LIC office, Bangalore. Photo courtesy: PL Tandon/Flickr

In spite of strong opposition from all sections of the society, the Finance Minister has recently asked her Ministries to speed up LIC Initial Public Offer (IPO). Does she realise that this can lead to collapse of the economy over a period of time because LIC is a golden goose which is giving golden eggs regularly to the economy, development projects and providing social security to the majority of the marginalised people of this country. Almost one third of the GDP is connected to LIC and almost one third of the budget of the GOI is financed by LIC. The FM has stated that the listing would bring discipline while giving retail investors an opportunity in wealth creation. She doesn’t say where the indiscipline is. It is her Ministry which is overseeing LIC and her Secretary is on the board of LIC. The so called retail investors in India are not even 3% to whom she wants to give wealth.

LIC’s growth:

From a simple investment of Rs 5 crores, today LIC has assets worth Rs 36 lakh crores as per the estimates. In 64 years it has paid a dividend of Rs 28695 crores to the Govt of India. It has invested Rs.38 lakh crores in securities, shares and infrastructure projects. It holds 9.25% shares in SBI the largest bank, 51% in IDBI Bank, 10.37% in ICICI bank, shares in many Public sector as well as private banks, considerable shares in public sector enterprises, considerable shares in private corporates like Infosys, TCS, Wipro, Piramal etc. And its income from investments last year was Rs 214833.95 Crores. It is the largest owner of land, after the Indian Railways. It is LIC which intervenes in the stock market along with the public banks when there is a crisis in the stock market.

So where is the indiscipline or inefficiency?

The listing, disinvestment of 5-10% shareholding initially will ultimately lead to Privatisation of this unique company which is functioning as a trust or mutual benefit society for almost every household in the country, especially the rural, marginalised and weaker sections of the society. India has 24.8 crore households and LIC has 40 crore policies.

Likely impact

During the takeover of 245 companies by nationalization to create LIC, there were some objectives that were laid down. These are followed till date:

- Spread Life Insurance widely and in particular to the rural areas and to the socially and economically backward classes with a view to reaching all insurable persons in the country and providing them adequate financial cover against death at a reasonable cost.

- Maximize mobilization of people’s savings by making insurance-linked savings adequately attractive.

- Bear in mind, in the investment of funds, the primary obligation to its policyholders, whose money it holds in trust, without losing sight of the interest of the community as a whole; the funds to be deployed to the best advantage of the investors as well as the community as a whole, keeping in view national priorities and obligations of attractive return.

- Conduct business with utmost economy and with the full realization that the moneys belong to the policyholders.

- Act as trustees of the insured public in their individual and collective capacities.

- Meet the various life insurance needs of the community that would arise in the changing social and economic environment.

- Involve all people working in the Corporation to the best of their capability in furthering the interests of the insured public by providing efficient service with courtesy.

- Promote amongst all agents and employees of the Corporation a sense of participation, pride and job satisfaction through discharge of their duties with dedication towards achievement of Corporate Objective. (Source: www.licindia.in)

A look at Social Security Schemes and policies maintained by LIC

With over 25 crores people below the poverty line, India today is in the category of “countries of mass poverty.” With waves of corona virus more and more people are coming under severe economic and financial distress. At the same time, unlike many other countries, over 90 percent of Indians do not have social security to take care of the distresses and tragedies of life. LIC is the only means left to them to provide for these distresses and tragedies. Depriving them of these would be an assault on the life and livelihood of the common people which is bound to be unconstitutional.

This deprivation would be violation of Part IV of the constitution.

Senior citizens deposit money in LIC to get assured return with safety and security. LIC handles social security schemes of Govt of India through cross subsidisation. A glance of few schemes shows the massive contribution of LIC in providing social security.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a government subsidized one year cover Term Life Insurance Scheme. The PMJJBY is available to people in the age group of 18 to 50 years having a bank account who give their consent to join / enable auto-debit. The life cover of two lakh rupees shall be for the one year period stretching from June 01 to May 31 and will be renewable. The premium is just Rs330 per annum. The scheme is being offered by Life Insurance Corporation and few others. Since the launch of scheme LIC has enrolled 1,42,29,371 members and paid claims under 1,17,851 cases amounting to Rs.2,357.02 crore as on 31.03.2021.

