Random Reflections

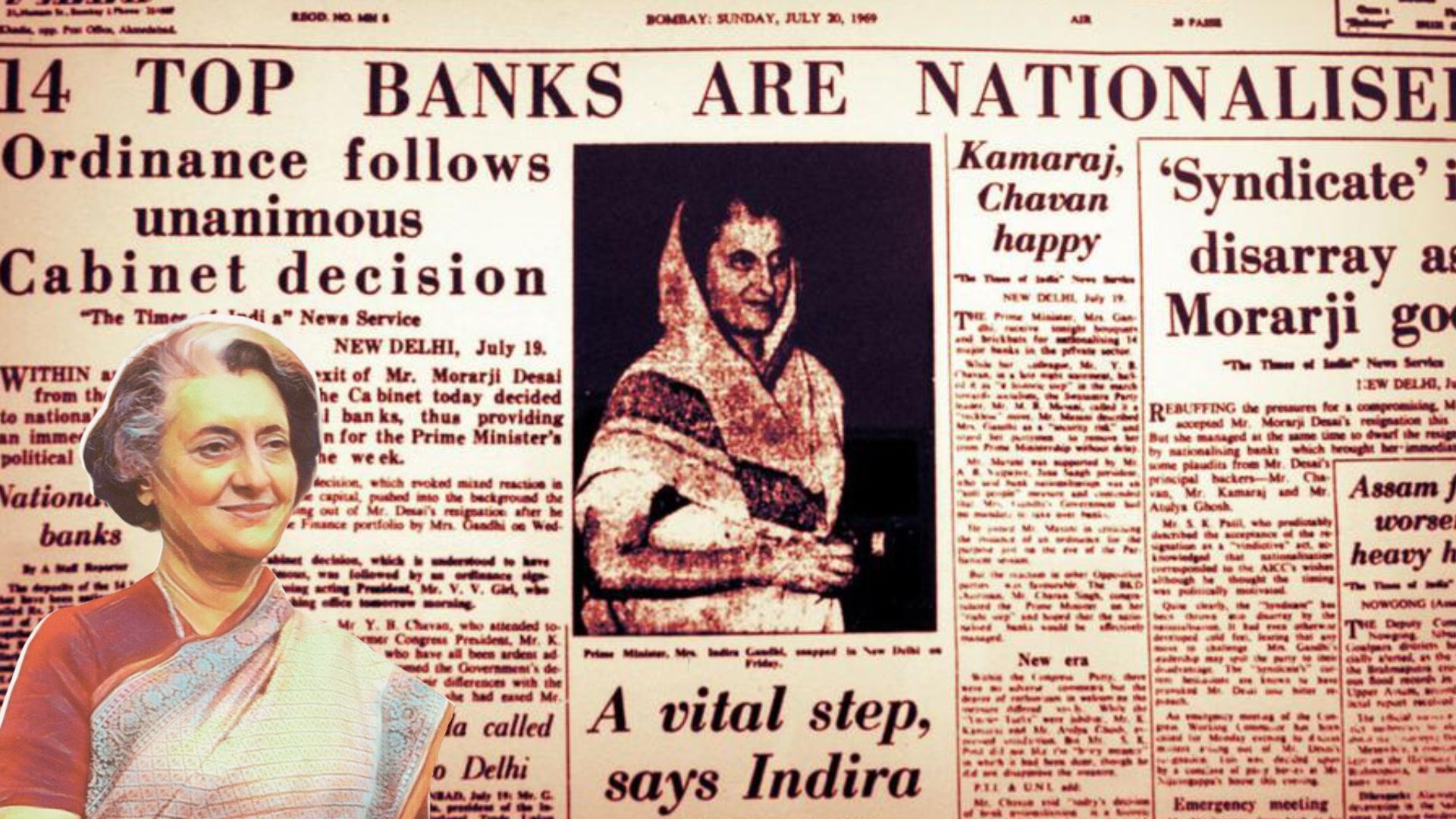

Though the government announced two years ago that it is going to privatise two public sector banks, it could not privatise even one so far because of the strong opposition from the United Federation of Bank Unions. Yet, using dubious methods, it has succeeded in reducing the strength of PSBs. Let us analyse this based on data provided by RBI itself.

