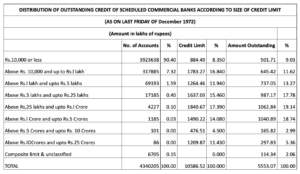

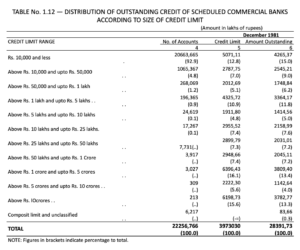

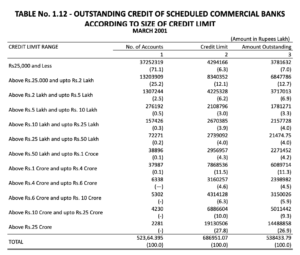

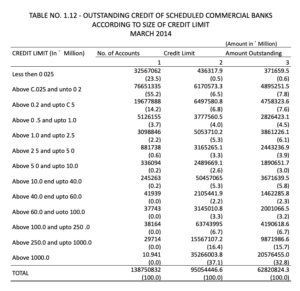

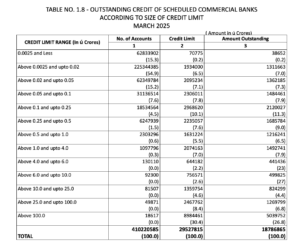

Please refer to tables from RBI over a period, given below:

In 1972, credit less than Rs.10,000 was for 90.40% of borrowers and the amount outstanding was 9.03% of total credit by banks. Credit up to Rs.1 lakh was given to 97.72% of the borrowers and 20.65% of the amount outstanding was less than Rs.10,000.

In 1972, credit less than Rs.10,000 was for 90.40% of borrowers and the amount outstanding was 9.03% of total credit by banks. Credit up to Rs.1 lakh was given to 97.72% of the borrowers and 20.65% of the amount outstanding was less than Rs.10,000.

In 1981, accounts with credit limit up to Rs.10,000 were 92.9% of the accounts and 15% of the outstanding. Credit up to Rs.1 lakh was 98.9% of the accounts and 30.2% of the outstanding.

In 1991, accounts with credit limit up to Rs.25,000 were 94.90% and the amount outstanding was 22%. Credit up to Rs.2 lakhs (considering inflation) was 99.20% of the accounts and the amount outstanding went up to 35.9%. This was the golden period for small borrowers.

In 2001, the number of accounts below Rs.25,000 credit limit came down to 71.7% and the amount outstanding was just 7%. Credit limit up to Rs.2 lakhs came down to 96.3% and the amount outstanding came down to 19.7%.

In 2014, accounts with less than Rs.25,000 credit came down to 23.5% and outstanding came down to 0.6%. Borrowers with credit up to Rs.2 lakhs came down to 78.4% and the amount outstanding was only 8.4%.

In 2014, accounts with less than Rs.25,000 credit came down to 23.5% and outstanding came down to 0.6%. Borrowers with credit up to Rs.2 lakhs came down to 78.4% and the amount outstanding was only 8.4%.

In 2025, accounts with a credit limit up to Rs.25,000 have come down to 15.3% and the outstanding amount to 0.2%. Accounts with a limit up to Rs.2 lakh have come down to 70.2% and the amount outstanding up to Rs.2 lakhs has come down to 7.2% only.

| Year | % of Accounts O/S up to Rs.25,000 | % of Accounts O/S up to Rs.2 lakhs |

|---|---|---|

| 1972 | 90.4% | 97.72% |

| 9.3% | 20.65% | |

| 1981 | 92.9% | 98.9% |

| 15.0% | 30.2% | |

| 1991 | 94.9% | 99.2% |

| 22% | 35.9% | |

| 2001 | 71.1% | 96.3% |

| 7% | 19.7% | |

| 2014 | 23.5% | 78.4% |

| 0.6% | 8.4% | |

| 2025 | 15.3% | 60.24% |

| 0.2% | 7.2% |

This is in spite of the government’s claim of Rs.10,000 loans to nearly 1 crore street vendors under PM Svanidhi and MUDRA loans under Kishore having been sanctioned to almost 50% of the 51 crore total borrowers (Rs.50,000 to Rs.5 lakhs).

Where did the money go?

In 1972, there were only 6,892 borrowers who were given loans above Rs.5 crores. The number of accounts was 0.15% and the amount outstanding was 10.41%.

In 1981, there were only 6,739 borrowers (reduced) who were given loans above Rs.5 crores (0.3%) and the loan outstanding was 17.6%.

In 1991, there were 2,811 borrowers (negligible %) with loans above Rs.4 crores (RBI changed format) and outstanding was 20.1%.

After liberalisation started in 1991, by 2001, the number of borrowers with a credit limit above Rs.4 crores became 18,151 and the outstanding became 46.6%.

By 2014, if we take borrowers with credit limits above Rs.10 crores (adjusting to inflation), there were 403,764 (2%) borrowers and the amount outstanding reached 65.5%. Surprisingly, 10,941 borrowers were given loans above Rs.1,000 crores. (Now RBI has abolished reporting loans above Rs.1,000 crores and figures are clubbed as above Rs.100 crores.)

In 2025, there are 149,995 (0.3%) borrowers with limits above Rs.10 crores and the outstanding is 38%. This is because, in 10 years, banks have written off Rs.16.5 lakh crores and closed lots of large loan accounts.

India’s population now is 146.3 crores and only 41 crores have access to credit through banks including Small Finance Banks. 30% could be below 18 as per estimates. So 102.2 crore need loans but only 40% or 41 crores have access to credit (it may be even less as one borrower can have more than one loan).

Where does the rest 60% go for loans?

To the Non-Banking Finance Companies (NBFCs), Micro Finance Institutions (MFIs) and moneylenders.

This government has consciously supported large borrowers and ordinary people are forced to go to the above agencies and borrow at high rates of interest.

As per Bharat Micro Finance Report 2024, outstanding loan accounts as on March 2024 were 16.13 crores and outstanding was Rs.4,42,700 crores (33% by banks). This is steadily increasing.

What are the reasons?

-

Government policy of promoting NBFCs and MFIs

-

Reducing staff strength in public sector banks (Refer previous article)

-

Changing goals of public banks from 1991

-

Reducing public banks from 28 to 12 through mergers

-

RBI relaxing norms to lend to NBFCs by banks

What is to be done?

-

Promote more public banks, branches, and triple staff strength

-

Reverse the policies towards the majority instead of a minuscule minority

-

Listen to the United Forum of Bank Unions and All India Bank Officers Confederation and address their strike demands including recruitment

Thomas Franco is the former General Secretary of the All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram and WhatsApp. Click here to join our Telegram channel and click here to join our WhatsApp channeland stay tuned to the latest updates and insights on the economy and finance.