Almost all financial newspapers have informed that 3-5 banks and 3 general insurance companies are going to be privatized. They have indicated that Bank of India, Indian Overseas Bank, UCO Bank, Punjab and Sind Bank and Bank of Maharashtra are being considered for privatisation. We will be left with SBI, PNB, BOB, UBI and Canara Bank; they presume as public sector to remain. Some people are circulating a RTI reply from Niti Ayog that they have not recommended privatisation of public banks. So these people still hope that privatisation is not around the corner.

It is not at all a surprise. Dr.Manmohan Singh as finance minister proposed, but had to reply in the parliament that he is not going to privatize banks due to opposition from trade unions and political parties in the parliament, especially the left.

Again in 2001, then Finance Minister Shri. Yashwant Sinha introduced a bill in parliament proposing to reduce share of government to 33% in public sector banks. Again, the trade unions and political parties opposed. The bill was referred to a parliament committee and did not see the light of the day.

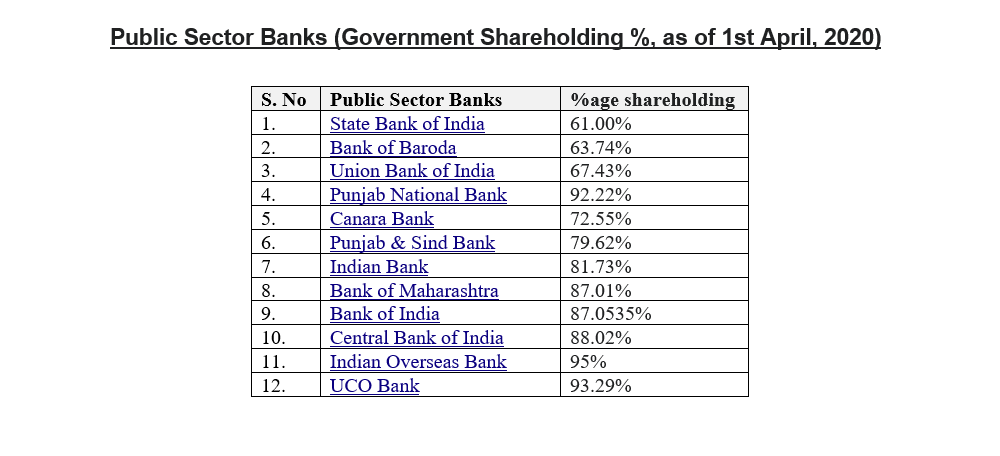

In 2014, the PM and FM attended a Gyan Sangam at Pune to which trade unions in the banking sector were refused entry. In that Mr. P.J. Nayak, who recommended privatization was a main speaker (He was MD Axis Bank earlier, which is a private bank). A road map for future was laid out. It was proposed to create a Banks Board Bureau which will collapse into a banking investment company and then the shares of the government will be transferred to BIC and privatisation will happen. It also recommended merger to banks which is already done by reducing public sector banks to 12.

Surprisingly, public sector bank chairman and managing directors headed the panels in Gyan Sangam and presented the power points of Consultancy Group Mckinsey.

So there is no surprise. Chairman and MDs have become puppets. There were personalities like Shri. R.K. Talwar who stood up against the wishes of Mr. Sanjay Gandhi and Mr. Pranab Mukherjee and refused to favour a friend of Mr. Sanjay Gandhi with a loan. Shri. R.K. Talwar was targeted by the government accusing him of collection of donation for the ashram at Pondicherry. But he stood his ground. Shri. A.K. Purwar was sidelined for supporting the indefinite strike for improvement in pension in SBI in 2006 in which the government had to yield some ground. But now the senior executives look for greener pastures after retirement or they are scared of getting targeted. Hence they tow the government line even if they don’t agree. Mrs. Arunthathi Bhattacharya, as Chairman of SBI made public statement that there is no need for merger of associate banks. But when the government forced it she towed the line and after one year of retirement joined Reliance as an independent director.

Some of the RBI governors had stood up to save the economy like Dr.Y.V.Reddy but of late they are worse than rubber stamps. So we cannot expect the senior executives of public sector banks and RBI to safeguard the interest of the people of their country. People are the real owners. The government is only an agent of the people. Moreover the banks in the country including private banks are owned by the customers. It is their deposits which is used for giving loans.

The trade union have a major role in safeguarding the banks. They have done if earlier and they have to do it again.

But more than that, it is the people of the country who have to fight. The way the government is going, if allowed we will have few big public sector banks which will cater to the rich in spite of being called public banks, there will be few big private banks who will cater to the creamy layer of the society and there will be few private banks, small banks, payment banks, fintechs and few co-operative banks which the middle class and poor can use by paying very high interest and service charges. By bringing co-operative banks under the control of RBI, state governments role has been superseded and very soon many of them may disappear. The money lender politicians will have a hay day. Already the public banks share in deposits have gone down to 67% from 90% in 1991. From 100% share holding by government it is going down.

