A report presented by Poonam Gupta and Arvind Panagaraiya at the India Policy Forum 2022 on 12th July, is clearly a prescription for destroying the Indian Economy which is already on the verge of collapsing.

Introduction

They start with nice statements- ‘Finance is the lifeblood of an economy.’ But their prescription will lead to the removal of the lifeblood of the economy and the savings of the people.

‘Since depositor interests are difficult to ignore in a democracy and large losses by banks pose a systemic threat to the economy, the government has to come to their rescue using valuable taxpayer resources. To avoid such episodes, it is important that banks are subject to commercial pressure and are closely monitored and regulated’ they say.

But the solution they give is to privatise all banks without looking at the failure of private banks which are only for profit. Between 1947 and 1951, 205 private banks went out of business. Between 1951 and 1967, 476 private banks went out of business. Between 1969 and 2008, 36 banks were taken over by other banks, most of them by public sector banks. In the US, 512 private banks failed between 2008 and 2020. Global Trust Bank, Centurion Bank, and the Yes Bank had to be saved by public sector banks only.

Evolution of banking in India

Talking about the history of banking, they state the facts correctly but blame the nationalisation for all the ills present in the banking sector today.

While speaking about the branch expansion they simply state that ‘The bank-branch-expansion program led to the opening of many unviable bank branches.’ Similarly, they directly attribute the problem of priority sector lending to NPAs.

As per them, branch expansion was wrong and priority sector lending should not have been allowed and has to be stopped. Will this not be a disaster?

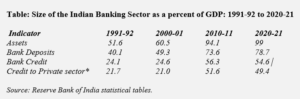

Deposits and credit have grown because of the public sector banks. But, due to the merger, prompt corrective action and the threat of privatisation, the gains earned are being taken away. This has accelerated after 2014 during which period the authors have been at the helm of the affairs and they are the ones to be blamed.

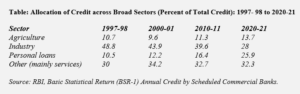

The authors report, the trends in sectoral shares of the total credit, saying ‘Agriculture, which has seen its share in GDP steadily decline to approximately 15 percent, has nevertheless seen a modest expansion in its share in bank credit.’ While at the same time praising the performance of personal loans- ‘The biggest beneficiary of the shift in credit allocation away from industry has, however, been personal loans. From just 12.2 percent in 2000-01, its share in credit has risen to 25.9 percent in 2020-21.’

It is due to the government’s policy of negligence of the agriculture sector, which rests on the utopian idea that agriculture should not be the major contributor to GDP, that we have come to this stage. Who is to blame? Now the whole world is concerned about agriculture because of the food grain shortage.

It is the Public Sector banks which have lent more to agriculture and industry. Private Banks have concentrated more on personal loans as they are considered safe. Yet the authors recommend privatising them. This is one of the main contradictions in their recommendations.

After 1991

While mentioning the rise of private banks, the authors have carefully avoided the takeover of failed private banks by public banks from 1969 onwards. Again, most of the mergers were with public banks to save the failing private banks. The new private banks like ICICI Bank, AXIS Bank, and HDFC Bank which are the largest private banks with government support are not mentioned by the authors. When there was a problem with ICICI it was the SBI which saved it. Even in future, these same experts will ask the government to save the private banks which fail due to mismanagement and fraud. That’s what happened in the US too.

What is important is the following. In a planned manner, Public Sector Banks have been made to underperform. It is the preparation for calling the dog mad before shooting it.

They say that the bank branches of the private banks have increased while those of the public banks have decreased. They quote that the number of employees in the PSBs grew steadily to 96,584 by the end of 2016-17, but has since shrunk to 90,160 at the end of 2021-22.

Why and How?

For a decade, there was a ban on recruitment in public banks. This was followed by a ‘Golden Handshake VRS scheme’ under which more than one lakh people were made to leave and even thereafter recruitments in Public banks were too little in the name of digitisation. With the merger, every public sector bank had to reduce the number of branches. There was a turnaround plan for 11 Public banks with Prompt Corrective action. A tripartite agreement with unions and associations was signed but not implemented. AIBOC gave bank wise turnaround plan which was not implemented. The authors themselves state elsewhere that PCA was a failure. So it is the wrong policies and not the character of public banks which led to this situation. As seen below these policies have led to the present situation.

