In the early years after Independence, India’s rural economy faced a deep and persistent credit crisis. Agriculture employed the majority of the population, yet formal banking institutions had little presence in villages. Rural households depended largely on moneylenders and traders, often at exorbitant interest rates, reinforcing cycles of indebtedness and poverty. Addressing this imbalance became a central concern for the new Indian state, eventually shaping the creation of the State Bank of India (SBI), India’s largest bank in terms of capital and customers.

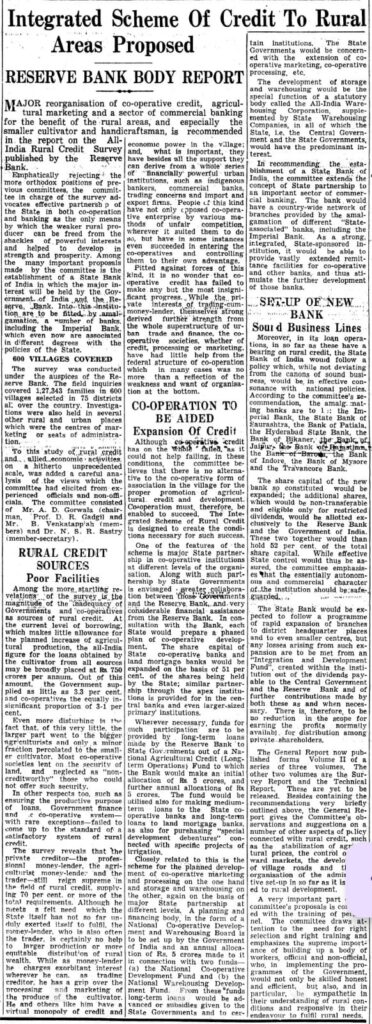

To systematically examine this problem, the Reserve Bank of India appointed a Committee of Direction to conduct the All India Rural Credit Survey. The Survey, completed and published in 1954, was the first comprehensive national assessment of rural credit conditions. Its findings were stark. Institutional sources—cooperatives, commercial banks, and government agencies—provided only a small share of rural credit, while non-institutional lenders dominated. The Survey highlighted not only the inadequacy of credit flow but also the structural neglect of rural areas by existing commercial banks.

The Committee of Direction concluded that piecemeal reforms would not be sufficient. Cooperative institutions were weak and unevenly spread, while commercial banks remained urban-oriented and profit-driven. The Survey emphasised that rural credit had to be treated as a developmental responsibility of the state, closely linked to agricultural production, marketing, and rural infrastructure. Without this integration, credit would fail to translate into sustained rural development.

These conclusions were prepared by the RBI-appointed body and reported in the press at the time . The proposals stressed that rural credit could not operate in isolation; it needed institutional backing, coordination with cooperatives, and a strong central banking presence capable of reaching villages. This thinking marked a shift away from the colonial banking legacy, which had prioritised trade and urban finance over agriculture.

One of the most significant recommendations of the All India Rural Credit Survey was that the Imperial Bank of India should be transformed into a state-associated institution with a clear mandate to serve rural and agricultural needs. The Committee argued that only a large bank with government participation could mobilise savings on a national scale and channel them toward priority sectors neglected by private finance. This recommendation directly laid the groundwork for the reconstitution of the Imperial Bank.

In 1955, acting on these findings, Parliament enacted the State Bank of India Act, converting the Imperial Bank into the State Bank of India. SBI was envisioned not merely as a commercial entity but as an instrument of planned development. Its responsibilities included expanding branches in rural and semi-urban areas, supporting cooperative credit structures, and increasing the flow of agricultural finance.

Thus, the formation of the State Bank of India was not an isolated institutional reform. It was the outcome of a rigorous, RBI-led investigation into rural credit, conducted by the Committee of Direction and published in 1954. The Survey’s diagnosis of rural financial exclusion and its call for decisive state intervention made clear that addressing rural credit was central to India’s broader economic transformation.

The Times of India

December 21, 1954