See the irony! RBI files an affidavit in the Supreme Court saying Google Pay does not require a license though what Google Pay does is one of the banking activities and within few days Google invests in Reliance Jio. IBC act was amended facilitating Reliance to buy NPAs at cheap rates. Just to help reliance the ceiling on advances to single corporates was increased from 25% to 30%.

By relaxing the bank licensing norms, SBI was allowed to be a partner with 30% share in Reliance Jio payment bank which has done hardly anything in the last 3 years, but waiting to take over SBI. It is not imagination. Reliance Asset Reconstruction company is sold loans of SBI at 15%, Reliance is a national business correspondent for SBI; The digital platform of SBI is managed by Reliance and there are board members who support Reliance. Even without privatisation SBI behaves as private and the bank charges have dented in its image.

ICICI Bank, HDFC Bank, Axis Bank were created by the government and privatized. It is not true that private banks have flourished on their own. Government has helped them. ICICI Bank is now classified as a foreign bank as majority shareholding is by foreigners.

Let us also remember what happened to Global Trust Bank, Yes Bank, Centurion Bank etc. (See Box for bank failures from 1969 to 2008). The latest is Yes Bank. Here for the first time a public sector bank is creating its own competitor instead of taking over. The government which asked public sector banks to save these banks did not do the same in the case of Punjab Maharashtra Co–Op Bank and other Co-Operative Banks which have been liquidated.

Let us not forget that the income inequality in the country could be reduced by public sector banks with government’s policies. 10% owning 40% wealth in 1960 came down to 30 % in 1982 – 83. Mainly due to public sector banks, after Nationalisation of 1969. Now 10% own 80% of the assets due to the change in the lending by banks through the policies which were introduced from 1991.

People at the top are not learning from history.

Today corporates negotiate interest rate and can avail loans at 7 % but the MSMES which are the backbone of the economy have to avail loans from NBFCs paying 24 % interest and to the Micro Finance Institutions, poor women pay up to 26% interest.

The situation is going to be scary. 60% of the population which just owns 5% of the wealth in the county will be the worst hit; next will be the lower middle class and upper middle class. They aspire to be rich and borrow for their house, car and other consumer goods at high interest rates. The younger generation will not get education loan and they have to either study in some low quality institutions or become workers in unorganized sector. It is 10% versus 90%

It is the banking sector which provides at least some loan to agriculture; some loans to small and micro enterprises; some loans for housing; Some loans for traders at cheaper interest rates. The scenario will change completely with privatisation.

The government says, the banks will become government controlled instead of government owned. Yes, they will control the credit. Corporates will benefit. We have government for the corporates, by the corporates and of the corporates. So they will not repay. They will buy the banks with the loans taken from the same banks.

With the reduction of deport interest rates, increase in service charges, FSDR Bill and poor service, people will shift their deposits and the banks won’t have money to lend.

With reduction in loans, agriculture, MSMES, cottage Industries, trades will fail, leading to huge unemployment. There will be chaos, riots, thefts, violence and the government will come hard with draconian measures taking away all democratic rights.

Should we wait for it to happen?

The worst part is that many in the media and many journalists have sold their soul. They say privatisation is the solution. They say the public sector banks are begging bowls without bothering the analysis. Dr.Soumya Kanti Ghosh, Chief Economist, SBI wrote on 21 Jan, 2015 in Economic Times under the caption, “Chastising public sector banks for every failure is a comedy of errors” that the public sector banks have paid back many times the investment to the government. Nobody wants to check this fact. From 1969 these banks were not running at losses. They made huge profit, they continue to make, they pay income tax promptly. In 1992 when the policies were changed 20 public banks out of 21 made profit. It is for writing off loans to the corporates, the government has to infuse capital. We should have laws to help recovery instead of writing off. There is no need for fresh capital then.

The RBI Governor who is given the responsibility of safeguarding the economy is saying that banks are going to make losses. Due to Mudra loans, due to corporate loans, they will. Is it not the responsibility of the government and RBI to safeguard the banks and the economy?. That is what is done by China, US and Europe.

Arise, awake and stop not till the goal is reached, said Swami Vivekananda. It’s a wakeup call for all of us today.

Our goal has to be to reduce income inequality, abolish poverty, improve education and increase employment. Private corporates and large private banks cant do it. They have not done it anywhere. It is the government, the public sector and public services which have made it possible. All over the world Covid 19 has proved it once again. Public sector is for providing service to the public not for profit alone.

Let us debate, discuss, evolve solutions for the larger majority not minuscule minority. Let us change the road which is leading to ruin.

‘The earth provides enough to satisfy every man’s needs but not every man’s greed’- Mahatma Gandhi.[Now read as few men’s Greed]

Thomas Franco is former General Secretary of All India Bank Officers’ Confederation.