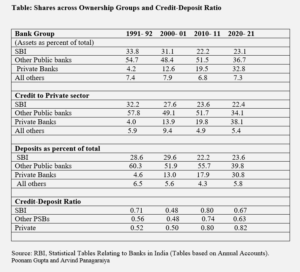

It is dangerous that the share in deposits, as well as advances, is going down for PSBs. It is because of the policies as explained above. If the government reverses the policies immediately the situation will change. Private banks are being given currency chests, and government business while their chiefs accompany the PM abroad. They are also present in all committees of the government. The Credit deposit ratio going down was also mainly because of mergers and related uncertainties. The staff says that many good customers left or they were lured away by private banks saying the merged entities will have poor service. Whenever there is a merger, a year before and after, the lending slows down which has a cascading effect.

The Real Issue

Authors Arvind Panagariya and Poonam Gupta credit private banks for growth in employment stating- ‘Between 2014-15 and 2019-20, private banks created 235,900 new jobs while PSBs experienced a net loss of 89,283 jobs.’

Also stating- ‘Between 2014 and 2021 68.6% of the credit by banks and 48.2% of the deposit growth have been cornered by Private Banks’.

This is the crux of the issue. Per employee customers in SBI is 1915, but in HDFC it is 501.

How do you expect to perform without adequate staff? When the number of branches reduces, how will the business improve? Despite these, the Public banks have grown and even doubled their profit last financial year. What we need is doubling the number of bank branches of Public sector banks, massive recruitment, conversion of contract workers into regular workers including business correspondents and massive credit programmes like the Integrated Rural Development Programme and Integrated Urban Development Programmes.

Blame game

The authors also blame all CEOs of Public banks.

“An additional factor at work in PSBs was that their CEOs were government employees appointed for limited terms. Therefore, the CEO’s incentives were to restructure doubtful loans and maintain their standard classification while they served even if it was clear that the loans had no chance of being repaid. In contrast, the managers of private banks remained answerable to their boards and shareholders, which translated into more responsible lending and restraint on restructuring doubtful loans”.

Is it really true? If this is true, why no action was taken against those CEOs? In fact, NPA norms were changed to show more NPAs and write them off. Any business can have a crisis. Declaring loans as NPAs within a period of 90 days and 30 days and stopping their transaction definitely takes a toll on the banks. When actually, 82% of NPAs were Corporate NPAs also stated in the Parliament. To write them off NCLT was brought in. The average write-off in the name of haircut is 67%. In many cases, it has exceeded 80%. Parliament Standing Committee on Finance has criticised it. But nothing has been done. The capitalisation given below is only for siphoning off money to corporate friends. Even after writing off banks don’t disclose the names of borrowers except for those cases coming to NCLT some of which can be traced.

“In dollar terms, the total amount infused into PSBs between 2010-11 and 2020- 21 to help them tide over the NPA crisis stands at $57.45 billion. Of this amount, $6.05 billion went to SBI and $51.40 billion to other PSBs”.

Dr Soumya Kanti Ghosh, Chief Economist, State Bank of India wrote in the Economic Times on the 21st of January 2015, “Chastising public sector banks for every failure is a comedy of errors- public banks have paid back many times the investment to the government.” So it is not true that the government is spending taxpayers’ money on the capitalization of banks.

Are Social objectives not needed?

Authors Arvind Panagariya and Poonam Gupta state-

“There is hardly any social goal related to financial intermediation that the government cannot pursue without ownership of banks. On the contrary, government ownership over the years has resulted in a high cost of lending and even impeded progress in the spread of banking. It is a plausible proposition that had the ownership been largely private, India would not have faced the acute NPA crisis that it did in recent years. And absent such a crisis, not only would deposits and credits have seen greater expansion, but the economic performance would also have been superior”.

Totally wrong analysis. India had a very weak banking infrastructure and was fully owned by the private sector which was totally inefficient. There have been too many bank failures. The trend changed only after 1969. The banking sector is a reflection of the economy. If the economy is not doing well banking sector cannot. The economy needs support from the government and policies. The private sector has played a negligible role in overall growth. Their failure has affected the economy as well as the banks. NPA crisis is not because of careless lending it is because of the economy as observed by a Finance Standing Committee report. If not for the Public banks, India would have been a poverty-stricken country even now. Even the ‘Green, White and Blue revolutions’ were supported by the PSBs.

Agnipath

The finance minister should read this part of the report.

