Random Reflections

Random Reflections

The Reserve Bank of India has been announcing repo-rate hikes for some time. While most of the commoners don’t understand what that means but know that it is spiking their EMI. They are told that it is inevitable to ease the worsening inflation. Nevertheless, inflation is still out of control, crossing the 6% mark most of the time. Stuck between rising inflation and EMIs, one can only expect that soon at least the price rise will ease. And may find some solace in not being the only one suffering for the greater good. But what if the rich in the country are not suffering/ paying as much as we do? Shocked? The Basic Statistical Return I released by the Reserve Bank of India reveals exactly the same. But that needs a little bit of data analysis.

Loans – how many and how much?

Out of the 140 crore population, about 94 crore are eligible for a loan -if we leave out those below 18 years of age (43 crore) and above 75 years of age (2.8 crore). For the 94 core eligible lot, there are only 31.43 crore loan accounts. Many borrowers will have more than one loan like a housing loan, car loan, credit card etc. So the actual number of borrowers may be around 20 crore out of 94 crore population. That means only 21% have access to credit!

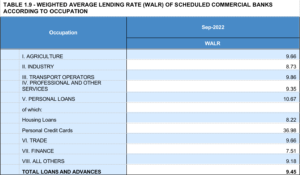

But data churners of RBI consider each loan as a stand-alone thing. Hence, their number is 31.43 crore loans. Out of this, as per data given below (Table 1.9 of RBI) the farmers get credit at 9.66% at an average, industry at 8.73%, transport operators at 9.86%, professionals at 9.35%, personal loans at 10.67%, housing loans at 8.22%, traders at 9.66%5, finance at 7.51%, others at 7.51% and credit card holders at a whopping 36.98%.

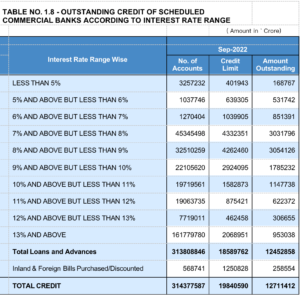

Fair enough. But there is something more. Our banks also offer loans even below 5%. 599 persons/companies have availed loans at less than 5% interest and their outstanding is Rs 71,385 Cr according to RBI data (Table 2.5 of RBI). These are loans above Rs 100 crore. If we see the data of borrowers with loans outstanding above Rs 100 crore and interest below 8% it is 6243 persons/companies with an outstanding credit of Rs 24,93,731 crore.

Fair enough. But there is something more. Our banks also offer loans even below 5%. 599 persons/companies have availed loans at less than 5% interest and their outstanding is Rs 71,385 Cr according to RBI data (Table 2.5 of RBI). These are loans above Rs 100 crore. If we see the data of borrowers with loans outstanding above Rs 100 crore and interest below 8% it is 6243 persons/companies with an outstanding credit of Rs 24,93,731 crore.

When we compare this with borrowers who are paying above 13% it is around 16 crore- To be precise 16,17,79,780 persons/companies who have an outstanding of Rs 20,68,951 Cr. If we take the number of account holders who are paying more than 10% it is 20,82,82,087 with an outstanding of Rs 49,89,703 crore.

But as per the guidelines for Priority sector lending, borrowers from the weakest section of society have to be provided loans at 4% Interest called ‘Differential Rate of Interest’. Surprisingly, the richest in the country are considered the weakest and provided loans at less than 5%! We know from the media that the Tatas got Rs 10000 crore from SBI to buy Air India. Adani and Ambani also may be getting loans at less than 5%. This is how Crony Capitalism operates in the country, creating a few global champions at the cost of the majority. Just 599 entities get loans at less than 5% while more than 20 crore Indians pay more than 10%.

There were times when loans above Rs 1 crore had to be approved under the Credit Authorisation Scheme of RBI. Interest rates were fixed by RBI. It is high time the Reserve Bank of India and the Govt of India have a review and adhere to the constitution of India to bring down income inequality. RBI should look at its original mandate of 1934.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.