Compiled by: Thomas Franco

Text: Priya Dharshini

Source: Basic Statistical Returns of Scheduled Commercial Banks (SCBs) in India, Reserve Bank of India

July 19, marked the 51st anniversary of bank nationalisation. This day has been celebrated by bank unions across the country and has been hailed as one of the most significant policy changes in the banking system of the country. This process not only brought banks under the ownership of the state, but also defined the nature of banking that the country needs. It emphasis on the social responsibilities of banks and saw banks as instruments of social and economic change. One of the aspects of this was to give credit access to the people. Hence small credits were encouraged, while large credits had more regulations. This however changed post structural reforms in the ‘90s. Banks were gradually pushed to giving credits to large scale projects. This has primarily been the cause of the NPA crisis, with many of the large scale credits ending up becoming bad loans.

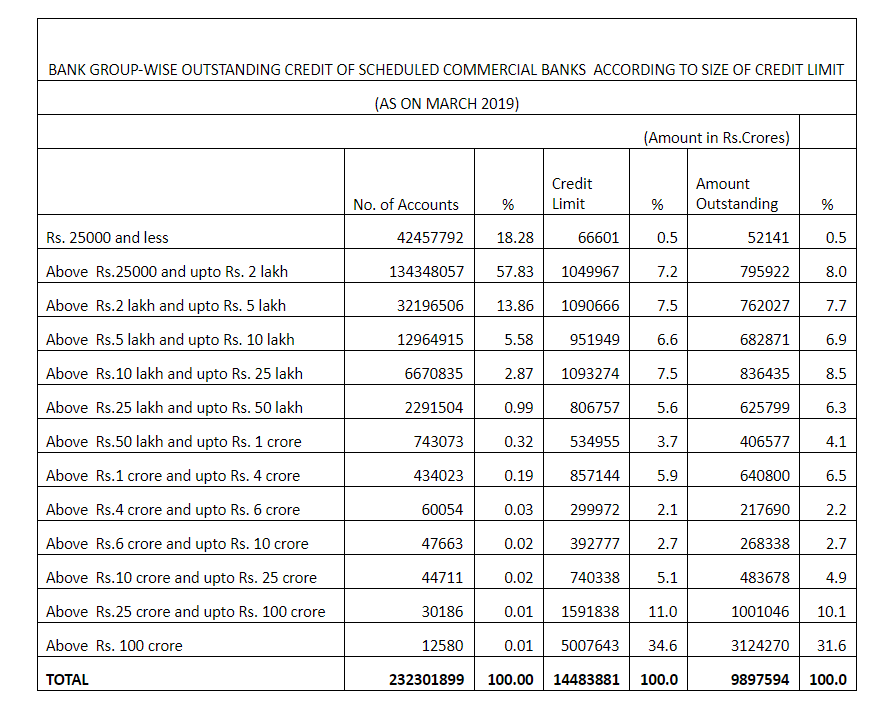

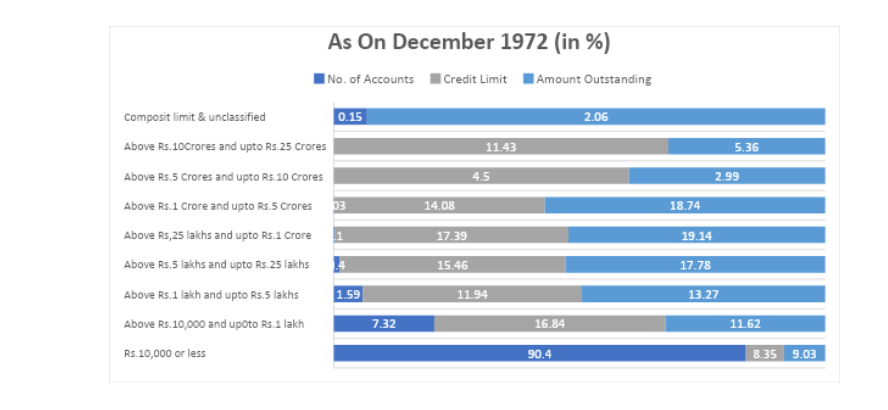

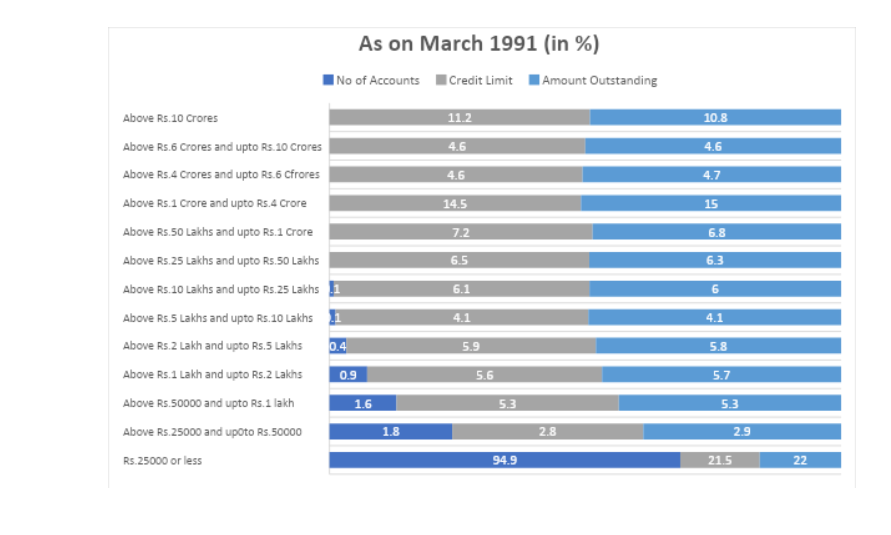

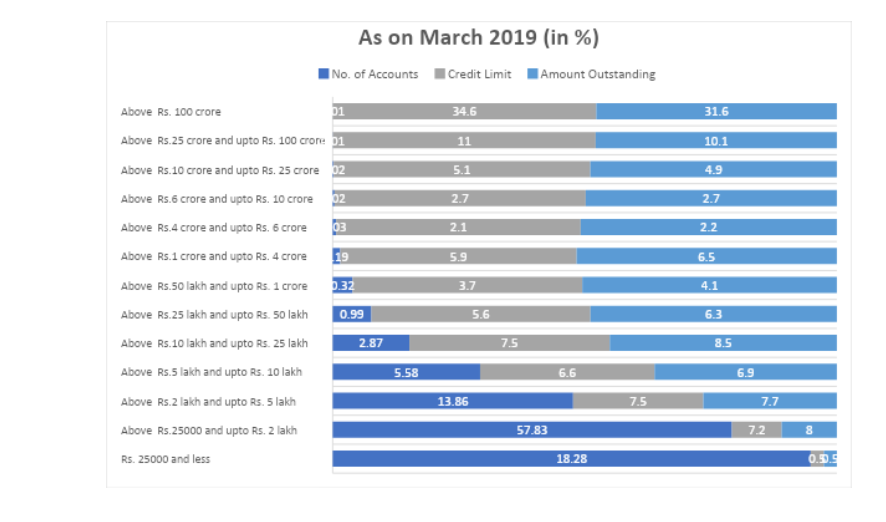

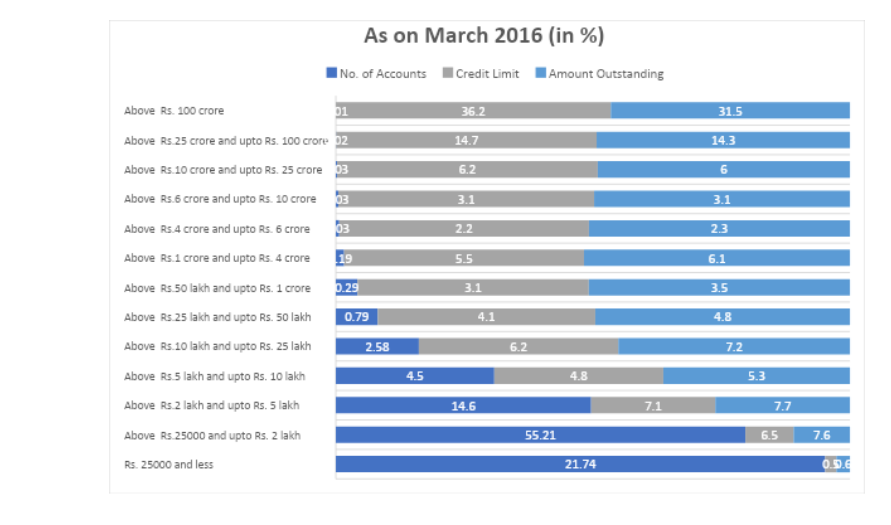

The following table shows the amount of small scale credits Vs large scale credits and the outstanding of such loans, comparing the years 1972 (immediately after nationalisations), 1991 (after structural reforms), 2016 (after the NPA crisis came to fore), 2019 (most recent).

In Charts

In Tables