When the Bill for ‘Insolvency and Bankruptcy Code, 2016’ was passed in parliament in May 2016, it was hailed as the biggest economic reform, only next to GST, by the current government. The Insolvency and Bankruptcy Code, 2016 consolidated and amended various laws relating to insolvency resolution of companies, limited liability entities, partnerships and individuals, which were contained in various enactments into a single legislation. The Insolvency and Bankruptcy Code (IBC) received praises from multilateral institutions like the World Bank and IMF and was considered one of the major reasons of India’s sudden jump in the Ease of Doing Business rankings.

The IBC came into force in December 2016 and the first case under IBC was referred to National Company Law Tribunal (NCLT) in January 2017. The first insolvency resolution order under IBC was passed in August 2017 for Synergies-Dooray Automotive, a company manufacturing automotive parts, where the lenders (banks + other creditors) were forced to take a 94% haircut. Since then a number of cases have been sent to NCLT by the lenders for the speedy resolution. The IBC process was projected as a panacea for recovery of NPAs or bad loans and the government went to the extent of claiming in April 2018 that more than Rs. 4 lakh crores of NPAs had been recovered through the IBC process. However, the data from RBI later revealed that the actual figures for recovery had been much lower. The NPA accounts of 40 companies referred by RBI for the resolution process came much into the limelight as they together account for 60-65% of bad loans in the banking system.

The Insolvency and Bankruptcy Board of India (IBBI) was formed under the Insolvency and Bankruptcy Code (IBC), 2016, where IBBI acts as the regulator for overseeing insolvency proceedings in India, along with other entities like Insolvency Professionals, Insolvency Professional Agencies, and Information Utilities. Recently, about a fortnight back IBBI came out with data on a list of insolvency cases which had yielded resolution under Corporate Insolvency Resolution Process (CIRP) up to June 30, 2018. The list has included only 32 companies so far. A July 2018 article from Business Today says that till November 2017, under CIRP some 4,300 applications had been filed in various benches of NCLT, but out of them only 470 cases had been admitted till June 2018. CIRP is the process of resolution of the insolvency of a corporate debtor as provided under IBC. Corporate debtor implies a corporate person who owes a debt to an entity. Corporate debtor includes a company, a limited liability partnership firm or any other person incorporated with Limited Liability under any law, but does not include a financial service provider. Apart from the corporate debtor, a financial creditor or an operational creditor can approach the NCLT for an order to admit the company (or corporate debtor) under the Corporate Insolvency Resolution Process. Financial creditors are those whose relationship with the entity is a pure financial contract, such as a loan or debt security, e.g. a bank giving loan to a company. Operational creditors are those whose liabilities from the entity comes from a transaction on operations, e.g. a company supplying raw material to a manufacturer. The IBC lays down the provisions that when a company is brought under CIRP, then the resolution process must be completed within 180 days, which can be extended up to 90 days. All the financial creditors of a corporate debtor collectively form a Committee of Creditors (CoC), who need to approve a resolution plan for the defaulting company by a majority of 66%. If the resolution plan for a company cannot be passed, then the company eventually goes into liquidation. In the CIRP, other companies of related sector or financial companies bid for buying the defaulting companies, through which the creditors can get back a certain percentage of their stuck money.

The data provided by IBBI provides some interesting insights about the companies for which resolution was achieved. The list includes a total of 32 companies, with total financial claims ranging from Rs 1.10 crores (Nandan Hotels Ltd.) to Rs 57,505 crores (Bhushan Steel Ltd.).

Among these 32 companies, in 9 instances the insolvency process was triggered by corporate debtor itself. Similarly, 14 cases of insolvency were triggered by the financial creditors and rest 9 cases were triggered by the operational creditors. The total amount of admitted claims for these 32 companies comes to approx. Rs. 89,400 crores, where the total claims of financial creditors stands at approx. Rs. 86,000 crores. The total resolution amount comes to Rs 49,800 crores for these 32 companies, where the financial creditors got the sum of Rs 47,800 crores. It should be noted here that in the resolution process, often a company bids for buying out the defaulting companies and the financial creditors may not get all the amount at one go, but might be paid to them over a period of few years.

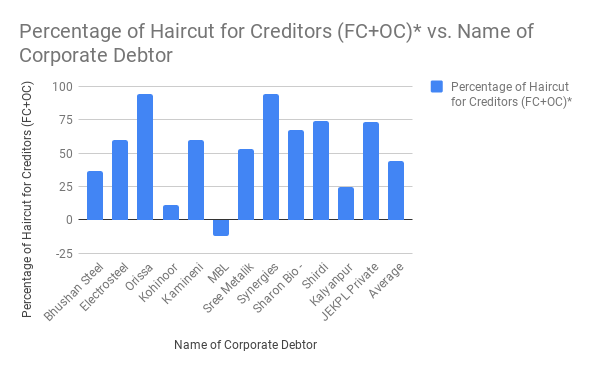

Given below is the data related to the resolution amount for the creditors and the percentage of haircut borne by the financial creditors. The companies which have total claims of more than Rs 500 crores have only been included in the table below.

Corporate Insolvency Resolution Process Yielding Resolution: As on June 30, 2018

(Amount in Crores)

| Sl. No. | Name of Corporate Debtor | Total Admitted Claims | Total Claims of Financial Creditor | Liquidation Value | Resolution Amount for Financial Creditor | Percentage of Haircut for Creditors (FC+OC)* |

| 1. | Bhushan Steel Ltd. | 57,505.05 | 56,022.06 | 14,541.00 | 35,571.00 | 36.51 |

| 2. | Electrosteel Steels Ltd. | 13,958.36 | 13,175.14 | 2,899.98 | 5320 | 59.62 |

| 3. | Orissa Manganese & Minerals Ltd. | 5,414.49 | 5,388.54 | 301.02 | 310 | 94.25 |

| 4. | Kohinoor CTNL Infrastructure Company Pvt. Ltd. | 2,578.64 | 2,528.40 | 329.9 | 2,246.00 | 11.17 |

| 5. | Kamineni Steel & Power India Pvt. Ltd. | 1,523.50 | 1,509.00 | 760 | 600 | 60.24 |

| 6. | MBL Infrastructure Ltd. | 1,506.87 | 1,428.21 | 269.9 | 1,597.13 | -11.83 |

| 7. | Sree Metalik Ltd. | 1289.73 | 1,287.22 | 340.62 | 607.31 | 52.82 |

| 8. | Synergies Dooray Automotive Ltd. | 972.15 | 972.15 | 8.17 | 54.7 | 94.37 |

| 9. | Sharon Bio -Medicine Ltd. | 917.92 | 891.38 | 182.69 | 294.03 | 67.01 |

| 10. | Shirdi Industries Ltd. | 695.74 | 673.88 | 103.05 | 176.36 | 73.83 |

| 11. | Kalyanpur Cements Ltd. | 631.95 | 131.05 | 119.74 | 98.6 | 24.76 |

| 12. | JEKPL Private Ltd. | 606.57 | 606.57 | 222.06 | 162 | 73.29 |

| Total | 87,600.97 | 84,613.60 | 20,078.13 | 47,037.13 | 44.41 |

FC = Financial Creditor; OC = Operational Creditor