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

To protect elderly people aged 60 years and above against a future fall in their interest income due to the uncertain market conditions, as also to provide social security during old age, Government of India launched a simplified scheme of assured pension of 8 per cent called the Pradhan Mantri Vaya Vandana Yojana (PMVVY). The scheme is being implemented through Life Insurance Corporation (LIC) of India. As per the scheme, on payment of an initial lump sum amount ranging from a minimum purchase price of Rs 1.50 lakh for a minimum pension of Rs 1000 per month to a maximum purchase price of Rs 7.50 lakh for maximum pension of Rs 5,000 per month, subscribers will get an assured pension based on a guaranteed rate of return of 8 per cent per annum, payable monthly.

Atal Pension Yojana

The Atal Pension Yojana (APY) was launched on 09.05.2015 to create a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector. APY is administered by Pension Fund Regulatory and Development Authority (PFRDA). APY is open to all bank account holders in the age group of 18 to 40 years and the contributions differ, based on pension amount chosen. Subscribers would receive the guaranteed minimum monthly pension of Rs. 1000 or Rs. 2000 or Rs. 3000 or Rs. 4000 or Rs. 5000 at the age of 60 years. The monthly pension would be available to the subscriber, and after him to his spouse and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the nominee of the subscriber.

In case of premature death of subscriber (death before 60 years of age), spouse of the subscriber can continue contribution to APY account of the subscriber, for the remaining vesting period, till the original subscriber would have attained the age of 60 years. Subscribers can make contributions to APY on monthly/ quarterly / half-yearly basis. Subscribers can voluntarily exit from APY subject to certain conditions, on deduction of Government co-contribution and return/interest thereon.

LIC is the fund’s manager for this scheme. As the pension paid under the employees provident fund scheme is meagre many workers join this scheme.

Pension Fund

During the year 2020-2021, LIC Pension Fund Ltd received an amount of Rs. 22,333.29 Crores under thirteen schemes. The total Assets under Management (AUM) was Rs. 1,21,027.69 Crore as on 31st March 2020 which rose to Rs. 1,63,389.50 Crore as on 31.3.2021. Of the above Rs.1,59,358.34 Crore is managed under five Government Pattern Schemes and Rs. 4,031.16 Crore is managed under eight Private Sector Schemes.

First Insurance

In pursuance of the corporate objectives of providing insurance cover to more and more people, greater emphasis is laid on covering individuals who have no previous insurance on their lives. During the financial year 2020-21, 186.44 lakh individuals were insured for the first time for the total sum assured of Rs. 4,90,404.08 crore as against the previous year’s figures of 185.53 lakh policies for sum assured of Rs. 5,15,975.10 crore. The ratio of first insurance to total business completed for the year comes to 88.89% & 83.67 % in respect of number of policies and sum assured respectively. Is it not remarkable to bring in almost 2 crore people every year into this social security? Does the FM know of this?

Rural Thrust

Sustained and conscious efforts are made to carry the message of Life Insurance to the rural areas, especially the backward and remote areas. As a result, there has been steady growth of new business from these areas. The new business from rural areas amounts to Sum Assured of Rs. 91,961.61 crore under 45,00,369 Policies representing 21.45 % and 15.69 % share of Policies and Sum Assured respectively completed during the Financial Year 2020-21.

Reach in Rural Areas

The private sector is heavily concentrated in the bigger cities. According to IRDAI (Report 2019- 20), in Tier I cities (with population of more than one lakh), LIC has 1844 branch offices while the private sector has 4717 branch offices. In Tier IV cities/towns (population between 10000-19999) LIC has 1037 branch offices whereas the private sector has only 107 Branch offices.

This clearly shows the urban bias and neglect of rural areas.

Micro Insurance

Micro Insurance Business vertical of LIC completed 9,92,200 policies with Rs 341.52 crore First Premium Income in F.Y. 2020-21. Total number of policies sold by the vertical since inception is 2.22 crore, thus providing valuable insurance cover to the underprivileged and low income segments of the society. The contribution of this vertical to LIC’s new business in terms of number of policies for F.Y. 2020-21 was 4.73%.

