Event Report

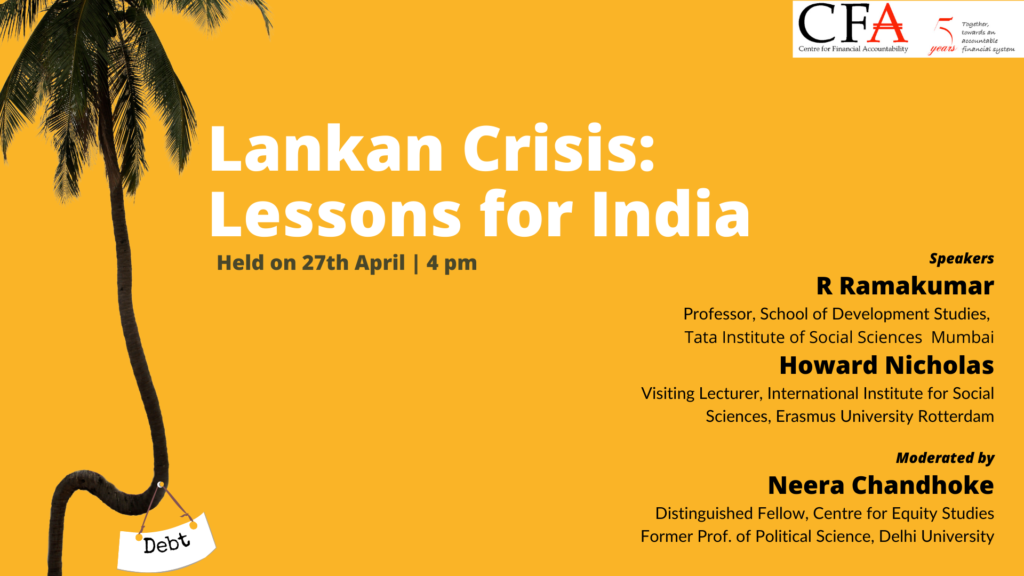

While the mainstream media covers the turmoil in Sri Lanka as something that is unfolding on a day to day basis, what is lost out is the long term trajectories that have precipitated the crisis. While the immediate reasons certainly lie in the pandemic affecting the tourism sector or the more recent Ukraine war, the crisis as we know it, was long in the making. It can be traced back to the IMF diktats that made Sri Lanka more dependent on foreign aid while it cut down on subsidies, wages and social sector spending. In the discussion moderated by Prof Neera Chandhoke on the 27th of April 2022, the discussants Prof. R. Ramakumar and Prof. Howard Nicholas threw light on the long term trajectories that precipitated the crisis allowing us to draw from it lessons that are also relevant to India as we have even more aggressively adopted the neoliberal path in the recent years.

____________________________________________________________________________

Is the Sri Lankan crisis a result of the Chinese debt trap?

Debt trap diplomacy of China is often quoted, even in some left progressive circles, as the cause of the Sri Lankan crisis. Prof. Ramakumar clarified some of these misconceptions around the Chinese investments in Sri Lanka, specifically the Hambantota port. He said that the Chinese geopolitical interests in Sri Lanka and other Latin American and African countries need to be appraised and is a separate discussion altogether, but it is not the reason for the current Sri Lankan crisis. The share of Chinese loans to the country stands at around 10% of the total foreign debt and China is only the 5th biggest lender to Sri Lanka. Foreign Sovereign Bonds, ADB and Japan are much bigger lenders to Sri Lanka than China. The Hambantota Port was built on a loan of about $1.2 billion from the Chinese EXIM Bank and when the port ran into losses the Chinese agencies actually bought the 99-year lease by paying 1.2 billion dollars to the Sri Lankan government. Hence the balance of payment crisis was in fact softened by the Hambantota port transfer and not the other way around. So then what were the long term trajectories that took the island nation on the current downward path?

