The fiscal challenges of maintaining a low fiscal deficit are used to curtail the entitlements of labour in India. The labour codes even take away existing rights. The e-Shram portal has over 28 crore registrations, but no benefits are available to them. EPF benefits, including a pension of Rs 3,600 maximum per month, are not a living pension. For the past 36 years, banks’ pensions have not been upgraded. No social security, like universal basic income, is considered. The vast majority of unorganised sector workers (94%) do not have access to provident funds or gratuities. One excuse is the fiscal challenges.

The fiscal challenges of maintaining a low fiscal deficit are used to curtail the entitlements of labour in India. The labour codes even take away existing rights. The e-Shram portal has over 28 crore registrations, but no benefits are available to them. EPF benefits, including a pension of Rs 3,600 maximum per month, are not a living pension. For the past 36 years, banks’ pensions have not been upgraded. No social security, like universal basic income, is considered. The vast majority of unorganised sector workers (94%) do not have access to provident funds or gratuities. One excuse is the fiscal challenges.

Controlling the fiscal deficit at all costs has become the IMF’s, the World Bank’s, and Finance Capital’s (data.imf.org))

Developing countries like India are suffering because of this. The Union Government is forcing the state governments to follow fiscal policies dictated by multilateral agencies.

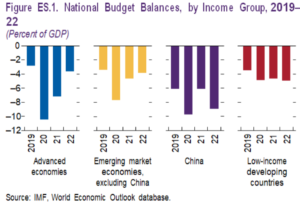

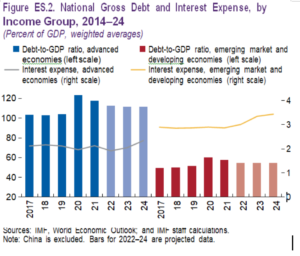

If we peruse the debt-to-GDP ratios of advanced economies, they are much higher than those of developing economies, but nobody questions them. See the charts given below:

China has a higher fiscal deficit, but it does not bother it at all. It spends more on development activities.The US has a higher deficit, but it does not bother me at all. However, the IMF and World Bank exert pressure on developing countries.

India’s fiscal deficit was 6.7% in 2021–22. The target for 22–23 is 6.4%. The April-Sept fiscal deficit is Rs 6.2 lakh crores, and the tax collection is Rs 10.12 lakh crores, which is 10% higher than last year due to GST. In spite of that, government spending in real terms is lower than last year due to inflation. The finance minister keeps talking about the fiscal deficit.

Let us look at the labour scenario in India.

Participation in the labour force has fallen from 46% in 2017 to 40% in 2022.

➔ The overall unemployment rate is 7.8%, with urban UE at 8.7%. (CMIE)

➔ 2.2 million women were laid off during and after the pandemic.

➔ Only 20% of women are employed or looking for work.

Let us recall the promise of 2 crore jobs per year made in 2014: We have the highest unemployment rate today.

The government should provide more employment, for which there is huge scope. As per the 7th Pay Commission Report (2016), there were 52 lakh Central Government employees. But this came down to 40.66 lakh in 2019.

In CPSES, 260163 jobs have been reduced in 10 years; Indian Railways has reduced 187920 jobs in 15 years, and instead of providing permanent jobs, it is using 7.5 lakh contract laborers.

In the banking sector, PSBs show a 100% increase in business but no increase in jobs

There are 11 lakh temporary business correspondents versus 7.5 lakh permanent jobs.

All this is done to reduce the fiscal deficit.

Privatization and fiscal deficit

According to our Prime Minister, the government has no business being in business. Privatization means fewer jobs, no less jobs, no security, and

No-reservation policy Privatization leads to more contract jobs and no social security.

Let us have a look at employment in the public sector and government in different countries.

So in India, there is huge scope for providing jobs in the government, public sector enterprises, and public sector banks. A government job entails a respectable, permanent job, paid leave, maternity benefits, medical benefits, a provident fund, a gratuity, and a pension.With this come housing loans, car loans, consumer loans, credit cards, and other benefits. It is time to demand at least one job for every family in the government sector.

Unfortunately, today, 94% of the workers are in the unorganised sector without any

social security; no permanence in a job; no pension; no medical benefits, etc.

The government said that there is no data available on migrant workers.

MSMEs, which create jobs, are in disarray as a result of the 2016 demonetization.

What are the solutions?

Forget about the fiscal deficit that developed countries have. As long as the money is used properly to provide jobs, the fiscal deficit will not matter.

Another alternative is to tax the rich.

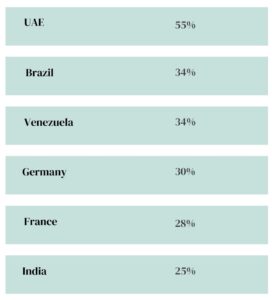

Income tax is 45% in the United Kingdom, France, and South Africa.In the United States, it is 43%.In Japan, it is 55%, whereas in India, it is only 30% at most.

Another avenue is corporate tax. See the chart below:

Similarly, the wealth tax in India is NIL. The carbon tax was repealed by this government’s inheritance tax, so there is enormous potential for increasing revenue by taxing the rich.

With that,

Employ people in GOVT and Public Sector

Provide Urban Employment Guarantee (Kerala, Rajasthan, Odisha, HP, Jharkhand, Tamilnadu & Madya Pradesh have already done)

Provide Quality Education for all-free

Provide Health Care for all-free

Provide Unemployment Allowance

Provide Pension for all – at least Rs.3000 PM.

Provide Credit for all

States can learn from the Kerala Model introduced by Dr. Thomas Isaac when he was Finance Minister.

Through the Kerala Infrastructure Investment Corporation, he could mobilise funds outside the budget and spend them on improving the infrastructure.The revival of 24 public-sector companies made them profitable. The Kudumbashree model, which has created lots of employment for women

and provided finance to panchayats for a real grass-roots democracy and just development that is inclusive,

If there is a will, there is a way.

Rather, there are many ways.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.