Micro Insurance policies are sold through specialized distribution channels comprising of Non-Government Organizations (NGO), Self Help Groups (SHG), Micro Finance Institutions (MFI), Corporate Agents, select Conventional Agents, Brokers, District Cooperative Banks (DCB), Regional Rural Banks (RRB), Urban Cooperative Banks (UCB), Primary Agricultural Cooperative Societies (PACS), Other Cooperative Societies (CS), Banking Correspondents (BC) and Farmer Producer Companies (FPCs). There are 21547 MI Agents on roll as on 31.03.2021. MI Policies are also sold through the Point of Sales Persons – Life Insurance (POSPs-LI) engaged by Insurance Intermediaries like Brokers, Corporate Agents, etc., and Rural Authorised Persons (RAP) & Village Level Entrepreneurs-Insurance (VLE-Ins) engaged by CSC e-Governance Services India Limited.

The products which were available for sale through this vertical during the Financial Year include the Term Assurance Plans, LIC’s Bhagya Lakshmi and LIC’s New Jeevan Mangal and the Endowment Plan, LIC’s Micro Bachat. This is another golden egg of LIC.

Average Premium Per Policy

This indicates the segments of population on which the life insurance company concentrates. The lower the premium per policy which is called ticket size is the indication that greater numbers of policies are procured from the weaker sections and lower middle class. Higher the size of premium is indicative of concentration on upper middle class and richer sections of the population.

For the year 2020-21, the average premium of a policy sold by LIC is Rs.16156 while for the private sector it is Rs.89004. It is interesting to note that for the year 2019-20, the ticket size for LIC was Rs.23871 while for the private sector , it was Rs.76804.

As can be seen, there is a decline in case of LIC while for the private sector there is an increase.

This is also indicative of the fact that the impact of economic crisis has been felt more by the segment LIC caters to compared to the segment which patronizes the private sector.

Investment in Development Schemes is REMARKABLE!

LIC is the biggest investor in various Public Sector Banks, Public Sector Enterprises and also Private Banks and Private Companies. 82% of its investments are in Govt securities which enables the GOI to spend money in the economic development.

Investment in Social Sector

The total investments of the Corporation amounted to Rs.36,76,170.31 crore as of 31st March, 2021. The Corporation subscribed an amount of Rs. 2,66,664.81 crore (Book Value) and Rs. 1,17,621.00 crore (Book Value) to the Securities of the Government of India and the new loan issues of the various State Governments (including other approved securities) respectively during 2020-21.

Social Responsibilities Fulfilled:

It has been the constant endeavour of LIC to provide security to as many people as possible and to channelize the savings mobilized for the welfare of the people at large. To meet this end, LIC has been promoting Social Welfare through investments in infrastructure and social sector which includes:

* Projects/Schemes for generation and transmission of Power

* Housing Sector

* Water Supply and Sewerage Projects/Schemes

* Development of Roads, Bridges, Road Transport & Railways.

The total Investment in these sectors during 2020-21 was Rs. 26,322.90 Crore. The investments as of 31.03.2021 by way of Central, State and other Government Guaranteed Marketable securities, Loans, Debentures & Equity investments in Infrastructure and Social Sector amounts to Rs. 26,86,527 Crores. These are long term investments and rate of return will be less. The shareholders will insist on reorienting the investments to get higher return even if the risk is higher.

Level of Efficiency

There is so much talk of efficiency of the private sector. The IRDAI Annual Report for 2020-21 has shown that the operating expense of LIC is 8.68% of the total premium income. The same for private sector is 11.72%. LIC has been serving larger number of policies at an economical cost.

All this will go away with privatisation. Shareholders will only insist on more profit ignoring the social security needed for the larger majority.

Unconstitutional

Policy holder’s right to property guaranteed under Article 300A is violated by the threat to their policy which will no longer be payable by a state but a private party. LIC Act provides a sovereign guarantee for all the Insurance Policies of LIC. Once privatised this guarantee cannot continue.

It will have effect on the reservation policy provided by the constitution.

Life insurance in India is not a purely business activity but an important and non-delegable activity of a welfare state which cannot be outsourced to the private sector.

Unethical

“The entire growth and expansion has been done through the policyholders’ money. Even the solvency margin required as per regulations has been provided for through the policyholders’ funds. This unique character of LIC makes it look like a Trust or a Mutual Benefit Society. This being the character of LIC, it is unethical for the government to sell the shares of LIC to meet its fiscal needs.”

Bonus to policy holders will get reduced

LIC is the only company which pays 95% of its profit as bonus after paying 5% of the profit to the Govt of India which had contributed Rs.5 crores. Here the relationship of the customer is not of a depositor but an investor. LIC is a trustee as per its website. Already the GOI has amended LIC Act making it 90% for the policy holders and 10% for GOI. Year after year it will come down so that the shareholders get more and policy holders on whom LIC is dependent get less.