The long shadow of a Colonial legacy:

The crisis in Sri Lanka is a balance of payment crisis and should not be misunderstood as an economic crash or a financial sector crash, says Prof Ramakumar. The crisis can be located within its history of colonialism, post-colonial history and the developmental pattern of Sri Lanka. Colonial rule drastically changed Sri Lanka’s agricultural patterns to suit its imperial interests. They introduced plantations – tea, rubber, coconuts and also spices. By 1948, Sri Lanka had two or three primary exports and depended on those heavily, creating a lock-in of the economy. Sri Lanka could not wriggle out of this lock even in the post-colonial period and it continues to rely on these exports. The only additions that have taken place are garments and tourism. A crude way to put it would be that the Sri Lankan economy comprises exports of primary goods, garments, tourism and remittances. It has very little diversification of its productive base making it more vulnerable to external shocks. This vulnerability to external shocks, says Prof Ramakumar, has been a persistent feature of the Sri Lankan economy and society.

What perpetuated the acute trade imbalance?

The primary reason is the callous apathy towards building a strong export-oriented industrialization policy. Every country that has failed to come up with such a strategy has had more or less the same unfortunate trajectory of receding into trade imbalances. For a very brief point in time, Sri Lanka went on an aggressive, export-oriented industrialization strategy so much so that it managed to turn around the trade imbalance for five years, says Prof. Howard Nicholas. It actually halved the imbalance. But then, the new governments that came into power reversed the export-oriented development strategy. As expected, it has landed the country in dire straits this time. It is important to note here that Sri Lanka during its brief attempt to industrialize faced stiff blockages from the western countries. There was almost a continuous attempt, he says, to undermine the rationale for export-oriented industrialisation.

Role of the IMF and neoliberal policies:

The IMF policies being promoted essentially only treat the symptoms and not the cause of the problem. In Prof. Nicholas’ words, the IMF in fact ignores the “elephant in the room” which is the continuous trade deficits. Irrespective of what the government has done with fiscal policy, Sri Lanka has maintained a steady trade deficit in the range of 10 to 11 per cent for more than 30 years. This makes it vulnerable to any shock in the global system.

Generally, the Sri Lankan economy compensates through migrant remittances and tourism, these being the two major earning sources which counterbalance a very large trade imbalance. And whenever it faces a global shock, the balance goes astray and the difference is acquired by borrowing. Instead of addressing this structurally, says Prof. Nicholas, Sri Lanka has taken the recourse of going back to the IMF for loans as many as 16 times since the second world war. And like every time, the policies that the IMF is likely to recommend this time around will actually make the situation much worse he feels. One of those policies that the IMF is likely to recommend is that Sri Lanka increases its exposure to international sovereign bond debt. So much so that essentially all its reserves will go on servicing the foreign debt.

Exposure to ISBs has made Sri Lanka more vulnerable:

Usually, the imbalance in the past was addressed through bilateral loans be it from India, Japan, or China, for instance, each one accounting for about 10% of its total foreign debt but since 2009, Sri Lanka has made itself overtly dependent on the international capital markets, i.e., on international sovereign bonds. So much so that these account for about 40% to 47% of its total foreign debt which is currently the problem. Bilateral loans can always be renegotiated, says Prof. Nicholas. But when it comes to the ISBs, these are extremely difficult negotiations.

Prof. Ramakumar says that the efforts of Sri Lanka to diversify its economy and expenditure in the social sector have been consistently frustrated by the conditionalities of the IMF loans that the country was lent between 1965 to 2016. Very early in its trajectory, Sri Lanka got catapulted to the status where it achieved high levels of social sector indicators despite low per capita income. This was partly funded by the income from the commodity exports, but this could not be retained due to the conditionalities that came with the IMF loans, since the 1970s. The 1977 loan from the IMF was important as it opened the doors for an intense phase of neoliberalism in Sri Lanka pushing back its achievements in the social sector. Prof Ramakumar says that the conditionalities of the IMF loans restricted Sri Lanka’s ability to expand its budget deficit, raise its tax rates and spend for the people. The island nation saw massive protests against such anti-people moves which were thoroughly crushed.

