What are waste to energy plants?

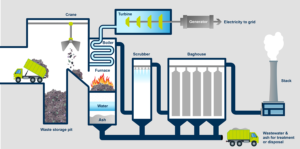

Waste to energy plants (WTEs) use waste as a fuel for generating power like other power stations use coal, oil or natural gas. They typically burn mixed municipal solid waste to produce steam in a boiler that is used to generate electricity. Municipal Solid waste is a mixture of kitchen waste, paper, plastic, garden waste and other similar waste generated at the household level. There are different types of waste to energy plants. The most common type is the one where unsegregated municipal solid waste is burnt in an incinerator with a boiler and a generator for producing electricity. The process reduces the volume of waste and results in bottom ash that is collected from the incinerator and also generates fly ash that is scraped off from the electrostatic precipitators installed in the smokestacks regularly. Although the volume of waste is reduced, the bottom ash and fly ash pose a huge problem as they contain toxic materials such as dioxins, furans and other organic chemical compounds that are highly toxic to all life. In addition metals (mercury, lead and cadmium), organics (dioxins and furans), acid gases (sulphur dioxide and hydrogen chloride), particulates (dust and grit), nitrogen oxides and carbon monoxide form a major challenge as air pollutants. There are other types of waste to energy plants too, where non-combustible material is removed and converted to refuse-derived fuel. Most of the WTE plants across the world saw closure in the last few decades except in a few countries such as Japan, Sweden etc due to mounting public pressure and increased awareness of their public health impacts.

How solid waste incineration works

Costs of setting up a WTE unit depend on several factors like type and cost of the technology chosen, characteristics of the waste, land, labour and financing costs. Even so, mass burning or incineration has repeatedly proven to be more expensive and hazardous than other options and these costs cannot be offset with energy revenues. A major challenge remains that the MSW in India has a large percentage of biodegradable waste that contains a lot of moisture that brings down the latent heat of the waste. As a result, most WTE plants in India have not been working satisfactorily and even continuously.

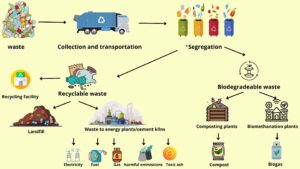

A typical solid waste management system

WTE plants claim to support resource recovery, scientific disposal of waste and the shift to renewable sources of energy. In India, they operate under the public-private partnership model, where local municipalities provide private developers with waste and state power distribution companies (DISCOMS) buy power from them. WTE plants are also supported by the government through financial incentives like subsidised loans, grants and funding under various schemes and policies, land at a nominal lease and tipping fees. Thus their main source of income comes from the sale of electricity, tipping fees, and government subsidies and incentives.

Existing studies provide sufficient evidence of direct and indirect health impacts of burning waste, which include neoplasia, congenital anomalies, infant deaths and miscarriages. WtE plants also emit 68% more greenhouse gases per unit of energy than coal plants and the power supplied by these plants is on an average 3 times costlier than non-renewable thermal power plants and solar power plants. And yet, the WtEs have been provided with the status of renewable energy in India and provided benefits by the Ministry of New and Renewable Energy (MNRE).

Are WTEs suitable for the waste we generate

According to the annual report filed by the Delhi Pollution Control Committee (DPCC) for the year 2020-21, out of the 10,990 tonnes of solid waste generated in the city every day, 5,457 tonnes is processed/treated and 5,533 is landfilled. This means that the city’s 19 composting plants, 13 bio methanation plants and 3 WTE plants are only able to process 49.65% of the total waste generated. Why so, when only the three WtEs put together have a capacity of treating 56% of the total waste? Why are they functioning below their capacity and are not able to reduce waste going to landfills? A major reason behind this is the nature of municipal waste generated in India. WtE plants need high calorific value combustible waste to operate, the kind of waste that is mostly made up of plastic. According to a 2020 report commissioned by the Delhi government, plastic waste only forms 10.10 per cent of the city’s waste. Out of this percentage, a major portion is made up of recyclable plastic that can be reclaimed and need not be burnt. Moreover, the Solid Waste Management Rules, 2016 clearly articulate that only segregated non-recyclable high-calorific fractions like used rubber tyres, multi-layer plastics, discarded textile and paper etc. are to be used in WTE plants. The waste processing quantity projected for WTE plants takes into consideration total waste generated in a city and not the non-recyclable high calorific fraction. Therefore, WTEs end up burning organic waste as well either in its original form or after composting and drying it.