“Going one step further, it stands to reason that as long as a large number of banks remain in the public sector, the government will find it hard to resist using them to pursue goals that are best pursued by using alternative instruments. In the past, the government has used PSBs as instruments of employment as well as subsidies to favoured actors in the economy through cheaper credit, including outright write-offs of loans. A recent example is the call by the Finance Ministry to PSBs and state-run insurers to explore employment opportunities for youngsters who would be looking for jobs after completing their four-year service in the military under the newly launched “Agniveer” scheme. Such mismatch between goals and policies is not only highly inefficient but also has an adverse effect on the growth of banking”

In short, the government should not do anything to bring down inequality, social justice, and reservation and give up its responsibility as a welfare state. It should give up the constitution itself. Then why do we need a government? Is it not anti-national to recommend such things?

Governance Issues perceived by Arvind Panagariya and Poonam Gupta

In their report, the authors mention several governance issues with respect to the PSBs, you can read them here- Privatization of Public Sector Banks in India: Why, How and How Far?

Let’s analyse their arguments, one by one.

- Earlier, they said CEOs are not accountable and corrupt, but now they lament that they are subject to strict anti-corruption laws. Is it wrong to have such laws?

- What incentive is needed than the opportunities to help people? The respect in society and above all a respectable salary and perquisites.? Promotion opportunities are good in Public banks. Even today, officers in HDFC, ICICI and Axis leave them to join SBI as Circle based officers and Probationary Officers. Incentive itself is corruption.

- Bank employees are poorly paid in comparison to Govt employees, RBI, NABARD, SIDBI employees and Insurance employees. Their pension is not updated for 36 years, unlike Govt employees. This needs correction. Only the Government can do it. Higher officials get various perquisites with lesser responsibility because of the committee approach to lending. Very few PSBs.

- Depositors leave Public banks due to poor service because of the shortage of staff. This needs to be corrected. Small depositors still stay with PSBs because of faith.

- In a democracy politics includes policies. The promise of loans to Agriculture and small business is not unethical. It has to be implemented. Voters are not fools. But the appointment of CEOs should be only on merit.

- Political loans and phone banking are rhetoric not reality. There may be a few cases. Banks have a very strict disciplinary procedure to take stringent action.

- In spite of YES Bank’s failure, they are defending Private banks. What about Chanda Kochar, Shika Sharma, Rana Kapoor, Dewan Housing, Ravi Parthasarathy and ILFS? They wrongly blame LIC for ILFS’s fiasco as it was a shareholder.

- Two masters, three masters is not a problem. Policies and certain independence are needed.

- Was Jan Dhan account opening wrong? Privates banks did not do it even when they were asked to. In that case, the MUDRA loan, PM Svanidhi, Atal Pension Yojana and all others have to stop. Everything should be immediately handed over to corporates. The present government is doing it but these two want it to be done immediately.

- RBI has its own nominees in PSBs. They have more power to deal with Public Banks than Private Banks.

- What is the use of making policies if you can’t get them implemented? Private banks have not been listening to you and they will not because they have to make a profit for their shareholders.

The report further states- “There is unequivocal evidence that the banks under PCA were performing poorly before they were placed on PCA (which was the reason that they got placed on PCA in the first place), and they showed virtually no progress after coming out of PCA. Indeed, NPAs actually increased and the return on assets declined. The conclusion that these banks will continue to be a burden on the taxpayer in the years to come is difficult to escape”

This is what trade unions have been saying. Where were you Mr Panagariya all that time?

Privatization: How and How Far? What is the future?

In short, as per the authors, all banks should be privatised, starting with Indian Bank, Bank of Baroda and Canara Bank. The government should not have any control, CVC should not investigate, RBI should become a mega ruler (who will dance to the tune of the political bosses as the directors have no accountability) and Corporates should have the right to run banks like they run NBFCs and foreigners should be welcomed to own our banks as they will bring innovation.

The small household depositors who have 62.63% of the total deposits and 81.17% of the savings deposits will lose their deposits over a period of time. 14,045 big borrowers who have Rs 35,12,801 crores (29.5% of all credit) of the outstanding loan can default and ruin the banks. Small borrowers will go to NBFCs and MFIs, will pay huge interest, default and lose their assets. Of course, there will be no reservation in employment. Basically, the economy will collapse. IMF and the World Bank will rejoice. Ambadani or someone will become the official or unofficial dictator. Poonam and Panagaraiya will live happily abroad.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.