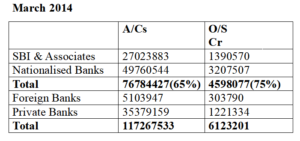

As per the RBI data of March 2014, Public banks owned 82% of the branches, 65% of the loan limit, and 75% of the loans outstanding. If we add foreign banks and small finance banks 36% of the branches, 66% of the loan accounts and 45% of the loans belonged to private banks.

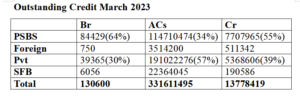

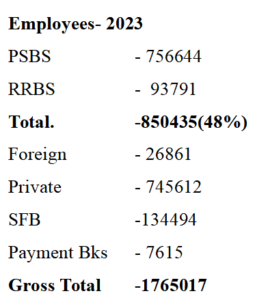

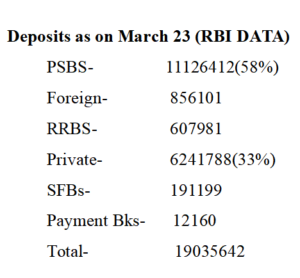

The staff strength of PSBs (including SBI) was 8,44,445, whereas private banks, including foreign banks, had a staff strength of only 3,35,615. The share of total outstanding bank credit of PSBs as of March 2023 has come down to 55%, and the share of total deposits has come down to 58%. The staff strength in PSBs has come down to 7,56,644, whereas for private banks, it has increased to 7,45,612. If we take RRBs as Public entities, the number is 8,50,435 which is only 48% of total Bank employees.

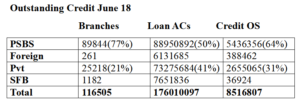

Even in June 2018 PSBs had 77% of the branches, 50% of loan accounts and 64% of the outstanding credit. In the last 5 years, the Govt has used various methods to increase the share of private banks, which includes banks with over 50% foreign shareholders.

Per Employee Customers

Look at HDFC Bank, the top private bank., now the 4th largest bank in terms of market capitalization. As of March 2022, they had 6,342 branches, with only 1,147 (18%) being rural, 2,036 (32%), semi-urban, 1,312 (21%), urban, and 1843 (29%) in Metro. They have 7.1 million customers. So the number of customers per employee is just 501. They have a staff strength of 1,41,579 employees. The total value of their business is Rs. 29,28,037 (Dep 15,59,217 + Advances 13,68,820).

Now let us look at the State Bank of India. SBI has 46.77 crore customers, 6.58 times more than HDFC Bank. It has a business of Rs. 67,855,501 crore, which is 2.31 times that of HDFC Bank. Its staff strength is 2,44,250, 0.5 times more than HDFC’s. Interestingly, while HDFC recruited 21,486 staff last year, SBI reduced its staff by 1402 people; the per-employee customer figure in SBI in 1680. SBI has 8,018 rural branches (32%), 7,215 semi-urban branches (29%), 5,253 urban branches (21%), and 4,462 metro branches (18%).

BOB has a total business of 18, 23,093 Cr. with 8,168 branches, of which 34.82% are rural, 25.5% are semi-urban, 18.6% are urban, and 21.62% are metro. BOB has over 13 crore customers and only, 79,000 employees, which is just half of HDFC’s staff strength. The per-employee customer in BOB is 1605. If they increase the staff strength in the public sector, their business, customer service, and profits will certainly improve. PSBs also provide reservations, including to those from economically weaker sections among the forward caste.

Media Reports

Yet, some media articles are lauding Modi and the Govt for its turnaround of the public sector banks! Credit is being given to the present government for unqualified success in NPAs, profit, growth in credit and resistance to external shocks.

A Reality Check

If we recall the past, when the whole world was dealing with the financial crisis of 2008, whose impacts are felt even today, Indian Banks were performing well, and the RBI governors were lauded for the same. This could be achieved mainly through credit flow from the banking system at that time.

Yes, during 2006-08 the government encouraged more loans, and banks were asked to lend to Infrastructure projects under public private partnership for electricity, steel etc as development Finance Institutions like ICICI, IDBI, UTI and HDFC were converted into commercial banks. They did lack the experience for long-term lending, but they adapted to these challenges and managed.

