World Bank Aid or that matter any aid and its impact on countries has been a controversial discussion in development finance circles. While it is true that aid provides an important source of income for poorer countries and has an effect on reducing poverty, there are debates on how the powerful and economic elites capture these resources. It is also seen that the level of corruption is very high in aid-dependent countries and some of these resources serve their interests.

The study Elite Capture of Foreign Aid Evidence from Offshore Bank Accounts by Jørgen Juel Andersen, Niels Johannesen, Bob Rijkers looks into this question of elite capture of foreign aid and finds that aid disbursements to highly aid-dependent countries coincide with sharp increases in bank deposits in offshore financial centers known for bank secrecy and private wealth management, but not in other financial centers.

The paper is very controversial after the ‘Economist’ magazine carried an article on the correlation of delay in publishing of this research and untimely resignation of the World Bank chief economist, under whose supervision the paper was produced. The paper was subsequently published by the World Bank. The paper study the aid diversion by looking at World Bank aid disbursement and data on foreign deposits from the Bank for International Settlements (BIS).

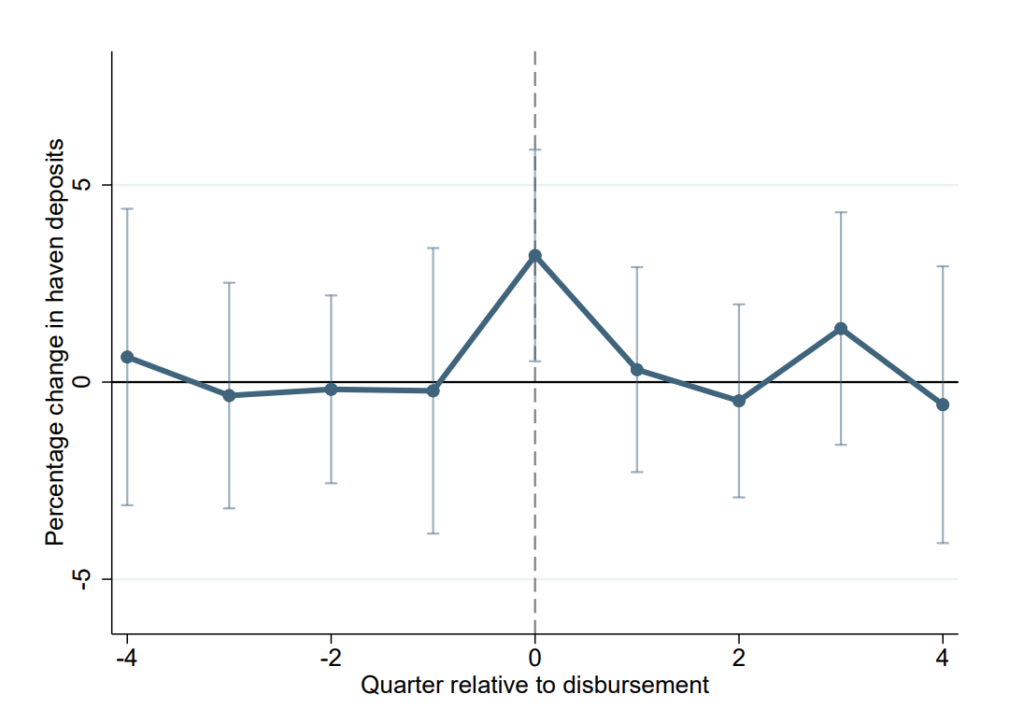

The study consisted of 22 most aid-dependent countries of the World Bank. It was seen that there were significant increases in the value of bank deposits in tax havens in the same quarter of World Bank aid disbursement. The spike in the deposits to tax havens in the same quarter of disbursements and no subsequent hikes in quarters before and after reveals a massive siphoning of World Bank aid meant for poorer countries who also happen to be high in the corruption index.

