The savings of people deposited in banks form the capital of banks which banks lend to borrowers. Banks earn interest on the loans issued to borrowers. The cost of operating expenses including salaries comes from this interest on the loans issued by banks.

The saving account depositors receive interest on their savings, and the borrowers pay interest on money borrowed from banks. The difference between these two interest rates constitutes banks’ income. The gap between lending rate of interest and rate of interest on savings which banks gives to depositors is very high. Banks usually give an interest of 3% to 4% (continuously decreasing with time) to their saving account holders whereas charge from between 8% to 14% (more in some cases) on the loans. Banks have always made profit from this income generated through the difference in interest rates of borrowing and deposits.

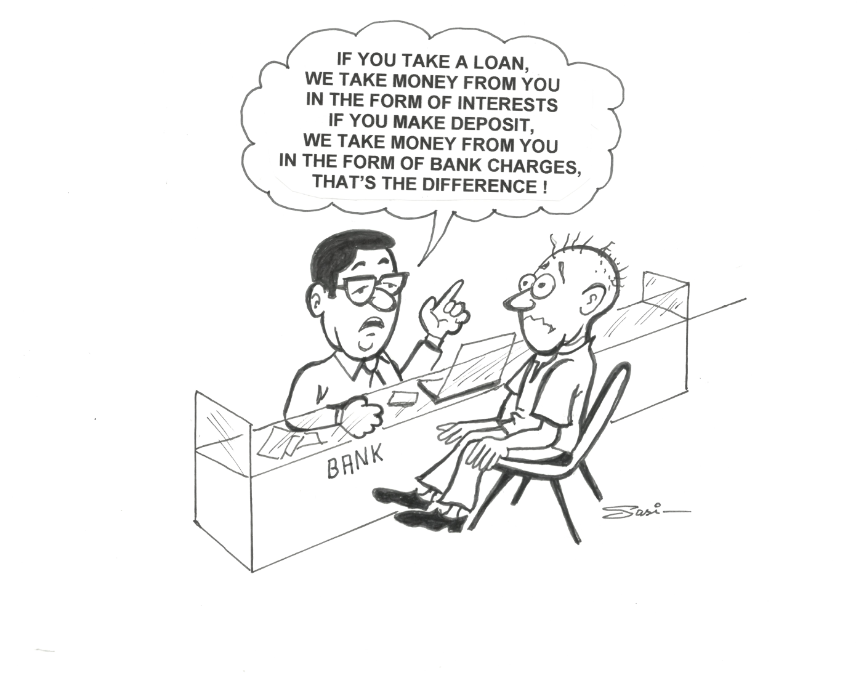

Since, it is the peoples’ savings deposited with the banks which they use for lending, banks won’t be able to survive without the savings deposits. But when banks started making loss from the loans issued to corporates and didn’t get the interest as well as the principal amount back, banks started charging the saving account holders for having the banks accounts and availing banking services. For every banking transaction, depositors are paying a certain amount of fee/charge including a certain amount for not having a minimum balance in the account. Basic banking services like cash withdrawal and deposit from bank branches as well as from ATMs, SMS alerts service, debit card usage, balance inquiry from ATMs, etc. are being charged. Earlier there was no charge on such services for saving account holders.

Thus, bank accounts which provide the money to banks for lending and were a safe option for people to keep their savings, have now become a medium to extract money from the same people.

Additionally, banks are also discriminating against the customers with less money in their accounts. People with small savings are paying huge amount of charges to avail the banking services whereas people with large savings in their accounts are provided all banking services for free.

‘No Bank Charges’ campaign demands that the Reserve Bank of India (RBI) and the government must take action and ask banks to stop charging saving account holders to compensate the losses incurred from the corporate loans.

The article published in CounterCurrents can be accessed here.