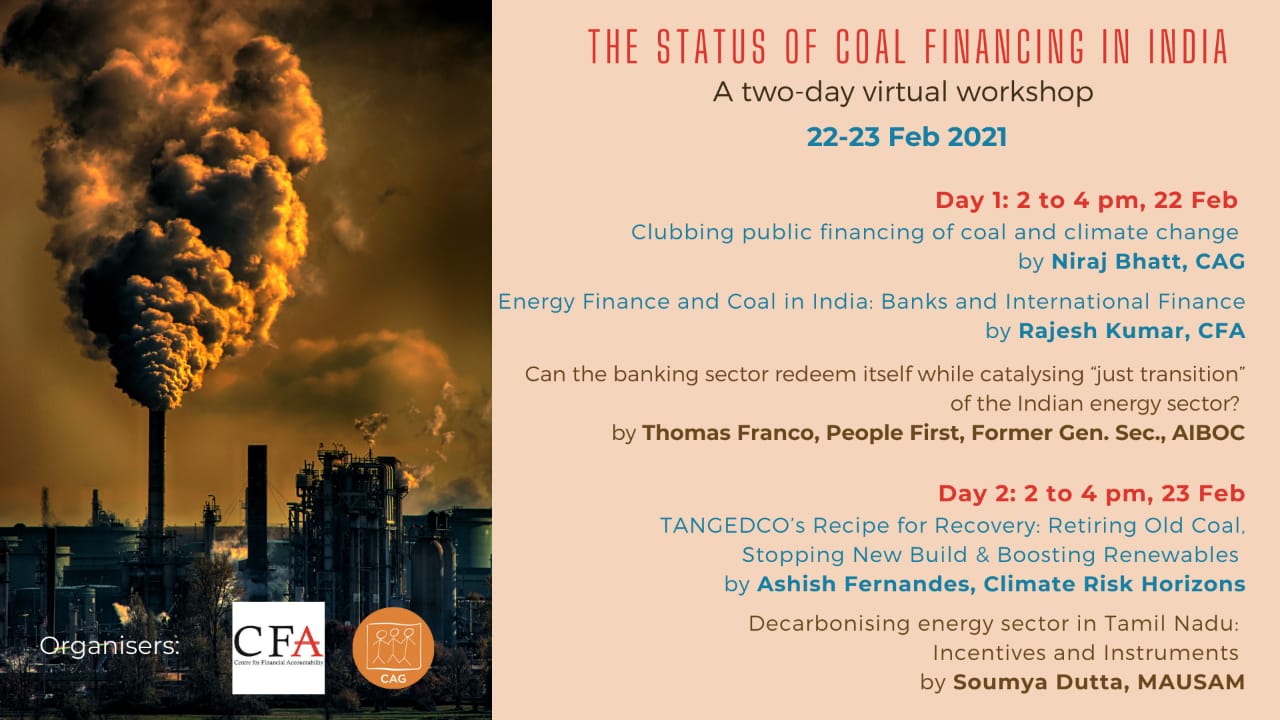

Citizen consumer and civic Action Group (CAG) and Centre for Financial Accountability (CFA) invite you to attend a workshop on ‘Status of Coal Financing in India.’ The workshop aims to bring together key stakeholders responsible for research, planning and management of energy finance, in particular those national and regional organisations working on energy, environment and climate change policies. We hope to provide practical approaches to engage in active advocacy in achieving the local and global emission reduction targets and making energy transition more affordable for our country.

According to NITI Aayog, around 44 per cent share of energy mix will be coal in 2040, which means coal will continue to be a key energy source in this decade. The coal sector has been under financial distress for years due to bad loans and

other business decisions that have saddled coal plants and distribution utilities. For example, the discoms within the Indian power sector continue to be a weak link and discom debts have hit levels of 1.3 trillion, according to independent

estimates. Consequently, a delay in payment by state power discoms has turned private power producers into Non-Performing Assets (NPA), which is having dire consequences on India’s Public Sector Banks (PSBs). Out of the total stressed assets, which is 10.25 Mega Million INR as reported by Parliamentary Standing Committee in 2018, around 1.75 Mega Million INR (11 per cent) are due to 34 stressed power projects of 40,130 MW. The lack of power purchase agreements (PPAs) and working capitals combined with the inability of promoters to infuse equity are causing troubles to operational power plants. Whereas, disputed coal block allocation and cost overruns from delay in project implementation are the root causes for the bad financial health of non-commissioned power projects. Right from coal mining to power distribution, the energy sector has a plethora of problems which are contributing to climate change and financing to coal is one of the main reasons for it.

At the moment, India is the largest global hotspot for SOx emission from man-made sources and coal power plants are the biggest contributors towards this. Dilution of the emission norms and lack of accountability has led to increases in

the emissions (SOX, NOX and PM) and accidents like the one that happened in one of the power plants of NLC India Limited in Cuddalore district, Tamil Nadu. At the same time, we are also witnessing a rapid fall in new financing of coal and a plateauing of the new financing for renewables. Does this indicate that the Indian market has put the final nail in the coffin of coal, or will it have federal life-support for a few more decades? The lack of monitoring and lack of data transparency makes it absolutely difficult for civil society organisations (CSOs) to advance these issues and advocate for appropriate action.

Registration:

https://forms.gle/7oX4TnmY7aFB4zEh8

For further information, contact:

aakanksha.tiwari@cag.org.in