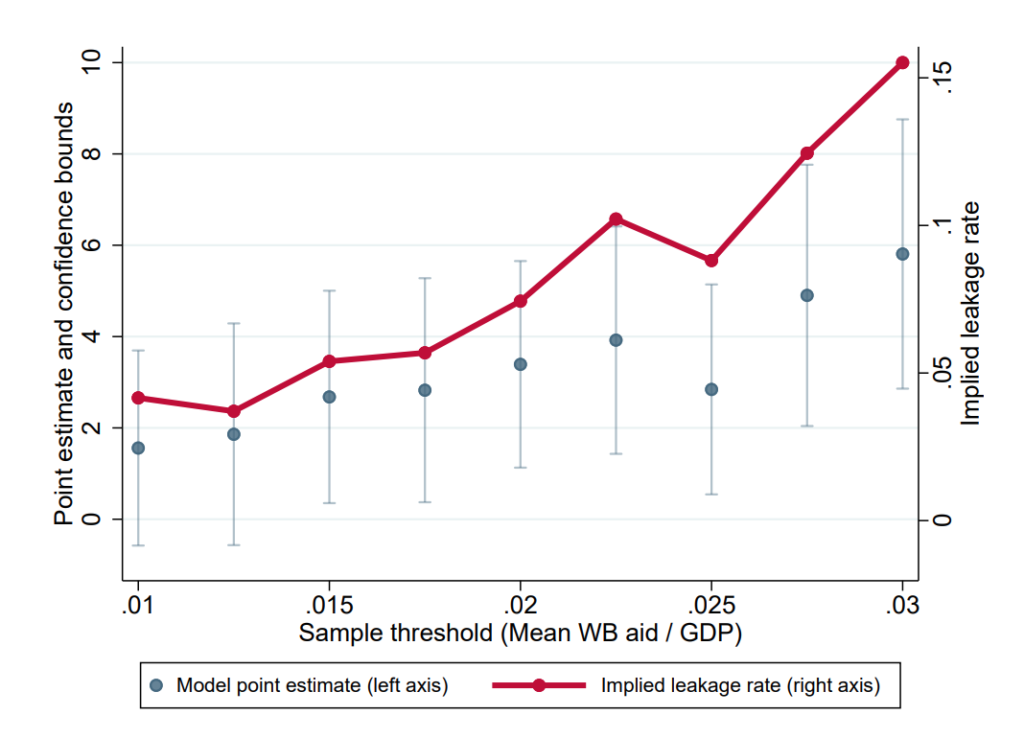

The study revealed that when a country receives aid equivalent to 1% of GDP, its deposits in havens increase by 3.4% relative to a country receiving no aid. The report states that at a mean about 5% of all the aid ended up in tax havens. This ratio increases with aid dependency. The more the aid, the more will be the leakage as is seen in the sample of countries which received 3% of GDP where the leakage rate is around 15%.

Much of the aid could be traced back to bank accounts in Switzerland and Luxembourg operated by the powerful elites from the aid-dependent countries. This, however, is just a tip of the iceberg as it calculates only the money which has flowed into tax havens and does not include investments in real estate, gold and other luxury goods including automobiles etc.

World Bank funding generally goes as either Development Policy Financing (DPF) or for Investment Project Financing (IPF), the latter being the one which is meant for projects which are supposed to reduce poverty. Project financing is said to be more robust and difficult to divert given the various policies including procurement and is tied to specific expenditure. However, the study reveals that an aid disbursement of 1% of GDP is associated with an increase in haven deposits of around 2.8% when the aid takes the form of DPF and 5.3% when it takes the form of IPF, bursting the myths of higher accountability and transparency in its funding.

While the above-mentioned study is regarding World Bank aid-dependent nations, the learning is relevant to countries like India which have also seen the capture of public resources meant for the poor and transfer of common resources to the countries elite. The level of corruption that existed when state-dominated economy earlier continues in new ways in the post-liberalisation era. Former Prime Minister Rajiv Gandhi in one of his famous statements acknowledged the leakages due to corruption. He stated that only 15% of the government intended to the poor reaches them. The situation did not change after liberalisation too. The former deputy chairperson Montek Sigh Alhluwalia has stated based on the planning commission study on PDS that only 16 percent was reaching the targeted poor in 2009.

In fact, the corruption scandals which involved public money being diverted to corporates have intensified after liberalisation when state-owned companies changed hands to private parties at throwaway prices or massive financial scams which seized public resources for private profit. India has seen a phenomenal rise in billionaires who have given from natural resources and its extraction be it coal, forests and state gifting of public resources like land. The increase in inequality post-reform period has reached such insanity that the combined total wealth of 63 Indian billionaires is higher than the total Union Budget of India for the fiscal year 2018-19 as documented by Oxfam India.

The recent financial scams including the high non-performing assets (NPA) where corporates took loans from public sector banks but diverted its uses and fattened themselves and later got huge subsidies, tax rebates and cuts and write-offs for the money they owed to the public banks. The study by Jørgen Juel Andersen, Niels Johannesen, Bob Rijkers though limited to World Bank aid also brings forward the issues of the capture of public resources which gets diverted for private profit. The mechanisms and policy prescriptions by the World Bank on Public Private Partnership and newer models of the same which pushes more and more risks to public exchequer need to be evaluated in this light.

The study calls for more transparency of public funds, strong accountability mechanisms and creation of quality democratic institutions and democratisation of existing ones to truly represent people to eliminate the elite capture of resources.