Ultimately, the question that arises is – where is the waste that we are installing these waste to energy plants for. Why has the government commissioned plants with a capacity to treat 56% of the city’s waste when only 10.10% is suitable for going into them.

Operational waste to energy plants in Delhi

| Location of the plant | Name of the SPV | Developer | Waste handling capacity | Electricity generation capacity | Rate of Tariff | Date of commencement of operations |

| Ghazipur | East Delhi Waste Processing Company Ltd. | IL&FS | 1300 tonnes per day | 10 megawatts | Rs. 3.668 per kWh with grants and Rs. 3.860 per kWh without grant | November 2015 |

| Narela Bawana | Delhi MSW Solutions Ltd. | Ramky Enviro Engineers Limited | 3000 tonnes per day | 36 megawatts | Rs. 7.03/kWh | March 2017 |

| Okhla | Timarpur-Okhla Waste Management Company Limited | JITF Ecopolis | 1950 tonnes per day | 23 megawatts | Rs. 2.833/kWh | January 2012 |

WTEs adding to Delhi’s toxic levels of pollution

Delhi’s existing WTE plants are located at Okhla, Narela-Bawana and Ghazipur. All three plants were built next to pre-existing dumpsites to mitigate the hazardous environmental and health effects of rising garbage mountains in the city. In 2017, following a long legal battle, the National Green Tribunal cleared the functioning of the WTE plant in Okhla. The judge ignored the sustained resistance of Okhla residents as well as the massive deviations the plant design had undergone from the original proposal cleared by the Ministry of Environment, Forests and Climate Change (MOEFCC). The judgement also directed the operators of the plant – Jindal Urban Infrastructure Ltd., to pay a compensation of Rs. 25 lakhs and the Central Pollution Control Board (CPCB) “to collect and analyse the samples of ambient air quality once in four months”. In a 2018 order, the NGT mandated that a joint inspection of WTE plants at Delhi be conducted by the CPCB and the DPCC. The most recent report available is of the inspection carried out in September and October 2020. All three functioning WTE plants in Delhi were found violating pollution regulations that included the release of excess Dioxins and Furans, Hydrogen chloride and excess quantities of particulate matter at nearby air quality monitoring stations. According to the WHO, dioxins are highly toxic and can cause reproductive and developmental problems, damage the immune system, interfere with hormones and also cause cancer.

Following this, the DPCC imposed a fine of Rs. 5 lakhs on each plant as “environmental compensation, without any further direction on future monitoring or reduction of the pollution levels.”

According to the results of the stack emission monitoring of the Okhla WTE plant, the dioxins and furans released by the plant are 890% more than the permitted amounts. Similarly, levels of hydrogen chloride exceeded prescribed limits by 296%. Interestingly, the Online Continuous Emission Monitoring System (OCEMS) installed by the plant had recorded readings vastly different from what the CPCB’s inspection found, showing figures closer to the stipulated norms.

The plant also produces 250 metric tonnes of ash daily from the combustion process that are disposed of at a landfill in Jaitpur.

The WTE plant in Bawana followed a similar route. Dioxins and furans were 390% higher than the prescribed limit and the plant was burning a higher quantity of waste than permitted while generating less than 24 MW electricity, its stated capacity. The ambient air quality in and around the plant was also worse than the prescribed limit. Fly ash generated by the incineration process is deposited within the plant premises in a landfill.

According to the CPCB report, the level of dioxins and furans recorded at the Ghazipur WTE were exceeding prescribed limits by 170% and the OCEMS data did not match the CPCB’s readings. Contrary to the detailed project report of the plant approved by the MOEFCC, no wet waste composting was operational in the plant. Further, the plant is operating without valid consent for operation CFO. Its consent to operate was valid till 8 December 2018 and at the time of the CPCB inspection, an extension had not been granted. During the inspection dates, the actual power generation of the plant was in the 3.45-8.75 MW range which is much lower than the plant’s 12 MW capacity.

