The report, prepared by Delhi-based Centre for Financial Accountability (CFA), finds that coal received Rs 60,767 crore ($9.35 billion) in lending whereas renewable energy received Rs 22,913 crore ($3.50 billion).

New Delhi: A majority of state-owned banks and financial institutions in India continued to fund coal projects in 2017 while private financial companies are investing comparatively more in renewable energy projects compared to coal, a new analysis of energy projects lending in India has shown.

The report, prepared by the Delhi-based Centre for Financial Accountability (CFA), finds that coal received Rs 60,767 crore ($9.35 billion) in lending whereas renewable energy received Rs 22,913 crore ($3.50 billion).

The report identified and reviewed project finance lending to 72 energy projects, comprising coal-fired power stations and renewable energy generation facilities in India that achieved financial closure in 2017. These projects attracted total lending of Rs 83,680 crore ($12.85 billion) .

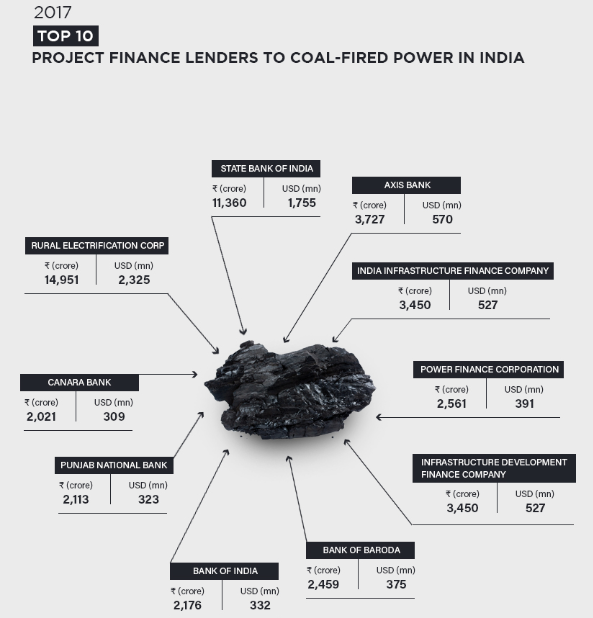

Of the top 10 lenders to coal power projects, eight were majority state-owned banks that collectively gave close to Rs 30,337 crore ($4.5 billion) in new and refinanced lending towards 12 coal power projects. These included Rural Electrification Corporation (REC), SBI, IIFC, Bank of India, Bank of Baroda, Canara Bank, Punjab National Bank, and Power Finance Corporation (PFC).

Over 70 per cent of lending for coal was refinancing of existing debt for projects which have already been built or are under construction. SBI, among other public banks, financed Rs 11,360 crore ($1,755 million) towards coal power projects and Rs 2,162 crore ($323 million) for renewables. In the financial year 2017, SBI wrote-off bad loans close to Rs 20,339 crore ($3,019 million), the highest among all public sector banks, the report states.

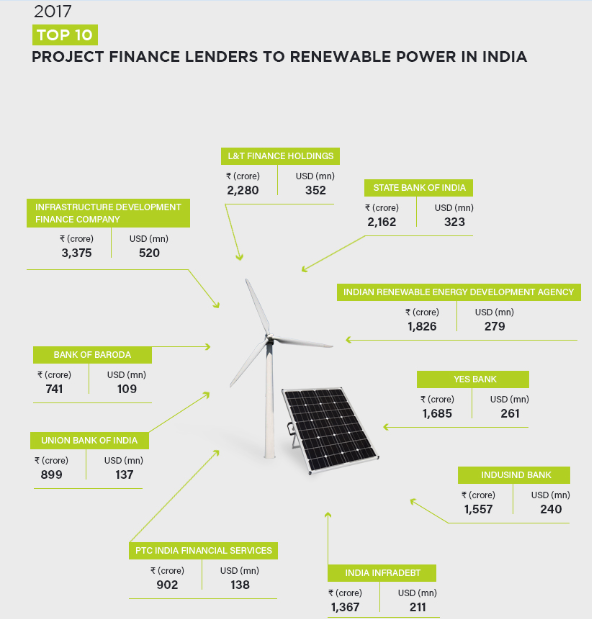

In contrast to coal lending, half of the top 10 lenders to 60 renewable power projects (solar and wind) were commercial financial institutions such as L&T Finance Holdings, Yes Bank, IndusInd Bank, IDFC, PFS, as opposed to majority state-owned banks. Also, 76 per cent of renewable energy project finance was primary finance and 24 per cent was refinancing of existing projects, indicating a vast growth in new RE projects in 2017.

All the lending identified by CFA was concentrated in 14 states. Of these, only two attracted no renewables lending — Jharkhand and Uttar Pradesh. States with significant renewables lending such as Karnataka, Punjab, Tamil Nadu and Telangana had no coal lending. Projects in Uttarkhand and Odisha received minimal lending overall, with no loans to coal-fired power projects and little to renewables.

In states like Gujarat, renewables lending outpaced coal lending more than four-fold. In most other states with both coal lending and renewable energy lending, coal lending was higher than renewable lending. Chhattisgarh represented an extreme example, where coal-fired power projects attracted almost 10 times that of renewables projects in 2017.

The story, published in The Economic Times, can be accessed here.