ICICI Bank converted in 1994, IDBI Bank in 2005, UTI Bank in 1993 which became Axis Bank in 2007 and HDFC Bank in 1994 were Development Finance Institutions(DFIs) created for specific purposes of long-term finance to specific segments. After long years the government has realised the mistake and now started a new DFI which is yet to show results.

NPAs

Net NPA in 2008 was 1% which is the same now. Net profit growth in 2006-07 was 27% and in 2005-06 it was 17.3%.

The NPAs of PSBs jumped to Rs. 2.17 lakh crore in 2014 because of the Asset Quality Review (AQR) and change in NPA norms, i.e. an account which was declared NPA after 180 days of non-payment was changed to 90 days and all restructuring schemes were stopped.

Quoting the large NPAs the RBI released a circular saying that corporates were responsible for the huge NPAs and announced that a ceiling of Rs. 10,000 Cr credit to one corporate will come into effect by 2019 and they will be asked to approach the market for more funds. Has it been implemented? NO! Instead, corporates are now getting unlimited loans and a large portion of NPAs belong to them!

Well, did the Govt or the RBI or the Banks put in efforts to recover the NPAs? The Govt brought insolvency and Bankruptcy code and created National Company Law Tribunals which are not helping to recover but write off loans with a legal sanction. Parliament Committee on Finance headed by Dr. Jayant Sinha itself has strongly commented on the write-offs called haircuts. The Banks have written off Rs13 lakh crore in 9 years.

Then how did the Bank’s balance sheets become clean?

Banks made a provision of Rs. 27,40,821.90 Cr between 2013 and 2022. Due to change in NPA norms, the provisions increased from Rs.74,310 Cr in 2013 to Rs. 2,10,927.4 Crores in 2016 and then to RS. 4,32,331.66 Crore in 2018 and more in the succeeding years. Instead of recovery, write-off increased. Between 2016-17 and 2021-22 alone, the amount written off is Rs. 11,00,013 crore. So naturally the balance sheets became clean and profits increased. Now restructuring has been allowed. More new loans have been given. The NPA increase will start soon.

Credit Growth

The credit growth in 2004-05 was 33.2%, in 2005-06 it was 31.8% and in 2006-07, the growth in credit was 30.6%.

The banks and the RBI were lauded for withstanding the external shock in 2008.

Does this not sound similar? The fact is, neither that period nor the present period is something to be celebrated and congratulated about. This is a cycle and the downslide is likely to start soon.

Instead of reducing corporate credit, banks have increased them under the watchful eyes of RBI and the government.

In Dec 2014 there were 10,452 Corporate loans above Rs. 100 crore each with an outstanding of Rs. 33,61,445 crore.

As on March 2023, the banks have 15,324 corporate loans with outstanding above Rs. 71,12,765 crore. This is the achievement of the Modi government! Today, 64 PSB Board of Directors posts are vacant; 24 posts of Officers/ Employee Directors are vacant; 6 posts of Non-Executive Chairman are vacant. The credit for this should also go to Mr Modi.

Let me point out a few portions of the statements of Raghuvaran Rajan quoted in an article by Y P Rajesh, from 2018-

“A large member of bad loans originated in the period 2006-08 when economic growth was strong and previous infrastructure projects such as power plants had been completed on time and within budget.”

“It is at such times banks made mistakes”

“Variety of Governance problems such as suspect allocation of mines coupled with the fear of investigation slowed down decision-making in Delhi”.

He also added that this happened under the UPA & NPA.

“The Govt has dragged its foot on project revival-the continuing problems of the power sector is just one example. “Appointment of CEOs is also wanting”

“In particular, the government should refrain from setting ambitious credit targets or waiving loans”.

But the finance minister still kept on giving targets and banks have in turn given out 43 crore loans to the tune of Rs. 23 lakh crore while NPAs are kept under the carpet. The moment they are declared, a new NPA cycle will start.

Now the RBI has come up with its circular on compromise proposals for wilful defaulters and frauds. Will that save the banks? No! The new cycle will start, and we will see another crisis soon. That means we don’t have a banking success story, either by NDA or UPA.

Notwithstanding the above, the need of the hour is to save PSBs and their character. They have a huge opportunity due to their branch network and customer base. The depositors still have more faith in PSBs as seen from the chart. If every one of them is given a loan, there will be huge growth in advances. For that, the employee’s strength should be at least doubled and outsourcing should stop.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.