On 1st October 2017, five associate banks of SBI were merged in the State Bank of India. Dena Bank and Vijay Bank were merged in Bank of Baroda on 1st April 2019, while in a mega merger Oriental Bank of Commerce and United Bank were merged in Punjab National Bank. Syndicate Bank was merged in the Canara Bank, Allahabad Bank was merged in Indian Bank, and Andhra Bank and Corporation Bank were merged in Union Bank of India on 1st April 2020. As of March 2017 there were 25 Public Sector Banks, which have come down to 12 as of now.

On 1st October 2017, five associate banks of SBI were merged in the State Bank of India. Dena Bank and Vijay Bank were merged in Bank of Baroda on 1st April 2019, while in a mega merger Oriental Bank of Commerce and United Bank were merged in Punjab National Bank. Syndicate Bank was merged in the Canara Bank, Allahabad Bank was merged in Indian Bank, and Andhra Bank and Corporation Bank were merged in Union Bank of India on 1st April 2020. As of March 2017 there were 25 Public Sector Banks, which have come down to 12 as of now.

The objective with which merger was being pursued, in the words of the Finance Minister, was-

“For greater National presence and Global reach”

“Banks with scale for building five trillion dollar economy”

“Big Banks with enhanced capacity and increased credit will provide impetus to amalgamated entities by increasing their ability to support large ticket size lending and have competitive operations by virtue of greater financial capacity”

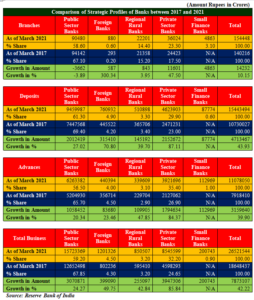

The background comparison of Banking Statistics as of March 2021 as against March 2017 is revealing.

During this period, Public Sector Bank’s Branch Network is reduced by 3,662 as against which Private Sector Banks have opened 11,601 Branches, Small Finance Bank 4,863 Branches and Foreign Banks 587 Branches. Consequent upon merger of banks, in the name of rationalisation of branches, merged entities have closed their branches the number of which is much higher since this reduction in Branch network is arrived at after factoring opening of new branches by those Banks.

Now, the first two mergers are settled down. During the period, Branch Network of State Bank of India is reduced by 836 while that of Bank of Baroda by 1,062 Branches. In case of Punjab National Bank, Union Bank of India, Indian Bank & Canara Bank the Branch closure process is in the midst hence we will get the real picture only after March 2022. In case of Banks involved in mega merger only in Union Bank of India, Branch Network is reduced by 117 Branches till now.

The worst affected State due to the merger is Karnataka where 516 branches have been closed since the banks with predominant presence in Karnataka such as the State Bank of Mysore, Corporation Bank and Syndicate Bank have been merged. The second most affected State is Maharashtra with 429 branches, as the State Bank of Hyderabad with predominant presence in Marathwada (the former Nizam State) and Dena Bank with significant presence in Mumbai have been merged. Next to it is Delhi with 268 branches and Punjab with 248 branches due to the merger of State Bank of Patiala and Oriental Bank of Commerce. Followed by Gujarat where 200 Branches are closed due to merger of Dena Bank and Kerala where 199 branches were closed due to the merger of State Bank of Travancore.

Even though banks have opened branches during the period in almost all areas, the net effect is reduction in branches as against which during the period, Private Sector Banks have expanded massively by occupying the space which PSBs have released and thereby the share of Public Sector Bank in Branch Network has reduced by 8.50% while in case of Private Sector Banks it has increased by 5.80%, in case of Small Finance Banks by 3.10% and Foreign Banks by 0.40%. The growth rate in Public Sector Bank is minus 3.80%, while in case of Private Sector Banks, it is 47.50% & in case of Foreign Banks it is 300%.

This has obvious effects on business. In case of deposits, Public Sector Banks’ market share is reduced by 8.10% while in case of Private Sector Banks, it is increased by 6%. The same is the case with credit, in which Public Sector Banks’ market share is reduced by 9.20% while in case of Private Sector Banks it is increased by 8.50%. As far as total business is concerned, Public Sector Banks’ market share is reduced by 8.60%, while share of Private Sector Banks is increased by 7.60%. In case of growth rate of Public Sector Banks it is 24.27% while in the case of Private Sector Banks it is 85.84%, mainly because in credit, Private Sector Banks have grown by 84.37% as against Public Sector Banks’ 20.34%. The data is self-explanatory. In the process of merger Public Sector Banks have lost their market share significantly which also means to that extent banking business has been privatized without formally privatizing the banks!

In the process, banking has suffered, customers are harassed & employees have opted out. Thus, it is banking, employees and customers who have paid the cost of the mergers. The purpose with which the merger was done; “it would help to create banks with scale comparable to global banking and capable of competing efficiently in India & globally”, ultimately has proved to be illusionary. It is Private Sector Banks who have been put to advantage. Was it the hidden agenda of the Government in carrying out the merger of Public Sector Banks? The Union, while opposing mergers, used to give the popular slogan “Merger is Murder” which unfortunately has proven to be correct. Now, while pursuing the agenda of bank privatisation at least, the Government should revisit its stand in the interest of banking, economy & people at large!

India should have a ‘National Banking Policy’ devised after informed debate with all the stakeholders, academicians, bank economists etc.

Devidas Tuljapurkar is the General Secretary of MSBEF

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.