It was only after the nationalisation of 14 banks on July 19, 1969, that the banks reached the common people. The main changes that were done included a shift from class banking to mass banking, a shift from big industries to agriculture, the development of small, medium, and micro enterprises, a shift from urban to rural areas, and a reduction in income inequality. However, after 1991, the reversal began slowly and accelerated in 2014, when the NDA took over the government, with slogans like the government has no business to be in business; the public sector was born to die, etc.

It was only after the nationalisation of 14 banks on July 19, 1969, that the banks reached the common people. The main changes that were done included a shift from class banking to mass banking, a shift from big industries to agriculture, the development of small, medium, and micro enterprises, a shift from urban to rural areas, and a reduction in income inequality. However, after 1991, the reversal began slowly and accelerated in 2014, when the NDA took over the government, with slogans like the government has no business to be in business; the public sector was born to die, etc.

They couldn’t privatise a public sector bank until now because of the UFBU’s strong opposition. But using dubious methods, they have reduced the strength of the PSBs. As per the RBI data of March 2014, 82% of the branches, 65% of the loan limit, and 75% of the loans outstanding were with public banks. The staff strength of PSBs (including SBI) was 844445, whereas private banks, including foreign banks, had a staff strength of only 335615 people. The share of total outstanding bank credit of PSBs as of March 2022 has come down to 54%, and the share of total deposits has come down to 60%. The staff strength in PSBs has come down to 770812, whereas for private banks, it has increased to 798977. For the first time, private banks have more staff than public banks.

Look at HDFC Bank, the top private bank. They have 6,342 branches, with only 1,147 (18%) being rural, 2,036 (32%), semi-urban, 1,312 (21%), urban, and 1843 (29%) in Metro. They have 7.1 million customers. So the number of customers per employee is just 501. They have a staff strength of 1,41,579 employees. The total value of their business is Rs. 29,28,037 (Dep 15,59,217 + Advances 13,68,820). Now let’s look at the State Bank of India. SBI has 46.77 crore customers, 6.58 times more than HDFC Bank. It has a business of Rs. 67,855,501 crore, which is 2.31 times that of HDFC Bank. Its staff strength is 2,44,250, 0.5 times more than HDFC’s. Interestingly, while HDFC recruited 21,486 staff last year, SBI reduced its staff by 1402 people; the per-employee customer figure in SBI in 1680. SBI has 8,018 rural branches (32%), 7,215 semi-urban branches (29%), 5,253 urban branches (21%), and 4,462 metro branches (18%).

BOB has a total business of 18, 23,093 Cr. with 8,168 branches, of which 34.82% are rural, 25.5% are semi-urban, 18.6% are urban, and 21.62% are metro. BOB has over 13 crore customers and only, 79,000 employees, which is just half of HDFC’s staff strength. The per-employee customer in BOB was 1605. If they increase the staff strength in the public sector, their business, customer service, and profits will certainly improve. PSBs also provide reservations, including to those from economically weaker sections among the forward caste.

How has the government succeeded in weakening the PSBs?

- The government promoted and supported private banks such as ICICI, HDFC, and Axis bank with currency chests, government business, fresh currency, and so on.

- More licences for private banks and the merger of public banks reduced the number of branches and staff of PSBs

- PSBs were forced to open 97.3% of the Jan Dhan accounts, whereas private banks opened only 2.7% of them.

- PSBs have opened 15675442 Atal Pension Yojana accounts (91%) as of 31/3/20 where while PVBs have opened just 1562997 A/Cs (9%).

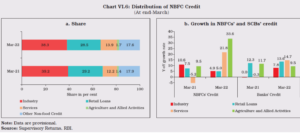

- PSBs have been forced to lend more to NBFCs in spite of those failing. They get loans at around 10% interest but lend at 24% or more. The business is shifting to NBFCs, as seen in the RBI Report. They depended on borrowing from and lending only to lucrative businesses.

They lend little to agriculture and related activities.

- The co-lending model is going to be a huge risk for PSBs. If we take the loans given by PSBs, PVBs, and NBFCs/MFIs, PSBs’ loan outstanding on March 22 was 49.22% (Rs. 73.33 lakh crore), private banks were 31.13% (Rs. 47.02 lakh crore), and NBFCs and MFIs were 19.65% (Rs. 29.67 lakh crore). So public bank loans are less than PVBs plus NBFCs.

- Instead of branches, Customer Service Points are opened through National Business Correspondents. Their increase from 167,1170 in 2021 to 35,13777 in 2022 requires closer scrutiny. Where are they? How are they performing?

What has happened is alarming. Public sector banks are marginalised, and understaffed and people complain of poor service and shift to private banks and non-banking companies where the interest rate for loans is much higher. This has increased inequality to its highest level. Poor and middle-class are at the mercy of modern-day loan sharks—the NBFCs, MFIs, and private banks. This is against the constitution and the idea of a welfare state. This has to be reversed as soon as possible.

Newspapers in Gujarat reported on January 9 that the police in Gujarat have launched a special drive against usurious moneylenders preying on distressed borrowers, quoting Director General of Police, Ashish Bhatia. In Surat alone, they have filed 34 cases. There have been suicides, rapes, and acts of violence, all because of private moneylenders, says a news article. Sometime back, DGP Tamil Nadu warned people about loan applications after a suicide. Similar incidents are happening all over the country. This can only be stopped by increasing the number of branches of public sector banks, staffing them, and issuing directives to give small loans. It’s high time for the government to conduct a quick assessment and take action.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.