Plans for more of the same – Tehkhand waste to energy plant

In 2017, the South Delhi Municipal Corporation (SDMC) issued a notice inviting tenders and Request for Proposal (RfP), for a Solid Waste Processing Facility adopting Waste to Energy (WTE) technology as per Solid Waste Management Rules, 2016 for 2,000 tonnes per day (TPD) of municipal solid waste. The project was approved by an SDMC standing committee that cited the overflowing of the pre-existing Okhla dumpsite as the reason behind the new plant located at Tehkhand. As of 2017, 1,800 tonnes of solid waste was going untreated at the existing dumpsite every day. According to the draft EIA submitted by the SDMC, the Rs. 375 crore project has a capacity of 25 megawatts and covers an area of 60.10 hectares. The SDMC commissioner at that time, Puneet Kumar Goel, had said that the Union Government will provide Rs 122.38 crore under the Swachh Bharat Mission and the Power Ministry will give Rs 52.66 crores for the development of the project. The remaining amount will be raised by the corporation itself, in collaboration with the appointed bidder. In its RfP, the SDMC assured financial assistance of Rs. 125 crores to the bidder. If this assistance is over and above the other grants, then the project proponent will get a plant worth Rs. 375 crores with an investment of Rs. 75 crores, having to pay only 20% of the project cost while the public funds all in all will be used to pay Rs. 300 crores. The Tehkhand plant will come up less than a kilometre from the Okhla WtE, greatly exacerbating the levels of toxicity being ingested by the residents of the region.

Financials

Companies that undertake the construction and operation of WTEs do so through the creation of special purpose vehicles (SPVs). An SPV is a subsidiary created by a parent company to isolate financial risk. It may be used to undertake a risky venture while reducing any negative financial impact upon the parent company and its investors.

Lack of availability of high calorific value segregated waste on one side, and high operations and maintenance costs on the other, have been responsible for the failure of several WTE plants in the country. Several municipal corporations have cancelled WTE contracts because of a massive delay in the commencement of construction and/or operations by the concessionaire. The costs of appointing new concessionaires, maintaining the plant and managing municipal solid waste in the intervening period are borne through public funds. In the case of Delhi’s WTE plants, loans from public financial institutions formed a big chunk of the projects’ financing. Thus, along with the social, environmental and health costs of WTE plants, people also have to bear the financial burden in case they fail.

The Okhla and Ghazipur WTEs do not have any provision for the payment of tipping fees, therefore their only revenue comes from the sale of electricity or financial assistance from the government. In their annual balance sheet filed in March 2021, the company controlling the Okhla plant declared a government grant of Rs. 10 crores received from the Ministry of New and Renewable Energy WTE division, awarded against a central scheme for “programme on energy recovery from municipal solid waste during the year 2007-08”.

Since the government seems keen on continuing to invest in WTEs, we analysed the financials of Delhi’s waste to energy plants, to assess their economic feasibility.

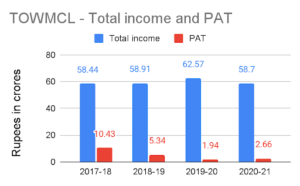

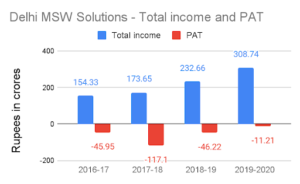

Total income and Profit after tax

As opposed to the total income made by a company in a financial year, profit after tax (PAT) is the net profit available for the shareholders after paying all the expenses and taxes by the business unit. A fall in this value indicates a decrease in the company’s profitability and ability to cover its day to day expenses.

The annual income of the SPV in charge of the Okhla WtE – Timarpur Okhla Waste Management Company Limited (TOWMCL) – has remained stable between approximately Rs.

58 to 62 crores for the last 4 years. However, PAT has been on a decline. It was Rs. 10.43 crores in 2017-18, Rs. 5.34 crores in 2018-19 and Rs. 1.94 crores in 2019-20, which improved slightly to Rs. 2.66 crores in 2020-21.

From March 2017 to March 2020, Delhi MSW Solutions (Narela Bawana) recorded a constantly increasing total income, with amounts totalling almost 4 to 5 times the income of the Okhla WTE. However, The company’s PAT was still in the negative range which indicates that costs and interest payments were still higher than the earnings.

Total income for East Delhi Waste Processing Company Limited (Ghazipur) between the years 2011-2016 was Rs. 14 lakhs and profit after tax was consistently in the negative. The consent for operation ( CFO) was received by the plant in 2016, financial records after that year are unavailable. In 2020, after the leading shareholder of the plant, IL&FS declared bankruptcy, ownership went to Ever Enviro Resource Management Pvt Ltd. Ever Enviro is a wholly-owned subsidiary of Green Growth Equity Fund (GGEF), a UK-India fund aimed to leverage private sector investments in ‘green infrastructure’ projects in India.

Debt to Equity

The debt to equity ratio of a company indicates its dependence on loans, it is a measure of the degree to which a company is financing its operations through debt versus shareholder funds. 1 to 1.5 is considered a good debt to equity ratio as a high debt to equity ratio means an excess reliance on debt for financing daily operations and growth, whereas a negative ratio implies that the business has fewer assets than it has liabilities.