Foreign Capital

The government is also allowing foreign capital in LIC. This will certainly enable the foreign capital to gain greater access and control over the domestic savings which would harm the national development project.

Insurance growth in the world is slowing down but in India it is increasing

Insurance penetration measures premium as a percentage of GDP while Insurance density is expressed as premium per capita. These are considered most important yardsticks of insurance development in an economy. As per the IRDA Annual Report 2019-20, the share of India in the global Insurance market increased marginally from 1.58% as in 2018 to 1.69% in 2019. The report further states that whereas globally the share of the life insurance business in total premium was only 46.34 % during 2019, in India, the share of life insurance business was high at 74.94%. During 2019 there was an increase in the life insurance business by 9.63%, whereas globally life insurance business increased only by 1.18 %. In India, the insurance penetration declined from a peak of 4.6% in 2009 to 2.5% in 2013. As on 2019, the insurance penetration in India was 3.76 percent. It is steadily increasing.

The market share of Life Insurance Corporation of India stood at 66.18% in Total First Year Premium and 74.58% in the Number of New Policies as on 31.03.2021. This is the reason why foreign capital wants to come to India.

Experience of failures abroad:

Between 1990 and 2020 there have been 82 Insurance company failures in USA as per the National Organisation of Life and Health Guarantee Associations.

Failure of American International Group (AIG)

AIG was seriously affected by the 2008 financial crisis. Under the pressure of the authorities that questioned some of the group’s practices, the group’s board of directors was pushed to part ways with its historic president Maurice Greenberg on duty for 35 years.

AIG was bailed out by American Federal Reserve (FED) which had to intervene on various occasions to inject the total amount of 205 billion USD. A drastic restructuring plan was then imposed on the group which was compelled to cede a large number of non-strategic assets including subsidiaries Alico in the United States and AIA in Asia. AIG had its insurance business in 130 countries, with 96000 staff and a turnover of US $77.3 billion when it went bust. The database of European Insurance and Occupational Pensions Authority (EIOPA) which comprises a sample of 180 affected insurance undertakings in 31 European countries dating back from 1999 to 2016 shows similar failures that took place in the United Kingdom. Actuaries UK lists the reasons for failures which are very much applicable to India today. If similar failure occurs with LIC, can the GOI bail it out? Well, the government is already bankrupt and selling its family silver.

Scenario in India

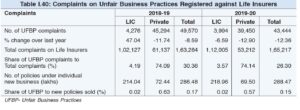

Our country already has 23 private unsurance companies including SBI Life managed by SBI- the largest bank in the country. As per the IRDA report the complaints of unfair practices in private insurance companies are very high though they share only 33 % of the premium.

Similarly mis-selling is the highest in banks running Insurance Companies.

Hence the efforts to privatise LIC step by step are going to be dangerous for the country and the majority of people. LIC is accountable to parliament today. There have been many parliament reports which have given suggestions to LIC which were implemented. LIC strictly follows RTI Act and has never been fined for violation of the Act.

All this will vanish with privatisation.

Will it get a fair valuation?

The valuation of LIC is a tricky business. The government has appointed the actuarial firm Milliman to value LIC. It is reported that they have estimated the embedded value of LIC as Rs.4 lakh crores which is questionable.

LIC sells more than 50 products and the present value of the future profits of these products have to be assessed. It is the biggest real estate owner in the country after Railways and these assets are located in every part of the country. The value of the real estate has to be arrived at.

LIC has many subsidiaries, both in India and abroad, and they also have to be valued. Moreover, it has a brand value which is difficult to estimate. There are expectations that in the next few weeks, the final valuation will be arrived at. This, by rough estimates, cannot be less than Rs 10-15 lakh crore. This sounds astounding as this value has been created on a capital of Rs 5 crore. It is very difficult to say whether this could be a fair value. We have experienced that public sector units that are sold by the government have always been undervalued.

No consultation with Stake holders

There has been absolutely no consultation with the stake holders- the 40 crore policy holders. There has been no discussion in the Parliament too. The Finance Minister should understand the reality and stop the sale of this Golden Goose.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation.

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.

Free market economy-Lesesizfair policy is making FM contribute to evading public duty to private good. It is tryst against TRUST which LIC established through unwavering achievements. Oppose IPO

An article par excellence. Thank you Mr. Franco.