The rise of right-wing politics and its ramification:

The 1970s was also the time when right-wing authoritarian politics was on the rise to curb the enormous protests that rocked the island nation between 1977 and 1983, subsequent to the IMF loan package. A presidential system was brought in under Jayewardene and there was a huge onslaught on the left movements and trade unions who protested against the IMF loans. The ruling classes needed an “enemy”, “the other” to deflect from the crisis precipitated by the neoliberal turn. This was the phase, says Prof. Ramakumar, when the president inaugurated a project of cultural chauvinism from a majoritarian perspective and the attacks on the Tamil minorities began culminating in the pogrom of July 1983. A long and bloody civil war ensued that lasted for 26 years. This was another phase of frustration for the Sri Lankan economy where all momentum of growth and the possibility of coming together for growth and development was lost. Mahinda Rajapaksa, who brutally suppressed the civil war in 2009, assured a new era of rejuvenation of the economy, but his route was to take yet another IMF loan of 2.5 billion dollars. The conditionalities of maintaining a fiscal deficit of less than 5%, tightening of the monetary policies, foreign investment promotions, controlling credit supply etc had an impact when the commodity prices started falling post-2011. From 2012 onwards the GDP fell, and so fell the savings rate, and export to GDP ratio and by 2015 we had a balance of payment crisis. Rajapaksa is then followed by Maithripala Sirisena, who went for the 16th IMF loan, bringing its string of conditionalities that once again was detrimental to the Sri Lankan economy. There is a convergence of the authoritarian regime and the neo-liberal policies and both sit very comfortably with each other in the 30 year period, typical of most right-wing formations. In 2019, a few other factors chipped in, making it impossible for recovery. The Easter bombings (2019, April) in Colombo had an enormous impact on the tourism sector.

Rajapaksa’s family returned to power with huge tax cuts. The VAT was cut from 15% to 8%, the threshold for payment of taxes was raised significantly, and the corporate tax was cut significantly from 28% to 24%. One of the watchdog organisations pointed out that these changes had resulted in a fall in registered taxpayers by 33%. All of these cumulatively contributed to the worsening situation of the economy in Sri Lanka. This was further exacerbated by COVID.

Assault on Reason:

Given the impact of COVID on a debilitating economy, the president decided to completely stop the import of chemical fertilizers, making Sri Lanka a 100% organic farming nation overnight. This was done under the advice that the country spends 400 million dollars and stopping this would save the foreign exchange. It was a unilateral decision bolstered with propaganda that kept all contrary advice at bay. It could be compared to the shock and awe policy like the demonetisation that happened in India. It was announced in April that from the 10th of May the country is going 100% organic. This decimated agriculture in Sri Lanka. The yala season was saved as the imports had already taken place but the maha season that began in October was severely affected with a fall in productivity of over 40% in paddy and a 20 to 30% fall in tea production. Ironically, the move was to reduce the pressure on foreign exchange, but the reduction in food productivity forced Sri Lanka to import 40-50% of rice.

What is to be done?

Once again there are those who are saying that going to the IMF is inevitable. The business community together with the government is hell-bent on it. But that is not going to solve the problem in the longer term. Prof. Nicholas, in fact, expects Sri Lanka to be back to the IMF again in the next 3 to 4 years. It could in fact be sooner, as he expects a global crisis in the wake of the Russian invasion of Ukraine. One of the areas that would be particularly badly affected is of course Europe, and Sri Lanka heavily relies on tourist earnings from that part of the globe. Without which it will be in deeper trouble.

Instead, what needs to be done is to resume the agenda of export-oriented industrialisation that has been off the agenda in recent years. The other effort ought to be to develop relations with friendly countries so as to ensure a bilateral credit line to minimize dependence on ISBs.

Then again, instead of going with begging bowls to countries like India, China, Japan or Korea, it needs to tie up the loans with investments from these countries. He says Vietnam, for instance, is a great example of a country that adopted this path and flourished to a large extent so much so that the dollar value of all of Vietnam’s exports is now greater than even India’s. This is the only means of breaking the vicious cycle that takes us back to the doors of IMF and gets us into a worse debt trap.

You can watch the debate here.

The economic crisis in Sri Lanka is a result of its aggressive globalization and ill-conceived borrowing policy, a path that India is also taking. The Lankan crisis is a case study of what exactly breeds under a regime of reckless consumption promoted by global MNCs, IMF, and the World Bank. It is also an outcome of an autocratic ruling elite that has relied on the politics of hate to distract the masses and has relied on drastic undemocratic decisions against the interest of the people. There are a lot of lessons to learn from the crisis in the island nation, only if we are listening carefully.

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.