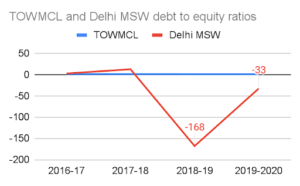

Timarpur Okhla Waste Management Company (Okhla) had the most stable debt to equity ratio out of the three as it remained stable between 0.5 to 1.5, in the last 4 years.

Delhi MSW Solutions (Narela Bawana) had the most steeply fluctuating debt to equity ratio from the lot. In 2019, it dipped to -168, which means that for every asset the company-owned, it had 168 liabilities. In 2020, the ratio increased to -33 still implying very high spending on interest repayment.

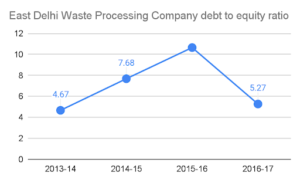

East Delhi Waste Processing Company Ltd. (Ghazipur) showed a debt to equity ratio higher than 5 in the period 2013-2016. This implies that during this period, the company relied on its borrowings rather than existing equity for its functioning.

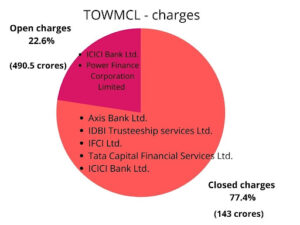

Out of the total charges issued by it, TOWMCL only has 22.6% of open charges. Power Finance Corporation of India, an Indian financial institution under the ownership of the Government of India, lent Rs. 135 crores to the SPV in 2019.Under the Companies Act 2013, the charge is defined as “any kind of interest or any kind of security on the property or any assets of a company or any of its happenings or both as security and includes a mortgage.” A company’s charges indicate the fixed and floating assets mortgaged by it to secure debt from financial institutions. Sustained debt means increasing spending on interest payments and a reduction in financial viability.Existing and closed charges

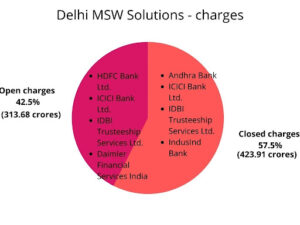

Delhi MSW Solutions has 42.5% open charges. In 2011 and 2013, Andhra Bank (a public sector bank merged into Union bank in 2020) lent the company Rs. 42.79 crores and Rs. 14.86 crores respectively.

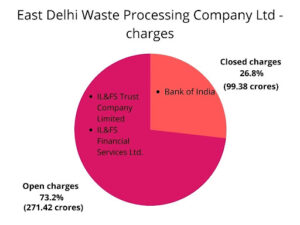

Of the three plants, EDWPCL has the maximum amount of assets mortgaged for debt. Bank of India, a nationalised bank under the ownership of the Union Government, extended a loan of Rs. 99.38 crores to the company in 2009.

Of the three plants, EDWPCL has the maximum amount of assets mortgaged for debt. Bank of India, a nationalised bank under the ownership of the Union Government, extended a loan of Rs. 99.38 crores to the company in 2009.

Conclusion

Despite being given concessions by the government, Delhi’s waste to energy plants are functioning with the help of debt financing. Only the Okhla WTE has had any financial profits over the last few years but they too have been decreasing from 2017 to 2021. The high income of the Narela Bawana plant is offset by its drastic debt to equity ratio, indicating a very heavy reliance on debt for facilitating plant operations. The Ghazipur plant generated Rs. 14 lakhs in revenue until 2016 following which the bankruptcy of IL&FS and the consequent sale of its assets caused a change in ownership and it is unclear whether the plant has restarted its operations as its consent to operate has not been renewed. This situation exists despite government subsidies and compulsory power purchase. Even after heavy investments, debts and expenditures, the waste crisis still remains in Delhi. The landfills and smaller dumpsites on the outskirts of the city continue to grow even as public money is pumped into waste to energy plants.

Those who present waste to energy systems as the only solution to handle India’s growing waste problem ignore community-based recycling and composting initiatives and decentralized resource recovery programmes that have time and again proven to be more environmentally and financially sustainable. The costs to public health, money and resources make it clear that investment in waste to energy projects is an investment in public harm and is actually a waste of energy.

Picture credits: Om Prakash

Centre for Financial Accountability is now on Telegram. Click here to join our Telegram channel and stay tuned to the latest updates and insights on the economy and finance.

[…] clearances proved to be a failsafe. All three of Delhi’s functioning WTE plants were exceeding permitted pollution levels, the Centre for Financial Accountability (CFA) found. The plant in Okhla was releasing dioxins and […]